-

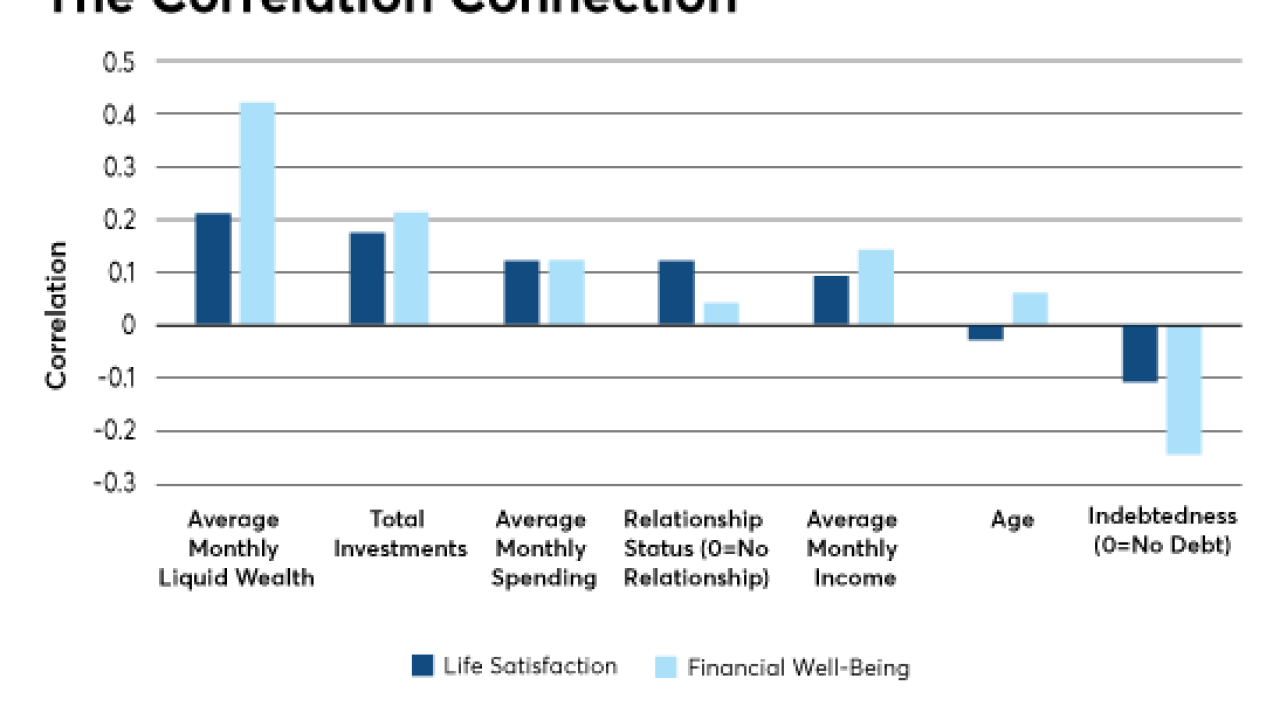

New research suggests we’re hardwired to crave substantial liquid reserves, but advisers can blunt it — if not outright quench it.

June 19 -

The wirehouse’s pre-tax earnings jumped 42% year-over-year despite losing 176 advisers in that time.

May 1 -

Dan Arnold expects that upheaval to lead to more movement of advisers and assets.

April 28 -

The firm's Private Client Group saw pretax profits drop to $29 million from $83 million for the year-ago period.

April 27 -

The firm's adviser headcount slipped 98 year-over-year.

April 25 -

The firm reported record revenues, net income and client assets for the first quarter.

April 19 -

First-quarter profits jumped almost 40% on $577 million in revenue.

April 19 -

Some brokers who recently left the wirehouse cited differences over its policy to cease offering commission-based retirement accounts.

April 18 -

While first-quarter revenue from insurance services fell 7.5% year-over-year, the overall wealth management business still managed to come out ahead.

April 18 -

The Buffalo-based institution generated $120 million in first-quarter revenue from trust services, up 8% year-over-year.

