Compensation

Compensation

-

Armed with private equity capital, Carson Group rebrands and will become an aggressive M&A player, outsource provider and breakaway recruiter.

September 20 -

Retiree savings are only as safe as the places that hold retirees' personal information, says expert.

September 19 -

An internal memo shows tight deadlines for half the brokers the IBD hopes to retain after the deal.

September 19 -

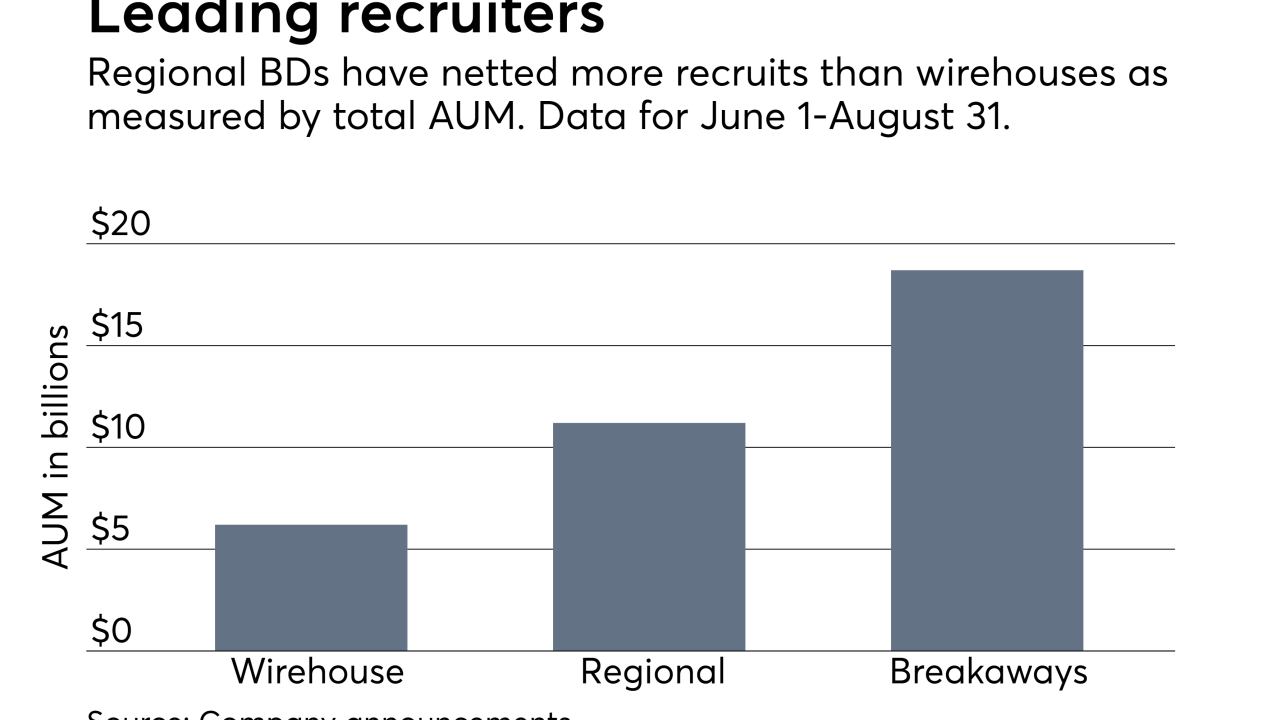

A different regulatory landscape is encouraging brokers to reconsider their options.

September 19 -

Clients may hold employer stock in their retirement accounts. It pays to know when and how to take distributions from it, Michael Kitces writes.

September 19 -

Clients could face a 100% penalty of taxes owed for filing late.

September 19 -

Beefed-up market research will help the firm’s advisors, says President Adam Antoniades.

September 18 -

Retirees can open health savings accounts, which offer tax breaks on contributions and qualified distributions, and tax-free growth on investments.

September 18 -

RBC has been on a recruiting tear, adding more advisors in the first half of 2017 than all of 2016.

September 18 -

Thomas Fickinger managed over 1,350 advisors generating $1.5 billion in revenue in 2016.

September 18 -

The firm's latest hires include an industry veteran of nearly four decades of experience.

September 18 -

The advisors join the regional BD’s offices in Chicago and Nashville, Tennessee.

September 18 -

Bill Morrissey, who is leading the effort, described the firm's rapid, multipronged approach.

September 18 -

Retirees can consider a Roth IRA if they want to leave assets that would not be taxed once inherited.

September 15 -

The IRS is relaxing some rules to make pulling money from retirement plans easier after hurricanes Irma and Harvey, but clients should remember the taxes and penalties associated with withdrawals are unchanged,

September 14 -

Private equity-backed parent Advisor Group made the shakeup at a challenging time for IBDs.

September 13 -

Give life advice and charge accordingly, says United Capital's Joe Duran.

September 13 -

The answer is in the investment details. If your employer offers a match, contribute at least enough money to get it since matches amount to "free money."

September 12 -

The platform provider has added 12 firms to its roster so far this year.

September 12 -

The relaunched program has the same name, but no new funding, a spokeswoman says.

September 12