-

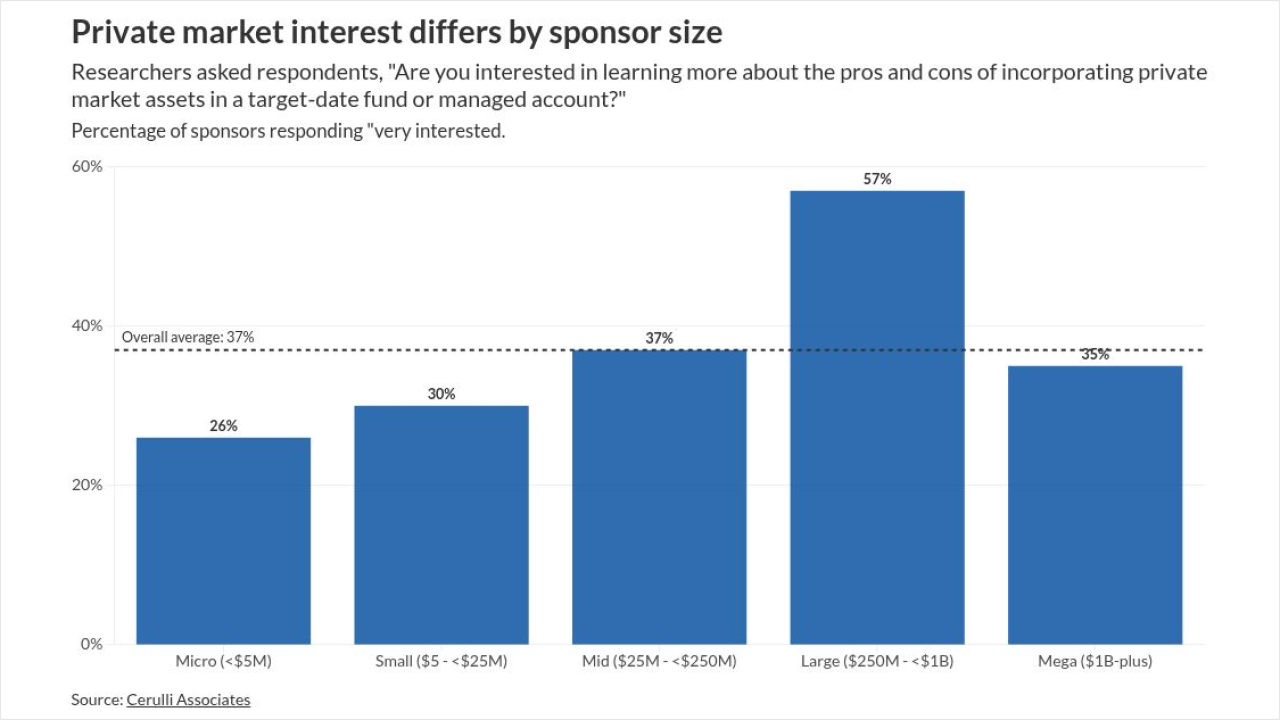

Plan sponsors show growing interest in private market investments for 401(k) plans, but regulatory uncertainty, fees and litigation risk continue to slow adoption, a Cerulli study found.

January 9 -

Financial advisors often urge clients to delay Social Security to maximize benefits, but new research suggests early claiming may be a rational choice for most households.

December 31 -

The loss of a $129 billion team for Merrill set the high-water mark in a year that also saw the departure of huge teams from UBS, JPMorgan, Wells Fargo and Oppenheimer.

December 29 -

Rockefeller becomes the latest firm to benefit from a steady stream of advisor defections from UBS this year.

December 26 -

Overspending, liability risk and emotional strain. Clients who ignore advice can jeopardize their own finances and create real challenges for advisors. But a few key strategies can help limit the damage.

