-

The bank is said to have been aware of the accusations for years.

April 4 -

A former spiritual advisor to presidents George W. Bush and Barack Obama plans to turn himself in as his attorney vows innocence.

April 2 -

The broker misappropriated his clients’ investment money for rent, credit card bills and other personal uses, investigators say.

April 2 -

Barry Snyder’s complaint depicts him as a victim of federal investigators and the bank, with both sides threatening to turn on him.

April 2 -

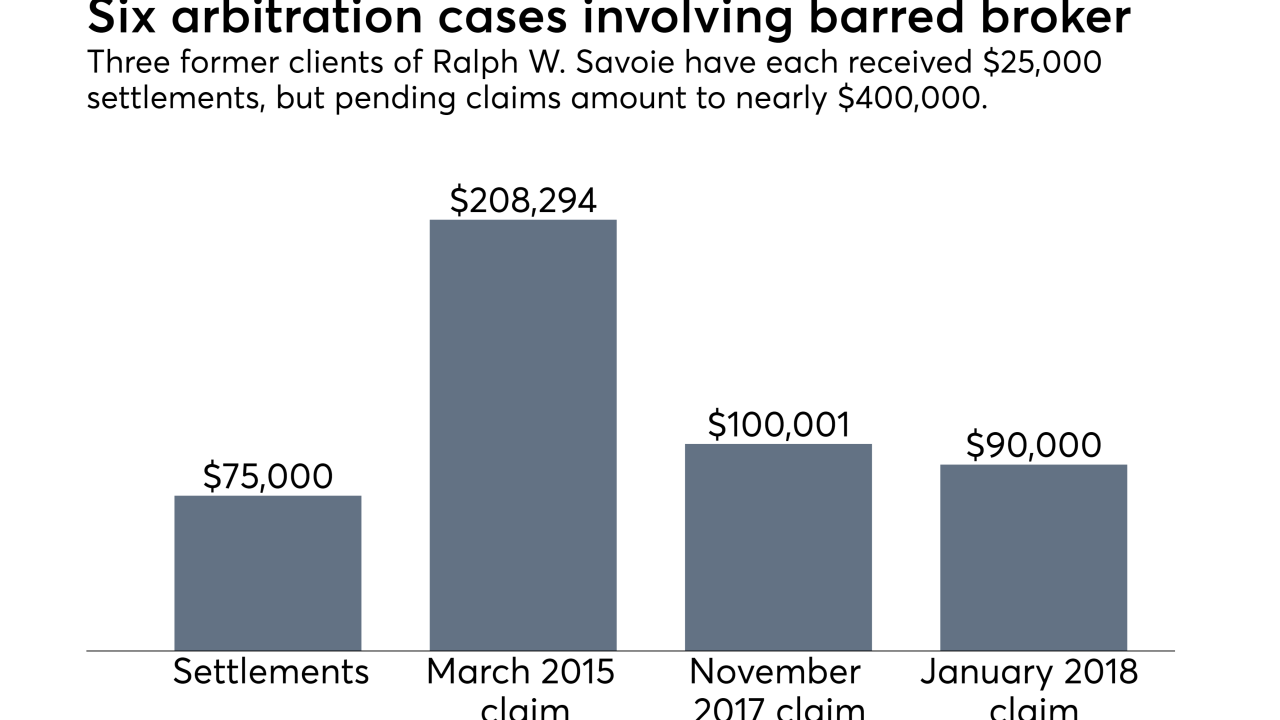

The broker belonged to Morgan Stanley's Chairman's Club, a group reserved for the elite among the firm's advisor ranks.

March 28 -

The regional BD failed to properly document its own investigations in the matter, and couldn't answer some SEC questions about who knew what and when, the regulator says.

March 27 -

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

The bank sometimes ignored the advice of its own diligence vendors in packaging and selling loans.

March 21 -

While some are mainstays, there are a few new ones to add to the list this year.

March 16 -

Investors were bilked out of approximately $611,000, say federal prosecutors.

March 15