-

Many U.S. stock funds posted double-digit percentage gains, but international equities fared even better. Which were the biggest winners?

January 10 -

Short interest on the largest ETF tracking the S&P 500 is the lowest level on record.

January 9 -

Despite returns of about 8% last year, the products lagged behind the S&P 500’s 22% climb.

January 5 -

Record-high stocks, growing geopolitical risk. Is our current market becoming eerily similar to 1972?

December 21 Unison Advisors

Unison Advisors -

Passive funds are the decisive victor in attracting cash.

December 13 -

The aim of the so-called systematic internalizer is to lift some of the regulation’s most onerous reporting requirements from its trading partners.

December 13 -

Improved prospects for tax legislation propelled the latest boost in equities.

November 30 -

They will incorporate trade data from as far back as 2014.

November 20 -

Plans from S&P and MSCI to recategorize internet and media stocks would blend some of the year’s best-performing equities with the worst.

November 17 -

One alternative tactic, though expensive, includes buying put options on equities or an index, according to the team.

October 31 -

There are things to learn from that debacle. Just don't overdo it.

October 19Ritholtz Wealth Management -

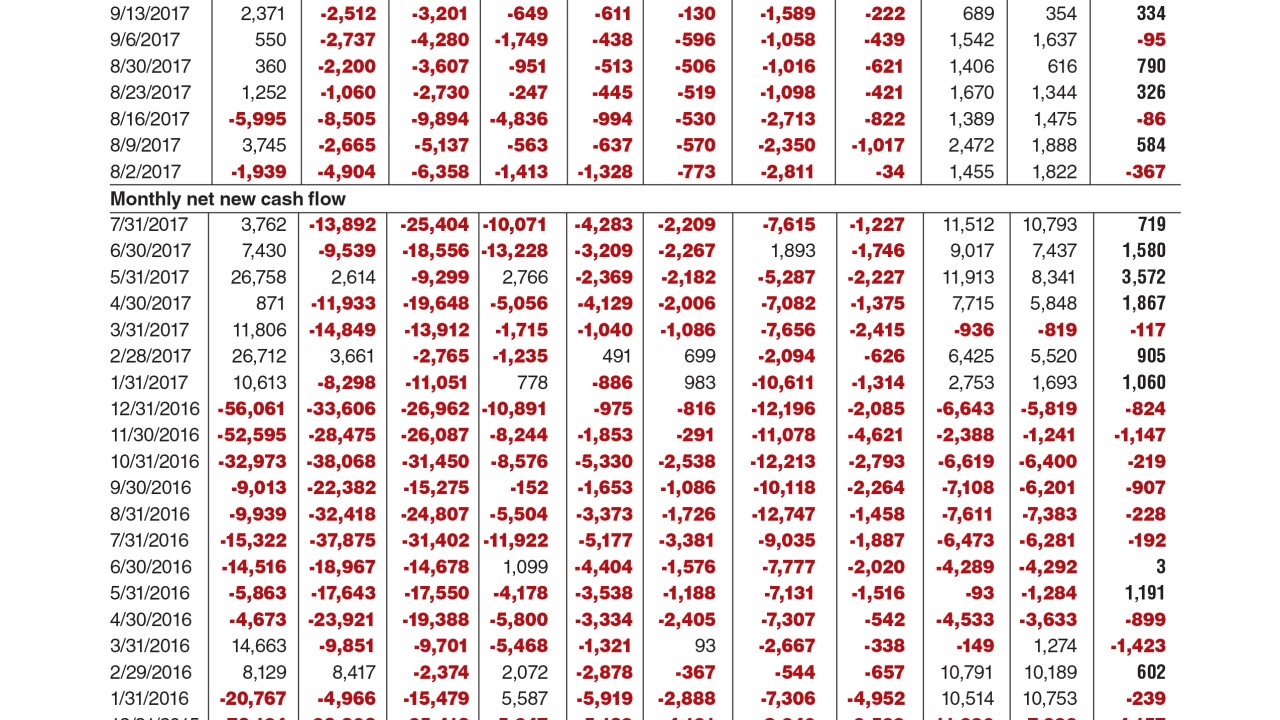

Data reported by the Investment Company Institute.

September 29 -

After spending a week holed up with several dozen employees in a New York hotel, the $1.4 billion hedge fund manager returned to Florida with a new focus.

September 14 -

When the current bull market fever subsides (or crashes), dividend investing will regain some of its lost appeal, writes an expert.

September 13 -

The firm wants to adopt a new benchmark that would add specialty REITs to the mix.

September 13 -

-

In addition to launching new smart beta funds, the firm may look to expand into “a whole host of different asset classes,” according to one executive.

August 30 -

The real concern is not just that actively managed funds could disappear but that the entire market could be left for dead.

August 29 -

Opened in the Roaring Twenties, the Massachusetts Investors Trust has weathered 16 recessions, roughly 20 bear markets and worse.

August 18 -

JPMorgan projects net corporate issuance of emerging market debt at just $22 billion for the rest of the year.

August 17