December 22 -

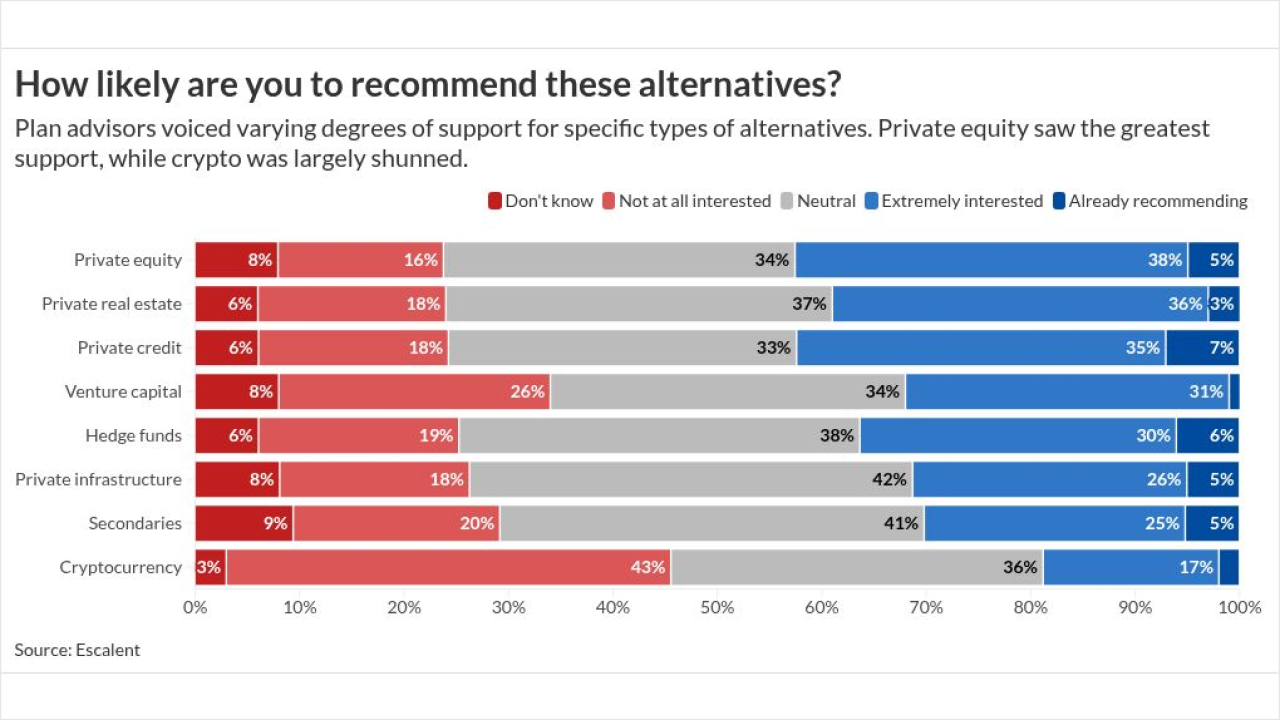

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Consolidation has been ongoing for more than a decade in wealth management, but it accelerated to unprecedented levels this year.

December 10 -

Retirement savers say they want investment choice, but confidence in navigating those decisions remains low, according to new T. Rowe Price research.

December 8 -

Researchers found that potentially traumatic childhood experiences, including physical abuse and parental separation, have lasting financial consequences, shaping workers' savings and retirement security decades later.

December 5 -

RBC CEO David McKay discusses plans to provide more clients with banking relationships while the firm announces a reorganization of its U.S. wealth management division next year.

December 3 -

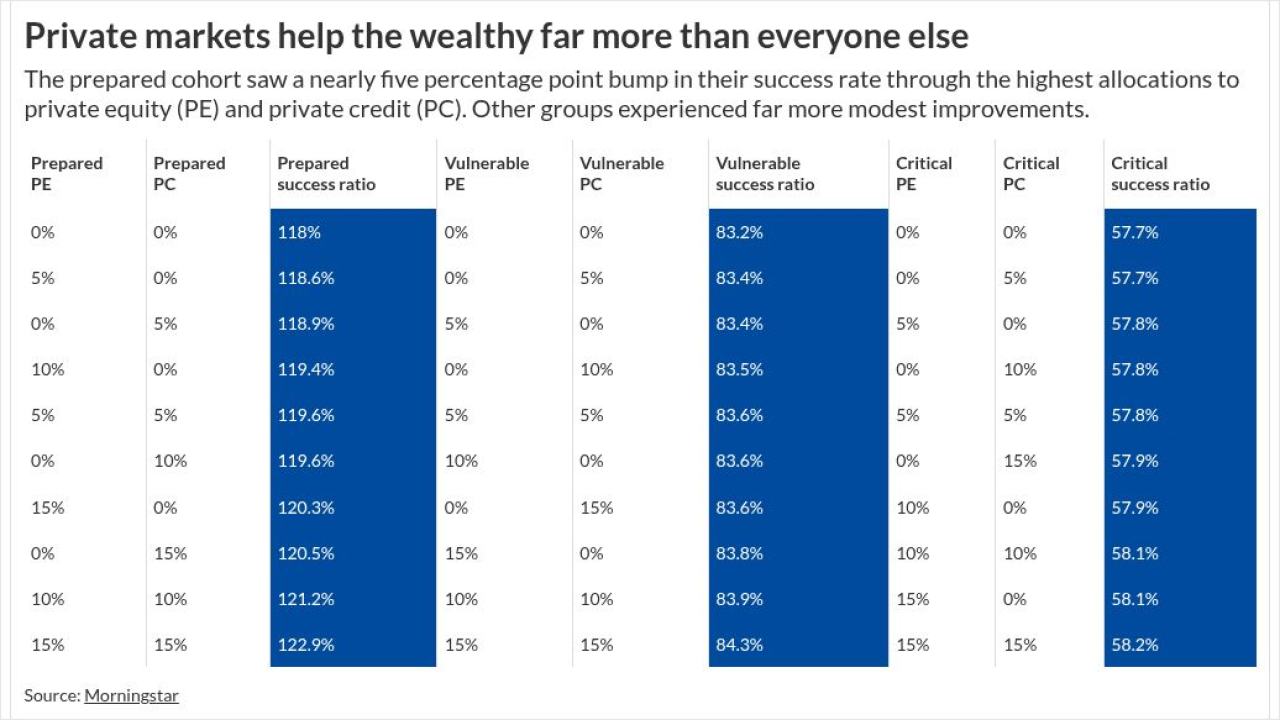

Private allocations can give retirees on a glide path a modest lift in returns, new Morningstar research shows — though the impact isn't uniform across savers.

