A pullback from much more significant gains has left the S&P 500 ahead 2.6% through Monday as measured by the biggest ETF that tracks the benchmark index (SPY).

But it’s hardly a surprise that many funds have managed to hold on to substantial advances. In a review of the best-performing funds year-to-date, many funds are strongly in the black — indeed, the average return among the top 20 was 24%. These standouts don’t come cheap; the average expense ratio was slightly more than 1% and ranged as high as 2%. The best performers tended to be focused on small-cap, growth and the health care sectors.

The market volatility fueled two VIX-related funds to the top of the list, hearkening back to pre-2012 levels, says Christine Benz, director of personal finance at Morningstar. Benz says she wouldn’t be surprised to see volatility persist. “The market seems to be teetering between worrying about higher interest rates and volatility, and worrying about a possible slowdown in growth,” she says. “Tariffs and trade worries add a further element of uncertainty.”

Scroll through to see the top-performing mutual funds and ETFs so far this year. In addition to year-to-date returns, we also show each fund’s annualized three-year return, expense ratio and total assets. Highly leveraged funds, institutional funds, those with less than $100 million in assets or investment minimums of more than $100,000 were excluded. All data from Morningstar Direct.

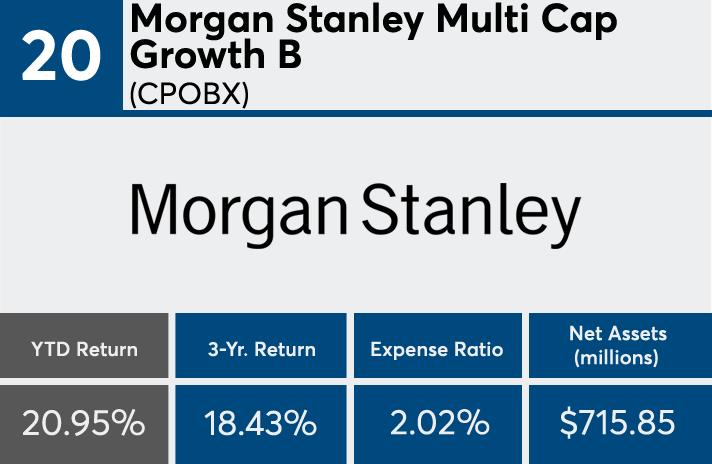

20. Morgan Stanley Multi Cap Growth B (CPOBX)

3-Yr. Return: 18.43%

Expense Ratio: 2.02%

Net Assets (millions): $715.85

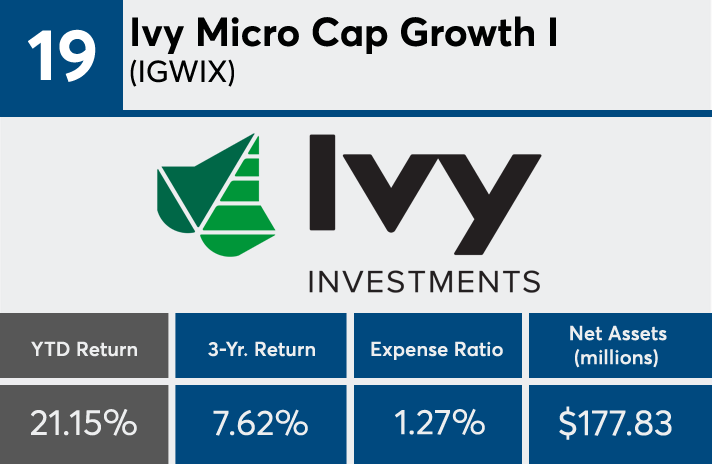

19. Ivy Micro Cap Growth I (IGWIX)

3-Yr. Return: 7.62%

Expense Ratio: 1.27%

Net Assets (millions): $177.83

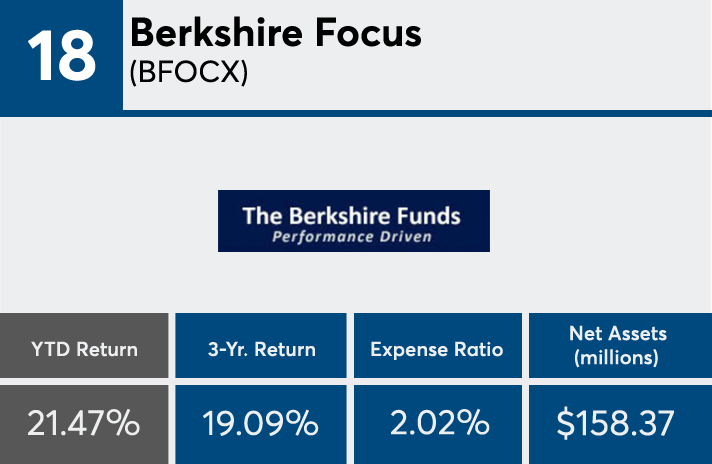

18. Berkshire Focus (BFOCX)

3-Yr. Return: 19.09%

Expense Ratio: 2.02%

Net Assets (millions): $158.37

17. Virtus KAR Mid-Cap Growth A (PHSKX)

3-Yr. Return: 16.02%

Expense Ratio: 1.40%

Net Assets (millions): $155.78

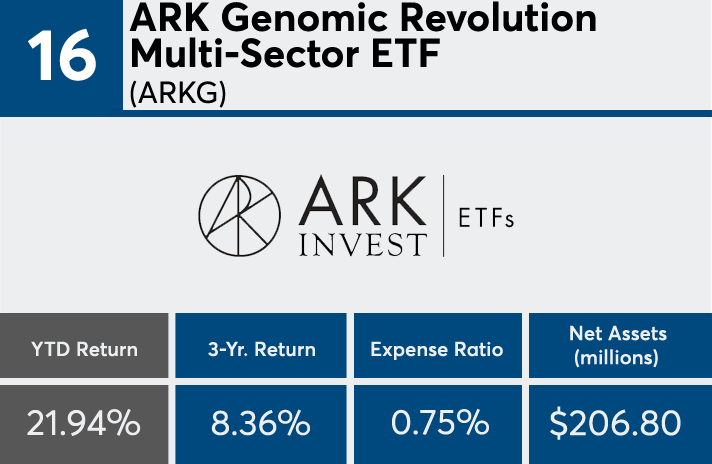

16. ARK Genomic Revolution Multi-Sector ETF (ARKG)

3-Yr. Return: 8.36%

Expense Ratio: 0.75%

Net Assets (millions): $206.80

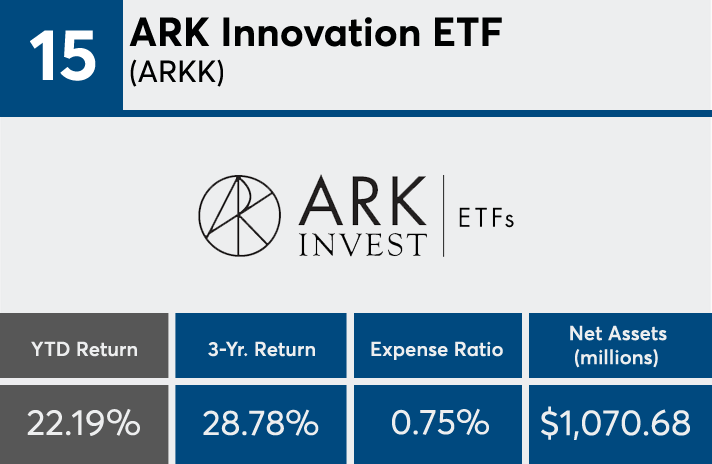

15. ARK Innovation ETF (ARKK)

3-Yr. Return: 28.78%

Expense Ratio: 0.75%

Net Assets (millions): $1,070.68

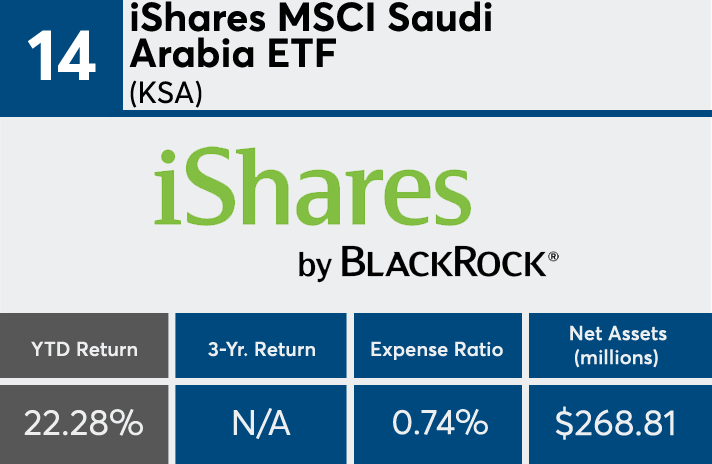

14. iShares MSCI Saudi Arabia ETF (KSA)

