-

The Justice Department disclosed a felony probe the day before the broker’s termination.

April 6 -

David Olson, an advisor of nearly 30 years, worked at Morgan Stanley until his termination in 2016.

April 4 -

The broker misappropriated his clients’ investment money for rent, credit card bills and other personal uses, investigators say.

April 2 -

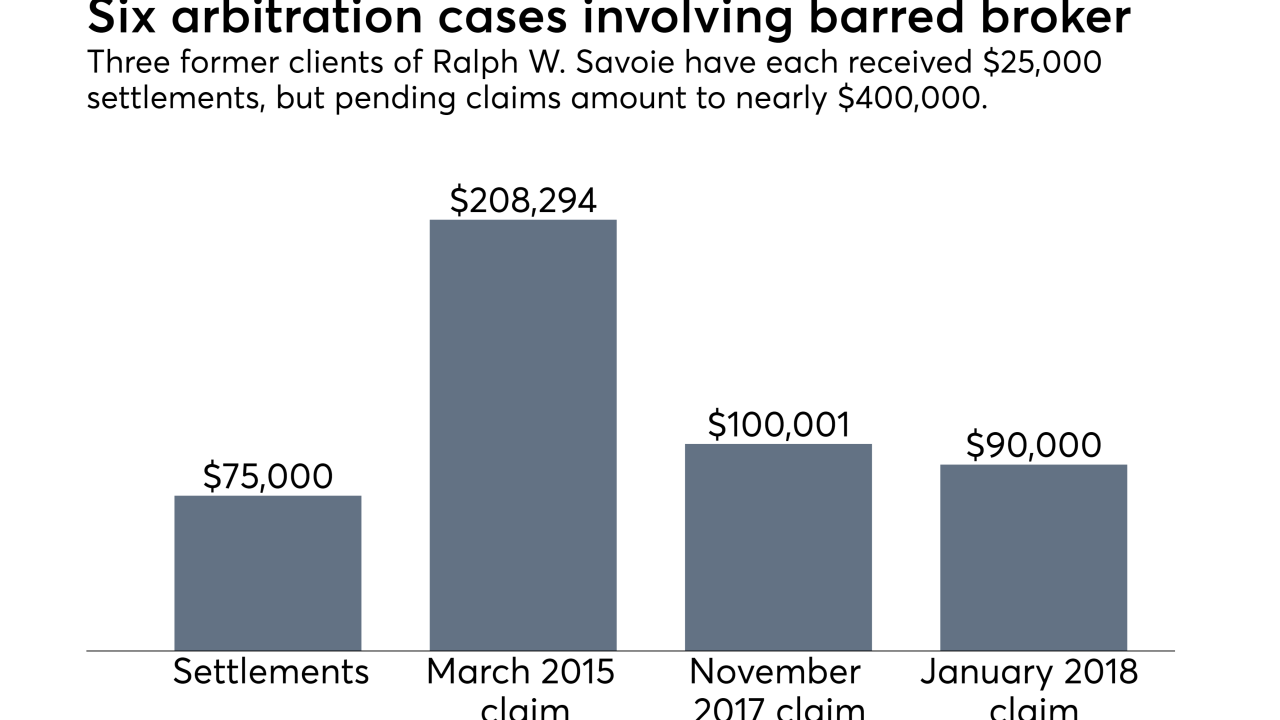

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

The trade group cautions that the SEC could outsource advisor oversight due to low examination rates.

March 20 -

Massachusetts regulators accuse the firm of running afoul of the impartial conduct standard by holding sales contests.

February 15 -

The regulator outlined the top priorities for 2018 examinations.

January 8 -

Caleb Fackrell repeatedly called his behavior “insane” in his testimony, according to transcripts obtained by Financial Planning.

December 22 -

The regulator charged the firm and its owner with fraud in a case centered on commissions and 12b-1 fees.

December 12 -

Advisors should expect more regulatory requirements, enforcement actions and uncertainty in 2018, experts say.