April 17 -

First-quarter revenue jumped 9% year-over-year even as the number of advisers fell by 10%.

April 13 -

Net income and client assets grew even as the firms' headcount continued its steady decline.

April 13 -

The last time the pool was smaller was in 2012, when it decided to cut large parts of the investment bank and was fined for trying to rig global interest rates.

March 10 -

The nation's largest IBD vows to take a “proactive approach” to the fiduciary rule.

February 9 -

CEO Jim Cracchiolo said the firm's efforts won't go to waste should the rule be overturned.

February 2 -

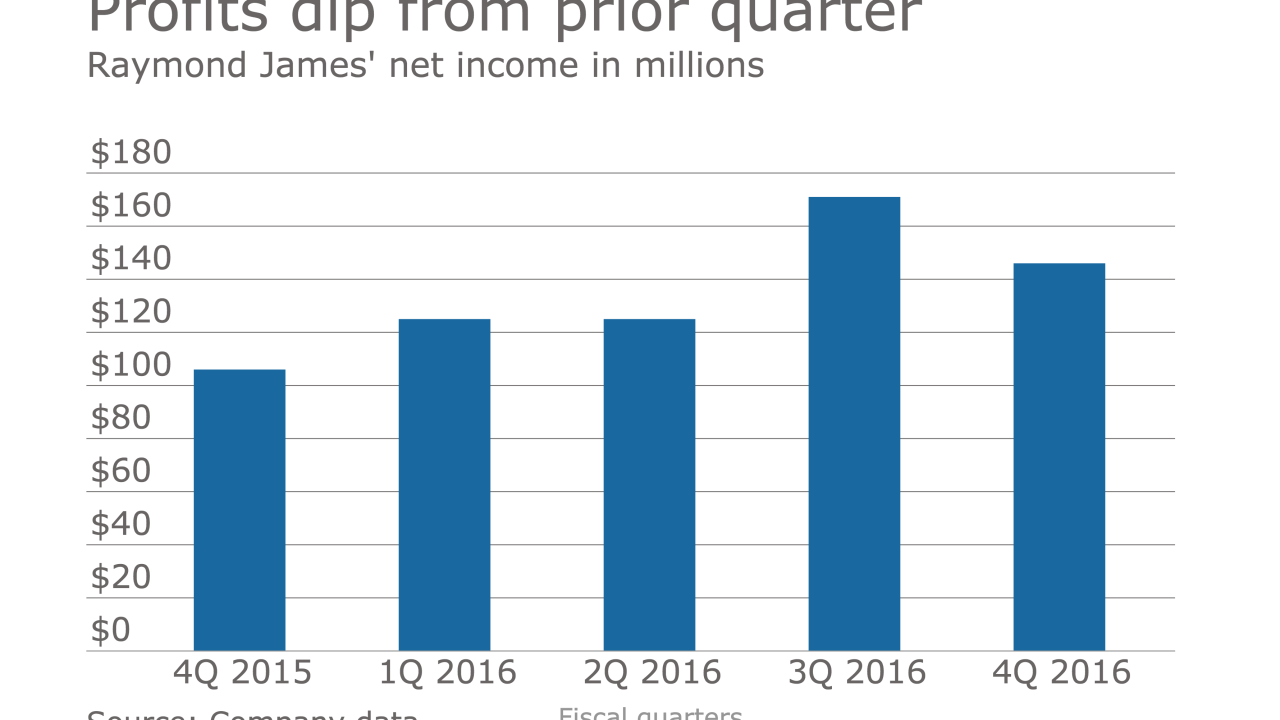

Ronald Kruszewski says a shift in the size of transition packages, made in response to the fiduciary rule, "benefits us competitively."

January 31 -

The wirehouse also reported record revenue of over $2 billion for the recent quarter.

January 27 -

What breakaway brokers and service providers can learn from the collapse of Sanctuary Wealth Services.

January 26 -

The firm is preparing for the fiduciary rule and contesting a lawsuit alleging that Raymond James allowed a $350 million fraud to be perpetuated.

January 26 -

Revenue in 2016 from the retail brokerage business slipped 6% to $281 million from $300 million in 2015.

January 20