-

The move for the company’s primary advisory accounts will cut costs for clients and build its fee-based business, President Elizabeth “Libet” Anderson says.

June 22 -

Most credit unions don’t offer planning services, and affiliating with the No. 1 IBD could help CUNA Brokerage change that, the firm’s president says.

June 22 -

The 10-person practice, rebranded as Puzzle Wealth Solutions, is led by CEO John Klaas and COO David Millington.

June 21 -

Its parent seeks to support more holistic planning by combining it with two other subsidiaries.

June 18 -

Good Life Companies fosters competition among wealth managers for its own health and runs food stores and a gym.

June 17 -

The hybrid firm’s giant parent tapped a new leader as it builds out a growing team with a mission.

June 16 -

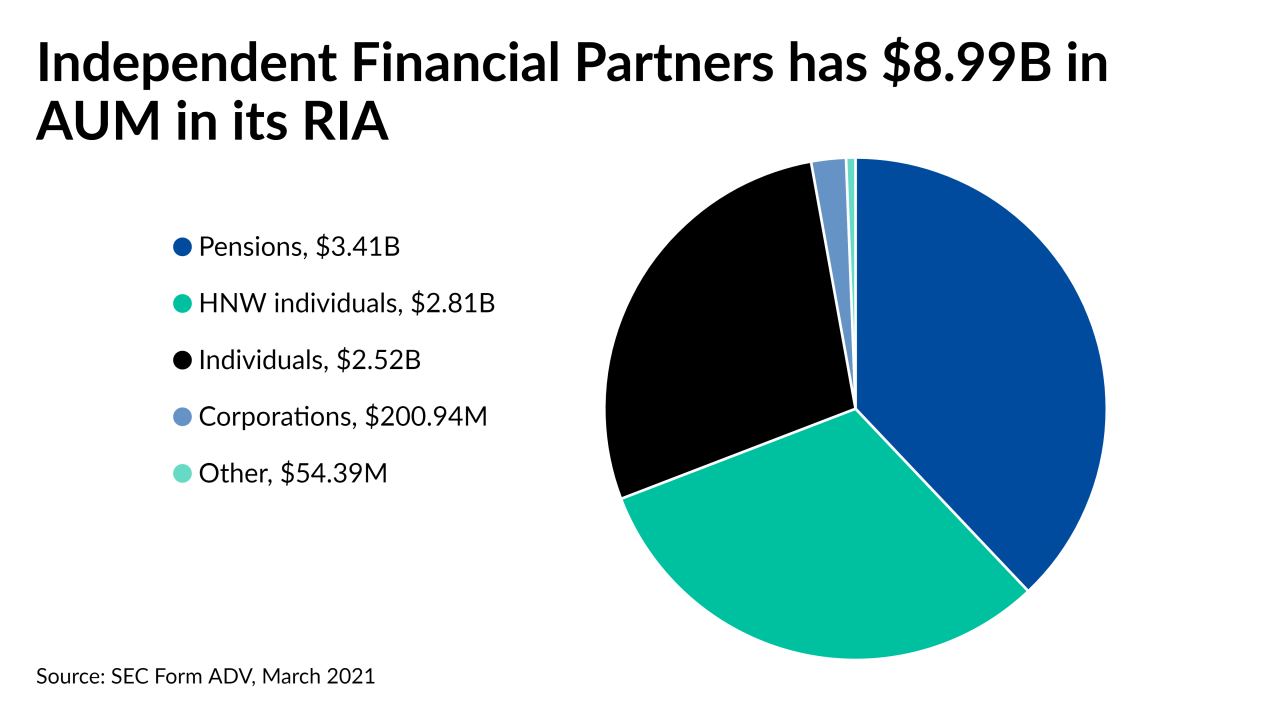

Bill and Chris Hamm admit it’s been something of a rocky start, but they say IFP is saving advisors and clients money compared to a typical wealth manager.

June 15 -

CUNA Mutual Group’s wealth manager of 550 financial advisors will almost certainly represent the largest recruiting move in the sector next year.

June 14 -

The Dallas-based hybrid RIA has more than 100 reps, and, if they follow the chief’s exit, it would be the the No. 1 IBD’s largest loss since 2019.

June 11 -

The case against Centaurus Financial comes after the industry and consumer advocates decried the previous administration’s approach for different reasons.