December 11 -

He intercepted checks from her home when she wasn’t there and forged her signature to steal her money, investigators say.

December 7 -

The wire fraud charge came nearly four years after the CFP Board revoked his certification.

November 17 -

Authorities say increased regulatory coordination has boosted scrutiny of firms and advisors.

October 6 -

Recent criminal charges parallel another case brought by the SEC against the broker.

September 28 -

The case marks the firm’s second in a month, but its special investigations unit helped crack it.

August 25 -

The move will streamline investigations and standardize sanctions, the regulator says.

July 26 -

Regulators now use deeper dives into specific areas rather than broad probes, experts say.

June 21 -

He confessed months after he was caught with 136 pounds of marijuana, investigators say.

June 6 -

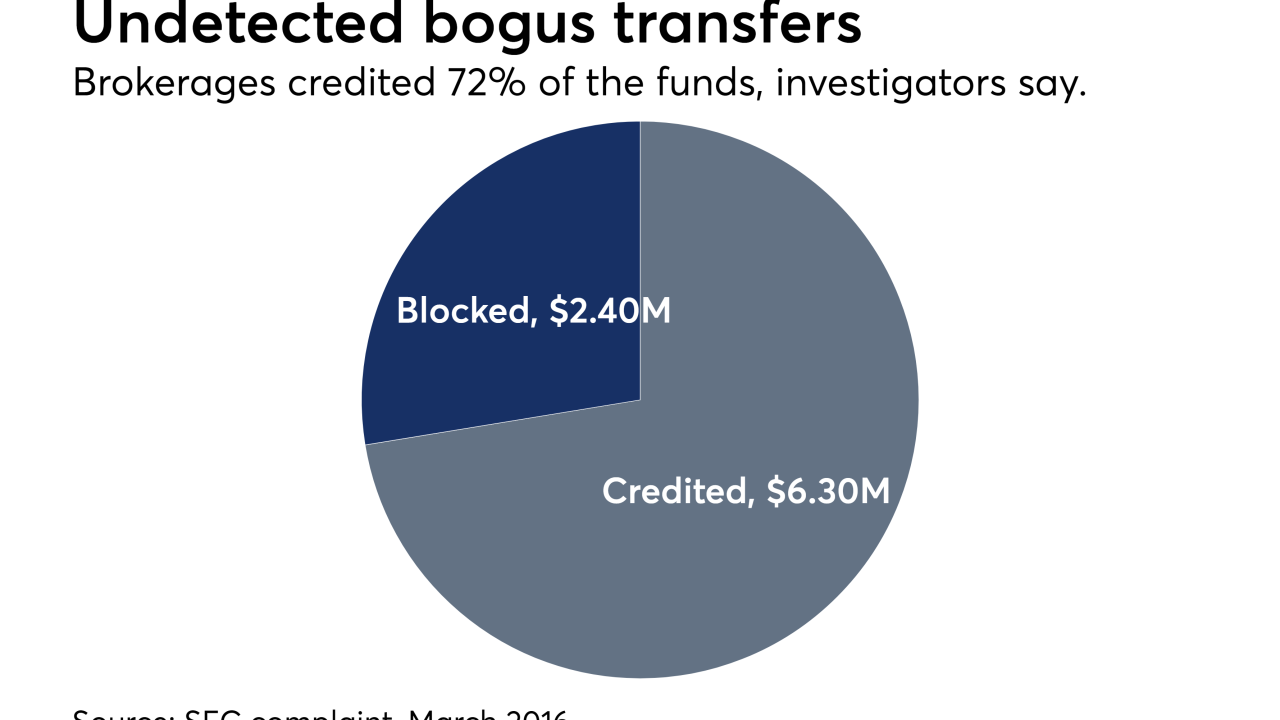

He concealed 300 transactions over two years while raking in millions of dollars, investigators say.

June 2 -

The investor received 15 months in prison after pleading guilty to wire fraud.

June 1