-

Managers will actively evaluate an asset’s characteristics — its value or momentum, for example — to determine what to buy.

August 1 -

The activity began last Friday when 6.4 million shares hit the tape, fueling a record daily inflow for the fund.

July 29 -

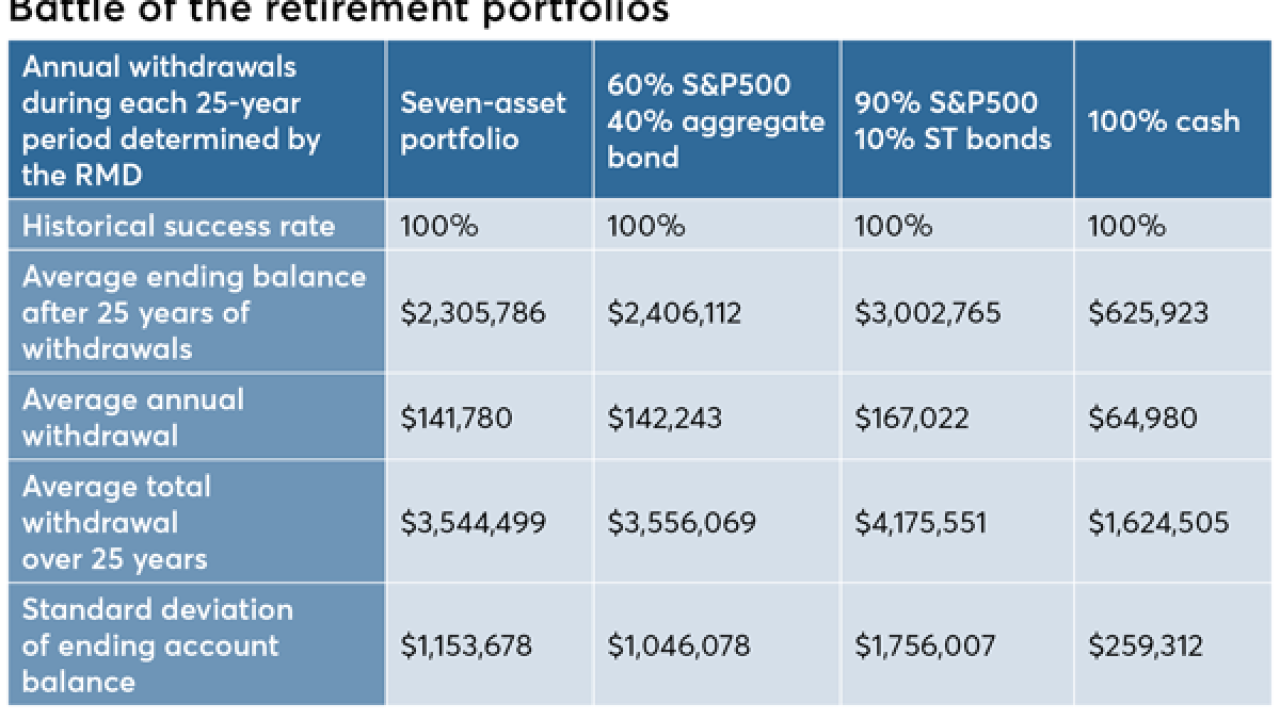

The famed investor recommends 90% large-cap U.S. stock and 10% short-term government bonds. Is it a crazy idea?

April 3 -

Home to more than $249 billion, these funds have expense ratios more than 20 basis points higher than the industry average.

March 13 -

Although it undercuts 2,000 existing U.S. products, some analysts say the price still isn’t low enough.

March 11 -

“These products are really focusing on who’s driving advances in innovation,” the global head of its asset management arm says.

March 7 -

A member-owned market is the wrong response to rising fees.

January 8 -

By sending orders to an exchange they own, banks and brokers presumably can save money on trading costs.

January 7 -

Daily volume jumped 22% to 20 million contracts in 2018.

December 31 -

The Global Income Fund slashed its equities exposure by nearly a third in October and moved part of the proceeds into U.S. and European high-yield debt.

November 30 -

One VanEck fund had $574 million of outflows, the most since June and almost 40% of its assets.

October 23 -

The fund recorded its biggest inflow since inception a week before plans from the S&P and MSCI to group together internet and media stocks.

September 19 -

The fund hasn’t seen a day of inflows since June.

August 27 -

One manager’s new group of funds will launch in collaboration with leading nonprofits.

July 19 -

If history is a guide, your clients can stop freaking out about having enough money during their post-work life.

July 19 -

Data reported by the Investment Company Institute.

July 13 -

The firm’s equity-trading business head Ted Pick, promoted to lead its division of investment bankers and traders, is one possible successor.

July 10 -

As equities in the sector extend a $3.8 trillion rout, the strategy has resulted in annualized returns of as much as 190%.

July 5 -

The firm’s new iShares fund comes amid massive outflows from the sector in recent periods.

July 3 -

This group racked up strong returns over a 24-year span of above-median inflation.

June 21