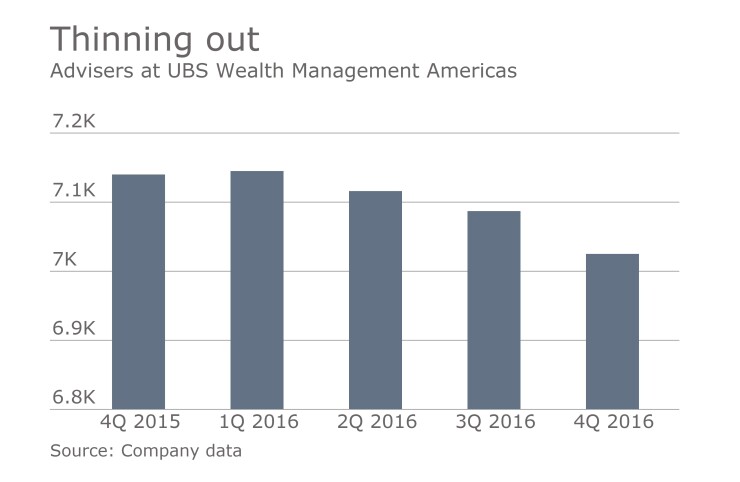

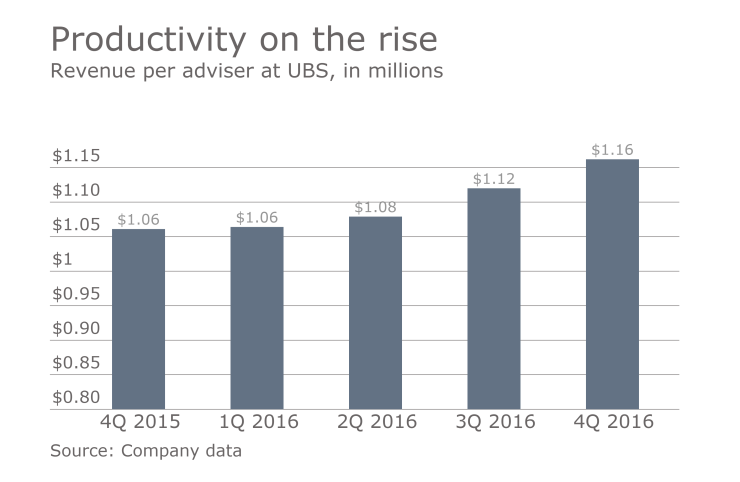

Adviser headcount may be shrinking at UBS, but the firm is reporting record revenue and rising FA productivity.

The shift is part of a new direction the wirehouse has taken under UBS Wealth Management Americas President Tom Naratil, who has concentrated on retention of the firm's existing advisers, who are the most productive in the industry.

"We are focused on organic growth, not recruiting," a spokeswoman told On Wall Street.

The firm's headcount, which fell by 65 from the previous quarter to 7,025, is still near its target of approximately 7,000 advisers, the spokeswoman says. And revenue per FA rose to $1.162 million, up 10% from $1.061 million for the year ago period, according to UBS.

While other firms have also notched recent gains in productivity, UBS still leads the pack. Morgan Stanley recently reported revenue per FA of $1.01 million, surpassing Merrill Lynch's $983,000 per adviser.

Broker compensation costs rose at UBS despite a lower adviser headcount, reaching $757 million, up more than 6% from $713 million from the same period a year ago. The wirehouse said that recruitment loans to advisers dropped 5% year-over-year to $3.033 billion.

UBS also reported record revenue of $2.059 billion, up 10% year-over-year.

CHANGING DIRECTION

Recruiting was also disrupted industrywide last October when the Department of Labor issued

Several firms cut the size of their deals, and others put a freeze on new deals while executives evaluated the impact of the Labor Department's guidance. UBS has yet to detail its plans for implementing the rule.

-

The firm is preparing for the fiduciary rule and contesting a lawsuit alleging that Raymond James allowed a $350 million fraud to be perpetuated.

January 26 -

The advisory business ended the year on a strong note, boosted by growth in net interest income, which rose 14% year-over-year.

January 13 -

The business, which includes Merrill Lynch, said profits were up 1.8% year-over-year, but down 9% from the previous quarter.

January 13

UBS also reported outflows of $1.3 billion compared to $800 million of net new money for the prior quarter and $16.8 billion for the year-ago period.

Total client assets stood at $1.16 trillion, nearly the same as the prior quarter and up from $1.084 trillion for the year-ago period.

The wirehouse's reported record pretax profits of $337 million, up from $328 million for the prior quarter and $13 million for the year-ago period, when UBS faced higher litigation expenses.

UBS continues to reap rising income from its lending and banking services to wealth management clients. Net interest income rose 24% year-over-year to $405 million. That helped offset slipping transaction-based income, which fell 1% to $372 million.

Expenses, meanwhile, fell 7% to $1.7 billion due to dropping administrative and legal costs. r