3-Yr. Return: N/A

Expense Ratio: 0.74%

Net Assets (millions): $268.81

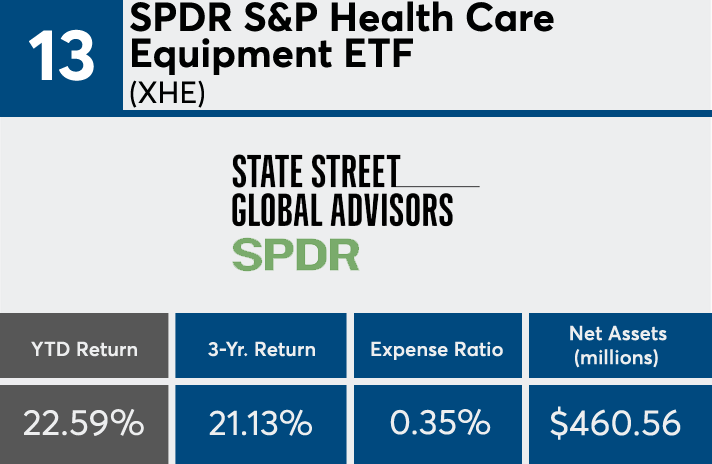

13. SPDR S&P Health Care Equipment ETF (XHE)

3-Yr. Return: 21.13%

Expense Ratio: 0.35%

Net Assets (millions): $460.56

12. Virtus KAR Small-Cap Growth I (PXSGX)

3-Yr. Return: 25.39%

Expense Ratio: 1.21%

Net Assets (millions): $4,252.49

11. Eventide Healthcare & Life Sciences I (ETIHX)

3-Yr. Return: 11.24%

Expense Ratio: 1.35%

Net Assets (millions): $695.49

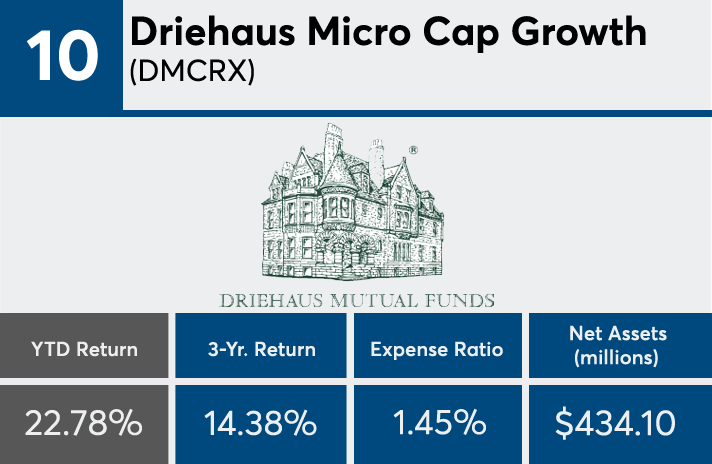

10. Driehaus Micro Cap Growth (DMCRX)

3-Yr. Return: 14.38%

Expense Ratio: 1.45%

Net Assets (millions): $434.10

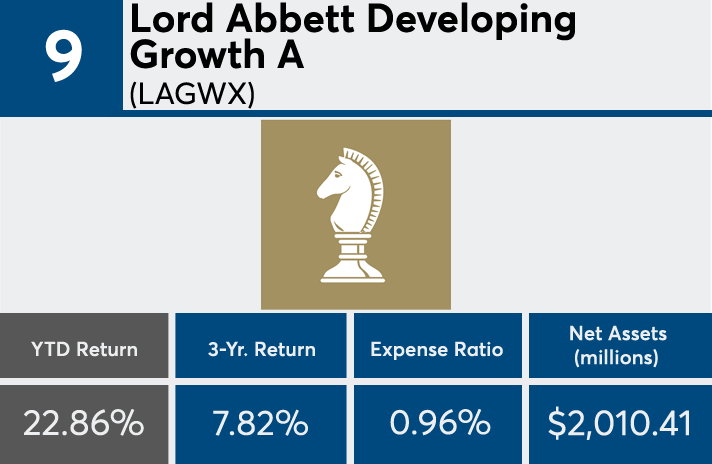

9. Lord Abbett Developing Growth A (LAGWX)

3-Yr. Return: 7.82%

Expense Ratio: 0.96%

Net Assets (millions): $2,010.41

8. Wasatch Ultra Growth (WAMCX)

3-Yr. Return: 17.31%

Expense Ratio: 1.35%

Net Assets (millions): $180.33

7. Invesco DWA Healthcare Momentum ETF (PTH)

3-Yr. Return: 11.29%

Expense Ratio: 0.60%

Net Assets (millions): $239.85

6. Amplify Online Retail ETF (IBUY)

3-Yr. Return: N/A

Expense Ratio: 0.65%

Net Assets (millions): $447.67

5. Alger Small Cap Focus I (AOFIX)

3-Yr. Return: 17.35%

Expense Ratio: 1.20%

Net Assets (millions): $1,391.09

4. First Trust Dow Jones Internet ETF (FDN)

3-Yr. Return: 26.03%

Expense Ratio: 0.53%

Net Assets (millions): $8,789.37

3. Invesco S&P SmallCap Health Care ETF (PSCH)

3-Yr. Return: 20.73%

Expense Ratio: 0.29%

Net Assets (millions): $737.15

2. ProShares VIX Short-Term Futures (VIXY)

3-Yr. Return: -49.11%

Expense Ratio: 0.87%

Net Assets (millions): $129.93

1. iPath S&P 500 VIX ST Futures ETN (VXX)

3-Yr. Return: -48.96%

Expense Ratio: 0.89%

Net Assets (millions): $859.75