Morgan Stanley saw its net new asset haul more than double in the fourth quarter as total wealth and investment assets climbed over $9 trillion for the first time.

On Thursday, Morgan Stanley reported that net new asset inflows into its wealth and investment management divisions rose by 116% year over year in the last three months of 2025, reaching $122.3 billion. Net new assets are often viewed as a key gauge of wealth managers' success, since they take into account only money brought in from new or existing clients rather than market returns.

The asset surge in Morgan Stanley's fourth quarter helped propel its holdings in both its wealth and investment management divisions to nearly $9.3 trillion, up from $8.9 trillion in the

Assets in advisor-led accounts, E-Trade and Morgan Stanley at Work

Of Morgan Stanley's nearly $9.3 trillion in assets, nearly 80% — roughly $7.3 trillion — was held in its wealth management division. Morgan Stanley saw its assets managed by advisors rise by 20% year over year to just over $5.7 trillion.

Roughly half of those were in accounts producing asset-management fees. Fee-generating accounts are generally prized for their ability to yield steady streams of income.

Meanwhile, assets held in Morgan Stanley's E-Trade online brokerage and other self-directed accounts rose by 16% to $1.67 trillion. Morgan Stanley reported it now has 8.5 million households using its systems for trading.

The

Morgan Stanley CEO Ted Pick told analysts in a call Thursday that, "The financial advisor, workplace and E-Trade channels are each thriving."

"The business had net new assets of over $350 billion last year," he said. "Over the last five years, the firm attracted $1.6 trillion plus of net new assets with a doubling of fee-based flows."

The wealth management funnel and 30% pretax margin goal

Chief Financial Officer Sharon Yeshaya noted in the same call that much of the assets in the firm's advisor-managed accounts originated in E-Trade or Morgan Stanley at Work. Morgan Stanley often describes its wealth management business as a funnel bringing clients in through self-directed or workplace accounts and moving them on to relationships with financial advisors.

"Advisor-led assets originating from Workplace and E-Trade relationships accelerated, growing to a record $99 billion for the full year, compared to historical averages of around $60 billion per year," Yeshaya said.

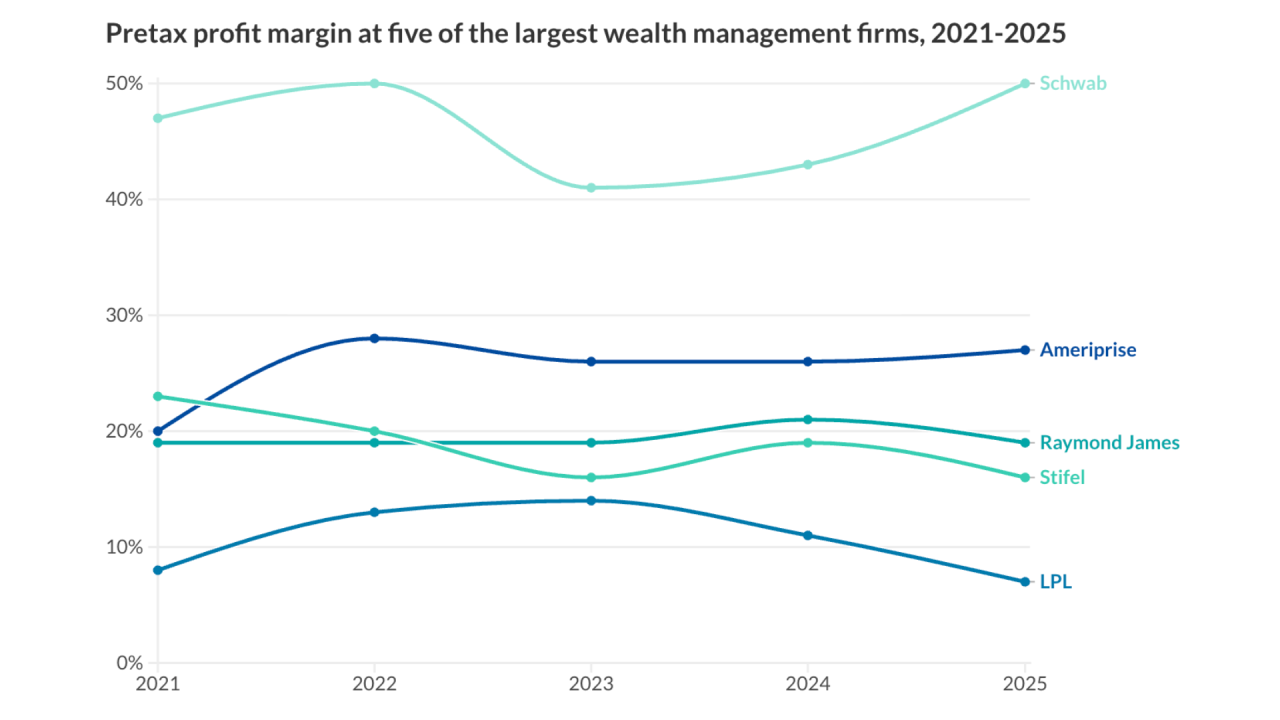

While making steady progress toward its $10 trillion asset target, Morgan Stanley held steady on another goal: maintaining a pretax margin of 30% in its wealth management business. That margin — the share of revenue the wealth division has left over following the subtraction of nontax expenses — rose to 31% in the last three quarters of 2025 after

Morgan Stanley patiently eyes M&A prospects

Pick said he and other executives are

Revenue, net income and AI savings

Buoyed largely by its asset gains, Morgan Stanley saw its wealth management revenue rise by 13% year over year in the fourth quarter to just over $8.4 billion. Its net income was up by 33% year over year to $2 billion.

For 2025 as a whole, Morgan Stanley's wealth division reported its net revenue increased by 12% year over year to nearly $31.8 billion. Its annual net income was up 21% to just over $7.1 billion.

Yeshaya said Morgan Stanley's

"That's happening using AI," Yeshaya said. "So there's technology that can be used both on the revenue side and on the expense side. That should help us drive the margin on both the top and the bottom line."