-

Renewed friction between Washington and Beijing threatens to undermine a trade deal signed only months ago, further jeopardizing global economic prospects.

May 7 -

Hedge fund managers, market academics and risk experts are channeling their data-mining smarts to the world of clinical sciences.

April 27 -

Analysis of two funds in particular shows how important the industry has become to the oil futures markets, as they have attracted record inflows.

April 22 -

Managers who are can differentiate with solid ESG credentials stand to prosper, especially as a younger generation begins saving for investment.

March 5 -

A recent sale-tax hike in the country and the impact of the coronavirus have driven the yen to it's biggest two-day drop since 2017.

February 20 -

While it’s debatable whether private donations should matter to an investor, transparency rules could become an issue as global warming accelerates.

February 14 -

The bank's asset management arm will introduce products “where they exhibit efficiency advantages over index funds.”

February 10 -

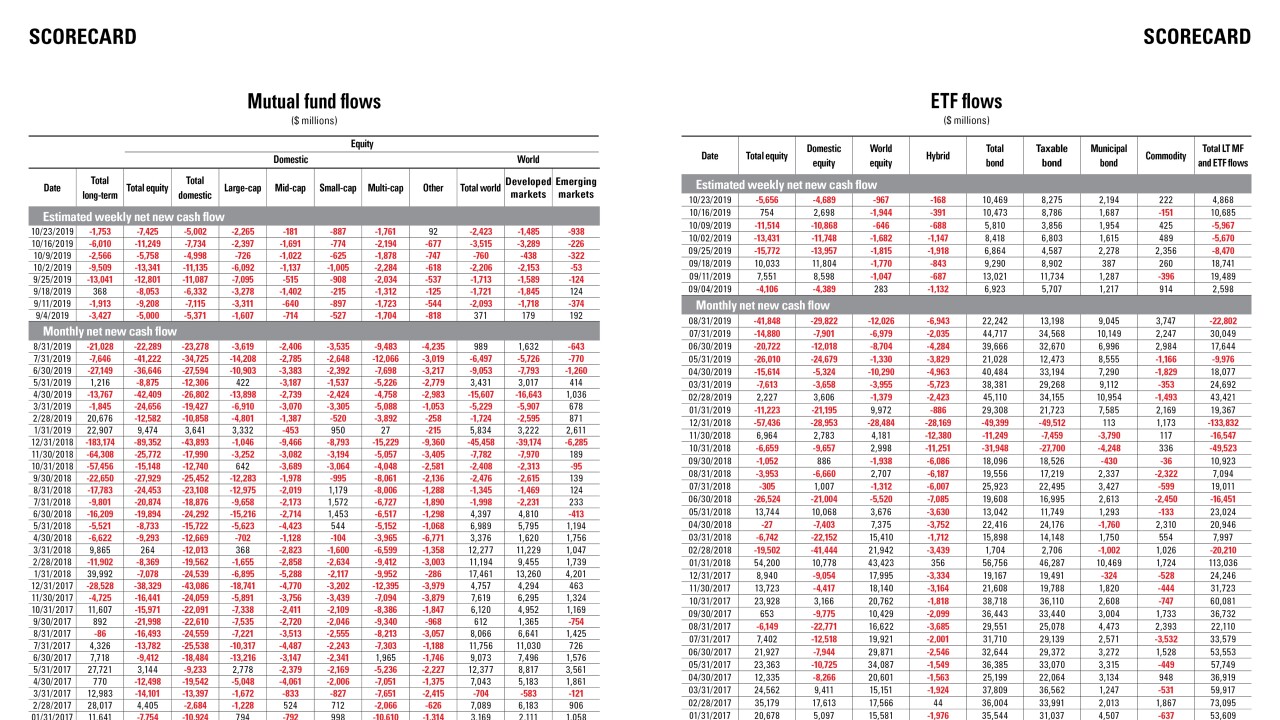

Data reported by the Investment Company Institute.

February 3 -

While the deadly virus threatens to harm the world economy, the funds have remained popular as the Fed signals low rates for the foreseeable future.

January 29 -

The funds raked in $150 billion in 2019 as investors have gotten more comfortable with how they react across different market environments.

January 28 -

Once a top-performing fund with assets well over double today’s value, Templeton’s flagship bond fund has been diminished by the march of passive investments.

January 21 -

Similar products are stockpiling unprecedented levels of new cash as investors look to alternative assets for growth and income.

January 13 -

It was the biggest annual leap for strategies focused on corporate or government debt since 2014, boosting assets to more than $800 billion, data show.

January 8 -

Already, the fund has agreed to transactions involving German wind energy project developer PNE and Altice Europe’s Portuguese fiber assets.

December 20 -

Data reported by the Investment Company Institute.

December 19 -

So much faith has been put on the partial trade deal with China that stocks have nearly recovered since President Trump’s first round of tariffs on imports.

December 17 -

Risky assets outside the U.S. are seeing fresh flows as a potential trade deal with China buoys expectations for global growth.

November 20 -

Equity funds tracking the sector are the second-most popular asset class after U.S. government bonds this year, BNP Paribas says.

November 14 -

Data reported by the Investment Company Institute.

November 7 -

The top 20 nearly doubled their gains over the last year, data show.

October 23