-

The fund took in about $22 million in August.

August 30 -

The fund hasn’t seen a day of inflows since June.

August 27 -

The liquidations are part of an ongoing process to ensure its products meet their clients' evolving needs, the firm says.

August 23 -

With $145 million of net inflows, the fund is on track for its best month since June 2017.

August 21 -

Funds with disproportionate exposure to FANG stocks are up big in 2018.

August 16 -

These expense ratios were closer to the average fund fee in 1996.

August 15 -

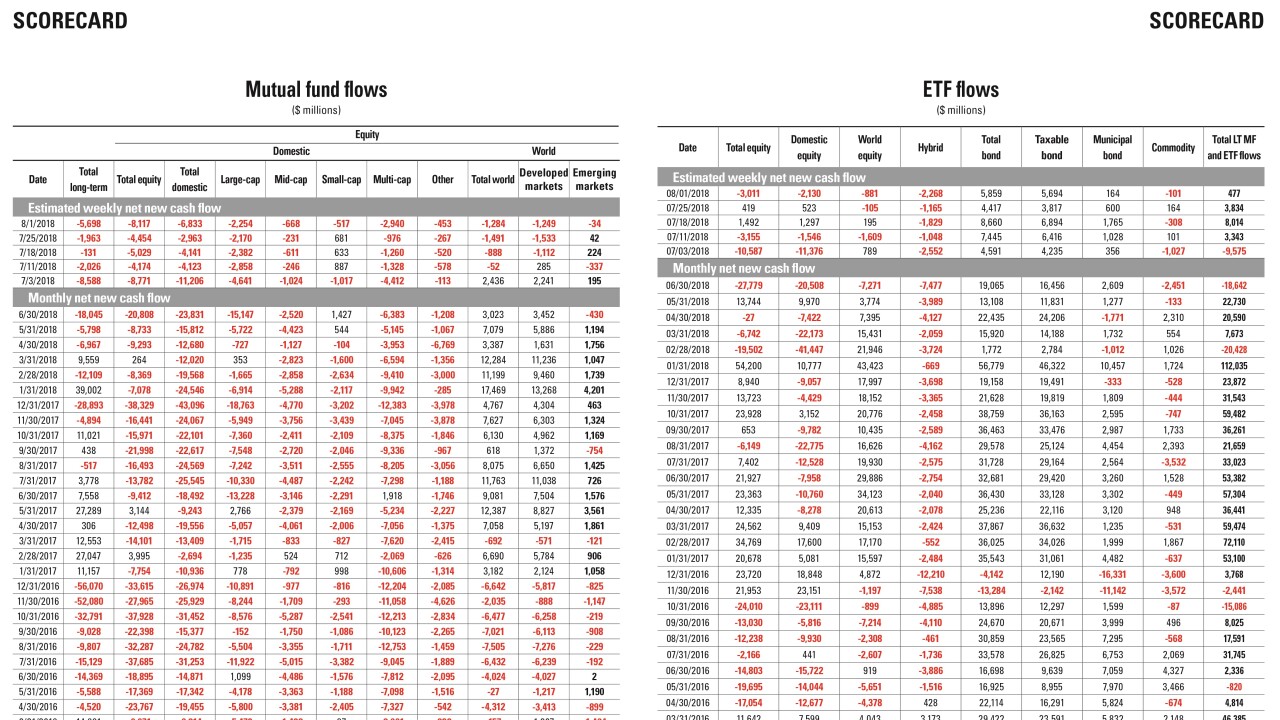

Data reported by the Investment Company Institute.

August 10 -

The legendary manager’s Unconstrained Bond Fund ended July down almost $1 billion from its February peak.

August 10 -

Many sectors have rallied the past decade, but tech and health care outperformed.

August 8 -

The biggest losers so far? High yield bond and large value products.

August 1 -

The flood of new money may be evidence that investor angst is confined to the highest-flying tech segment and not the industry at large.

August 1 -

Some funds that were in the black still turned in a poor performance — it’s all relative.

July 24 -

A 20% gain sounds good, until you find out the category returned 30%.

July 18 -

Data reported by the Investment Company Institute.

July 13 -

Passive funds attracted new cash even if their returns were negative.

July 12 -

The asset manager's flows are down 42% year-over-year. The industry: 50%.

July 6 -

As equities in the sector extend a $3.8 trillion rout, the strategy has resulted in annualized returns of as much as 190%.

July 5 -

Volatility has returned in 2018, while easy stock gains have vanished.

June 27 -

The fund provides access to China-based companies committed to implementing the digital ledger technology. Plus; other launches.

June 22 -

Investors yanked $7.7 billion from emerging-market equity and investment-grade credit funds due to trade tensions and tightening monetary policies.

June 22