A nonprofit investment manager is starting a group of socially responsible ETFs that could change the face of values-based investing. Their twist: a little help from the experts themselves.

Impact Shares’ NAACP Minority Empowerment ETF (NACP) is expected to start trading Thursday on the NYSE. The fund, which has an expense ratio of 0.74%, is the first in what the firm hopes to be a series of ETFs that hone in on single issues rather than broad ESG strategies that focus on environmental, social and governance issues all together.

Each Impact Shares ETF will be created in collaboration with a leading nonprofit to set the qualifications for companies in the fund. In this case, that nonprofit is the NAACP. And in return, the organizations get the fund fees after Impact recoups its operating costs, meaning the NAACP will receive about $5 a year for every $1,000 invested in the fund, which charges investors $7.50, according to Ethan Powell, the founder of Impact Shares.

“Not only are you creating a portfolio that’s reflective of your individual social values, but you also have a great degree of credibility behind the social implications,” he said. “It’s not a bunch of middle-aged white dudes sitting in a room wondering, ‘Hey, I think women and minorities meet X, Y or Z from corporate America.’ It’s YWCA that’s been advocating for women for 160 years, it’s the NAACP that’s been advocating for people of color for over 100 years.”

-

Some investors are demanding action on gun manufacturer and retailer stocks. Can financial advisors deliver?

March 23 -

Integrating the strategy into portfolios has become one way clients and institutions strive make a difference.

September 8 -

Although millennials like impact investing, those with grandkids may also be on board.

August 12

Impact, which is based in Frisco, Texas, plans to launch its women’s empowerment ETF in partnership with YWCA Chicago on Monday, Aug. 27, the day after Women’s Equality Day and the anniversary of the passage of the 19th amendment granting women the right to vote in the U.S., Powell said. Other funds in the works will partner with organizations such as the United Nations, the American Heart Association and Facing Addiction in America. Future products could tackle topics such as access to infrastructure, heart health, opioid addiction, health care and gun control.

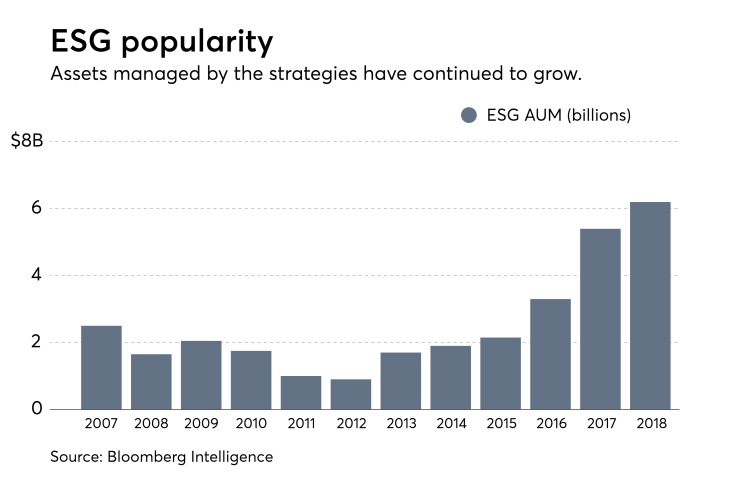

Socially active ETFs have been around since 2005 and their popularity has increased in recent years. However, many investors have criticized ESG funds for everything from their performance to their stock picking methodologies. Impact Shares aims to overcome selection issues by directly tapping the expertise of its nonprofit partners. And investors know that their fund fees are going directly to the charity they invest in.

A 20% gain sounds good, until you find out the category returned 30%.

The Rockefeller Foundation has also come on board, as a source of funding and to help link Impact with nonprofits. To Adam Connaker, senior program associate at the foundation working on its “Zero Gap” innovative finance portfolio, there’s reason to invest in a socially-focused product such as the NAACP fund and not just make a one-time donation, notably because this gives the nonprofits influence in the private sector.

“You’re giving a tool to the NAACP or whoever it might be that they don’t currently have,” he said. “So it really gets more impact out of the dollar that you’re spending.”