December 2 -

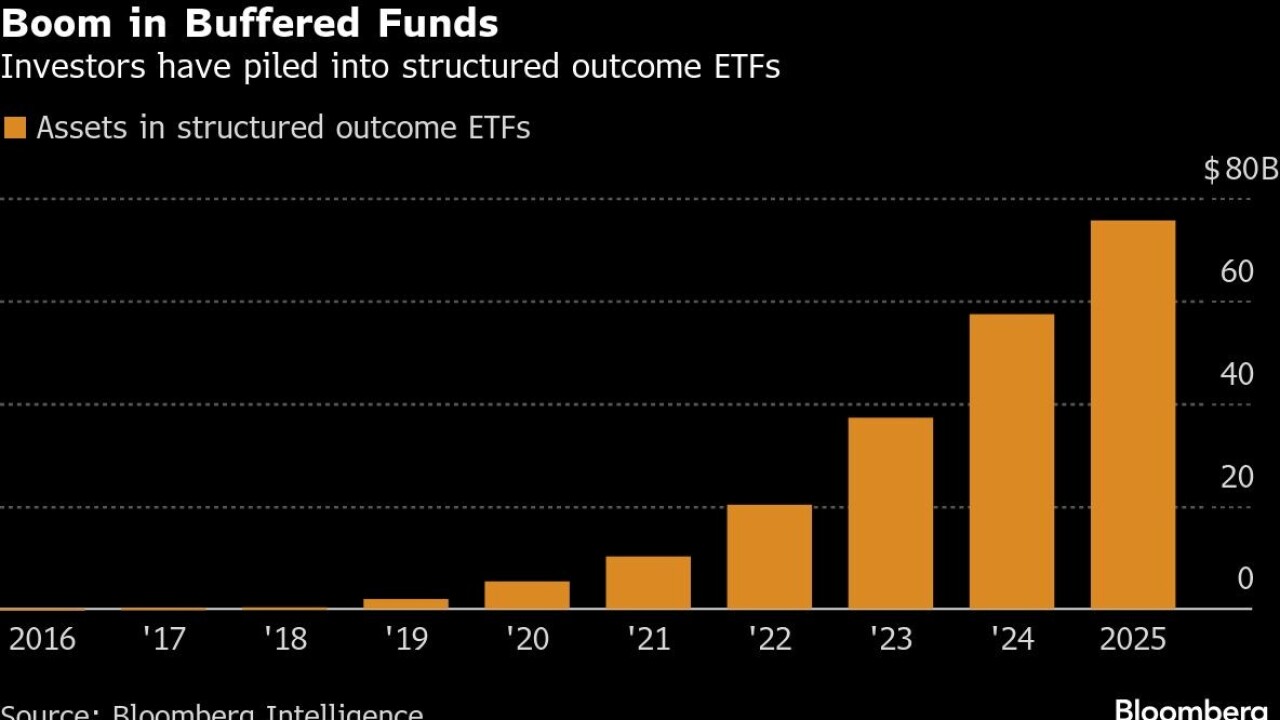

Innovator Capital Management, which Goldman will acquire next year, was a pioneer with ETFs that hedge risk by offsetting investors' exposure to equity losses by also capping their ability to realize gains.

December 1 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28 -

Advisors who reframed strategic decisions shifted investor perceptions of identical financial results, research shows; here's what that means for retirement planning.

November 26 Janus Henderson Investors

Janus Henderson Investors -

A new Cerulli report finds that advisors who outsource investment management spend more time in direct dealings with clients.

November 24 -

With New Year's resolutions on the rise, financial advisors are using the seasonal focus on money goals to engage clients and spark action.

November 21 -

Concerns grows that the the $1.7 trillion private credit industry could be adding hard-to-detect risks to the U.S. financial system.

November 21 -

A hedging product tied to bitcoin offers investors enhanced gains and downside protection — as long as an underlying ETF doesn't lose more than 25% of its value.

November 19 -

At a time when private equity ownership is causing clashes between independent broker-dealers and some of their largest advisory teams, Private Advisor Group found another option.

November 19 -

Financial therapist Rahkim Sabree wove his personal experiences into a detailed manual on a problem he and others say is often glossed over by the industry.

November 13