-

-

-

To fill the gap, they are looking at the existing debt market with fresh eyes, tapping into potentially overlooked asset classes.

August 29 -

When the financial clouds are gathering, your clients have preparations to make. Top of the list: reduce risk.

August 21 -

-

-

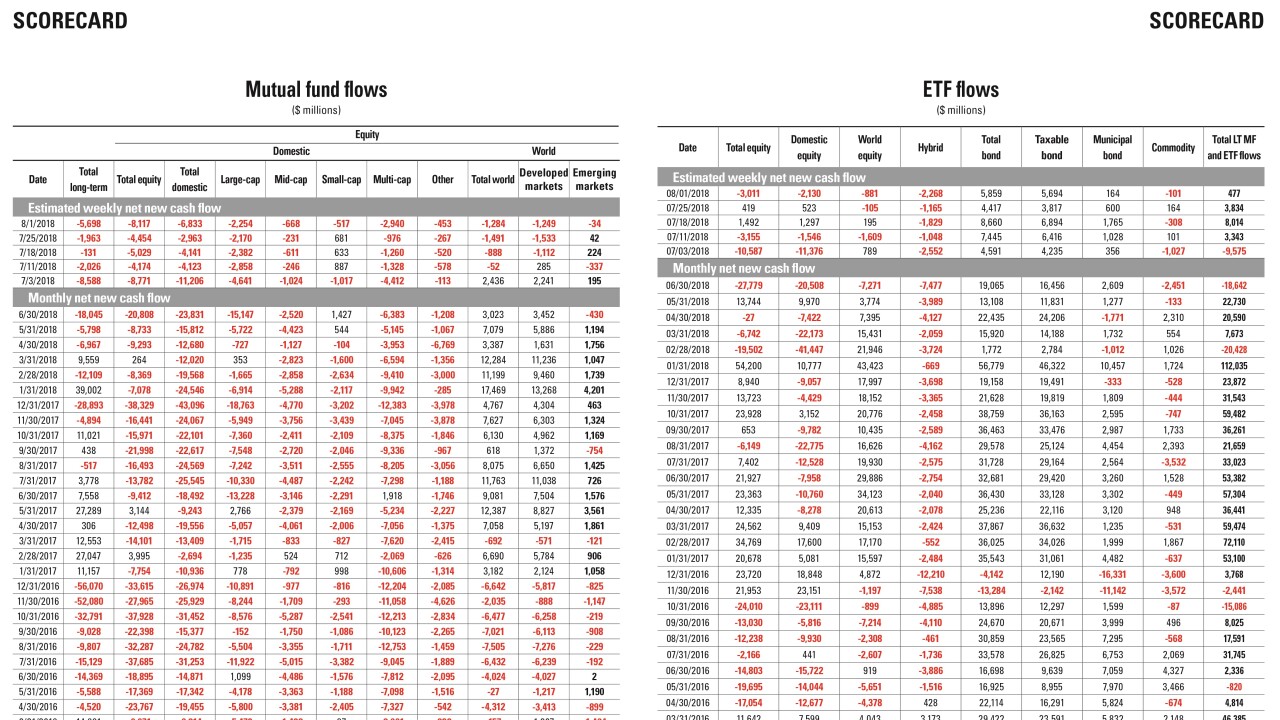

Data reported by the Investment Company Institute.

August 10 -

The shift in strategy comes as central banks move away from policies that have buttressed markets since the financial crisis.

August 8 -

The pool of money will primarily buy investments from so-called side pockets of illiquid stocks created before 2008.

August 6 -

AllianceBernstein’s Gershon Distenfeld is sounding the alarm bell on a strategy that’s grown increasingly popular with some of the world’s biggest bond funds.

August 1 -

The fund’s portfolio management team began dumping exposure to the social media giant in light of the Cambridge Analytica scandal.

July 27 -

These funds emerged as investors sought yield amid an otherwise low-interest rate environment. As rates normalize, does this approach still have a purpose?

July 19 Retirement Matters

Retirement Matters -

With stock selection pegged to 10-year Treasury sensitivity, can these ETFs work when short-term rates rise?

July 18 -

-

Muted core inflation increases and relentless haven flows have kept a lid on longer-dated developed-market yields.

July 11 -

The firm’s equity-trading business head Ted Pick, promoted to lead its division of investment bankers and traders, is one possible successor.

July 10 -

Investors have found the sector attractive again as Treasury yields dropped to 2.8% in six days.

July 10 -

Total assets of the fund have increased almost 20 times since December.

July 9 -

The asset manager's flows are down 42% year-over-year. The industry: 50%.

July 6 -

Treasury yields have fallen in response to tariffs imposed by the Trump administration, making defensive sector holdings more attractive.

July 3