June 10 -

The PE-backed hybrid RIA is acquiring a practice with nine financial advisors managing $1.46 billion in client assets.

June 9 -

Concurrent is catering to breakaway teams assessing their options after back-office frustrations during the coronavirus, co-founder Mike Hlavek says.

June 3 -

With technology upgrades and the hiring of former TD Ameritrade recruiters, the No. 1 IBD eyes further expansion in the RIA channel.

May 21 -

The Financial Services Institute blasts the move and won't rule out legal action to reinstate the more favorable Trump-era regulation.

May 12 -

The tax-focused wealth manager’s parent disclosed lower first-quarter earnings after an eventful period marked by a proxy fight and a reported acquisition offer.

May 7 -

The enterprise could reach more than 50 registered representatives in the next couple of months, depending on how many of them leave MassMutual.

May 6 -

The nation’s largest independent broker-dealer will onboard a substantially higher share of assets and advisors than after its last comparable deal in 2017.

May 5 -

More growth is on the way: the No. 1 IBD has one more massive recruiting move and a $300M acquisition to complete.

April 30 -

The litigation reveals how wealth managers’ deals with product sponsors work and how one with a former Voya unit went awry.

April 29 -

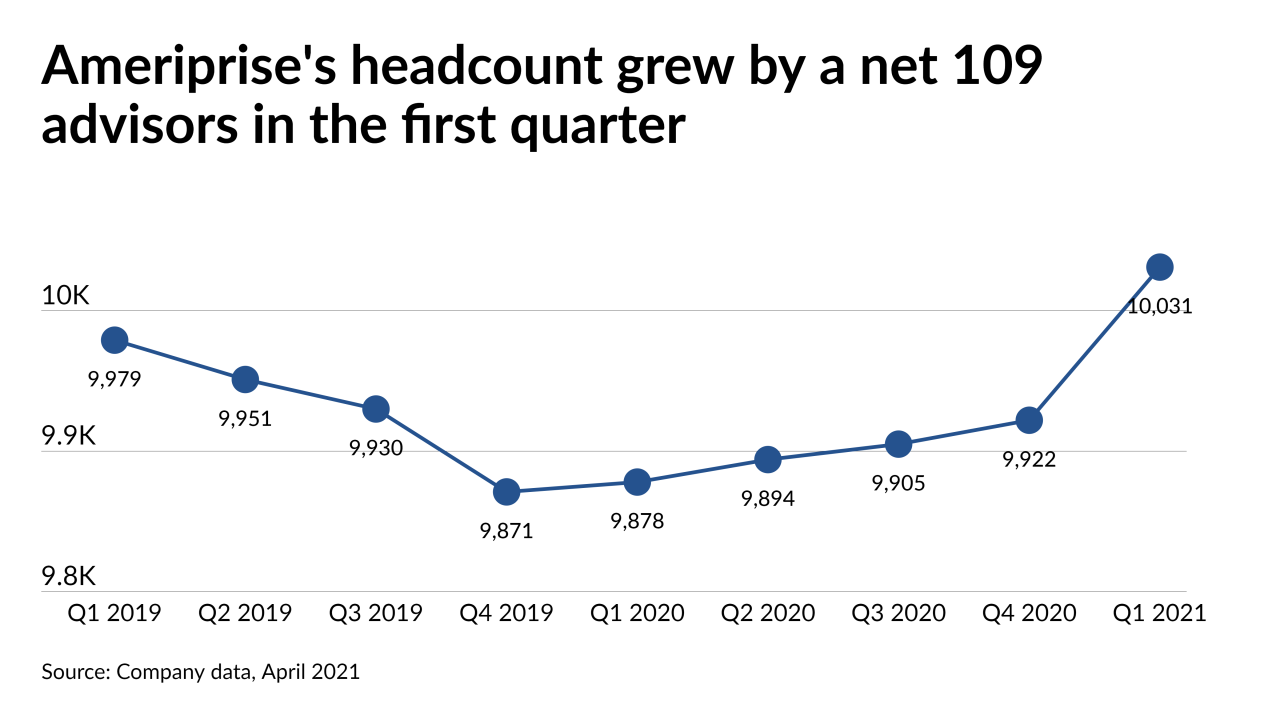

The firm’s recruiting is also gaining steam, despite the ongoing impact to its bottom line from low interest rates.

April 28