-

RBC Wealth Management-U.S. sees a 12% surge in assets under administration — thanks largely to skyrocketing market gains.

February 26 -

With AI concerns crimping wealth management firms' stock values, an analysis by Fitch Ratings reveals the companies' underlying dynamics after a strong 2025.

February 24 -

UBS Americas reported $14 billion in net new asset outflows in Q4, marking its worst period since the firm announced major compensation changes in November 2024.

February 4 -

CEO Rich Steinmeier looks past advisors defections to tout progress toward its goal of retaining 90% of the assets Commonwealth Financial Network had at its purchase last year.

January 30 -

Ahead of the expected closing of Fifth Third Bank's deal to acquire Comerica Bank, Ameriprise CEO Jim Cracchiolo provided few new details.

January 29 -

CEO Paul Shoukry took a swipe at big private equity-backed acquirers, saying in an earnings call that most advisors want to be at firms "where they're not going to have to have another disruption in three to five years."

January 29 -

Stifel CEO Ron Kruszewski said a surge in advisor recruiting and record wealth management results could lead the firm to invest even more in hiring in 2026.

January 28 -

The raise comes following a year when the firm earned $57 billion in net income, approaching a record set in 2024.

January 23 -

Total net new assets for the quarter totaled $158.2 billion, more than the $144 billion projected.

January 21 -

Goldman Sachs shattered expectations with a record $4.31 billion in fourth-quarter equities trading revenue, topping its own Wall Street high set just months earlier.

January 15 -

The wealth management giant capped off 2025 by pressing ever closer to the asset and wealth management target set by former CEO James Gorman.

January 15 -

A sharp fourth-quarter decline in net new investment assets weighed on Citi's wealth division, tempering full-year growth despite revenue gains.

January 14 -

Bank of America's wealth management businesses suffered a blow last year when principals of a team that managed $130 billion in AUM left for independence. Merrill executives are now looking to the future with ambitious recruiting and cross-selling plans.

January 14 -

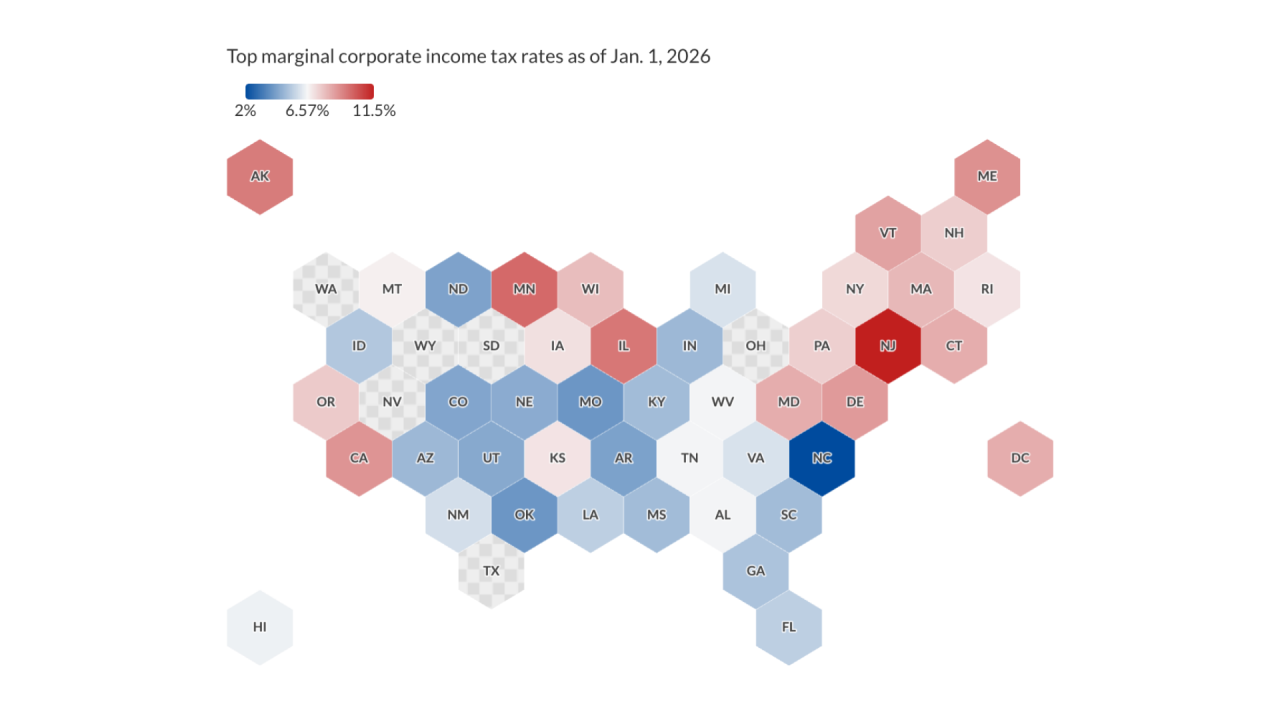

Corporate tax rates vary widely by state, affecting client business decisions around relocation, expansion and growth planning. Here's how the landscape is changing in 2026.

January 13 -

The massive intake preceded the BNY-owned custodian's rollout of a new financial advisor matchmaking service aimed at conversions from institutional clients.

January 13 -

The megabank sees its asset inflows swell by 14% while reporting greater numbers of client advisors and private bank advisors.

January 13 -

RBC CEO David McKay discusses plans to provide more clients with banking relationships while the firm announces a reorganization of its U.S. wealth management division next year.

December 3 -

Concerns grows that the the $1.7 trillion private credit industry could be adding hard-to-detect risks to the U.S. financial system.

November 21 -

Edward Jones added $17B in net new assets despite a sharp slowdown in new client households, reflecting a focus on high net worth clients and specialized services.

November 7 -

LPL CEO Rich Steinmeier said the firm is nearing its goals for retaining Commonwealth Financial Network's assets and advisors, freeing up internal recruiters to bring in advisors from other firms.

October 31