-

Clients who have $30,000 in student loan debt would have missed as much as $325,000 in investment opportunities in their 401(k) plans; Plus, the one money move to make before the end of the year.

December 10 -

Setting aside 15% of income for retirement may not be enough to build a nest egg that is adequate to cover living and other costs in the golden years; Plus, why investors should say no to universal life insurance as a retirement fund.

December 9 -

El-Erian says we have borrowed market returns from the future. Allan Roth is having none of it.

December 9 Wealth Logic

Wealth Logic -

Seniors are advised to work longer and retain their equity investments to help their portfolios keep up with inflation; Plus, why retirees are moving again.

December 8 -

Companies can use extra cash in their coffers in a number of ways to benefit clients. But if dividends are the goal, these companies arent likely to find a place in the mix.

December 7 -

Sky-high prices at recent art auctions in one case up to $170.4 million may have some wealthy, art-enthusiast clients seeing painted visions of dollar signs.

December 7 -

A new study claims its better to buy whole life than to buy term insurance and invest the difference. What are you telling your clients?

December 4 -

Advisors can help clients know the limits on gift-giving to avoid the tax implications. Plus, year-end tax saving moves, and seven ways to lower your client's taxable income.

December 3 -

Investors should move to protect their money rather than reach for higher returns next year as central bank efforts to stimulate the global economy set the stage for markets to ultimately fall.

December 3 -

For clients looking for income, here are the large-cap companies that boosted their dividends the most in the past three years.

December 1 -

People in higher income brackets can consider replacing less of their pre-retirement income than the 80% usually suggested by financial planners; Plus, five things retirees can do to navigate the current environment.

December 1 -

Market performance under different U.S. presidents highlights the importance of heeding this key economic measure.

December 1 -

Retirement investors who want a new approach to asset allocation may consider one that classifies securities based on how long they intend to keep the investments in their portfolio to achieve their targets; Plus, which retirement savings plans are best for teachers?

November 30 -

Considering a tactical adjustment for your client portfolios to benefit from the holiday season? Here's how each of the 10 sectors in the S&P 500 performed in Q4, on average, since 1990.

November 30 -

Recent jittery markets give advisors a terrific chance to judge liquid alt funds. Better yet, a close look can help you better position the portfolios of clients worried about global markets.

November 27 -

Bank stocks are generating buzz among investors and if rates rise, the outlook is even better. Here are the best-performing funds with a concentration in banking.

November 23 -

Seniors who have no need for required minimum distributions from their retirement accounts may re-invest the funds so the money can start generating an income again; Plus, seven retirement money wasters to avoid.

November 23 -

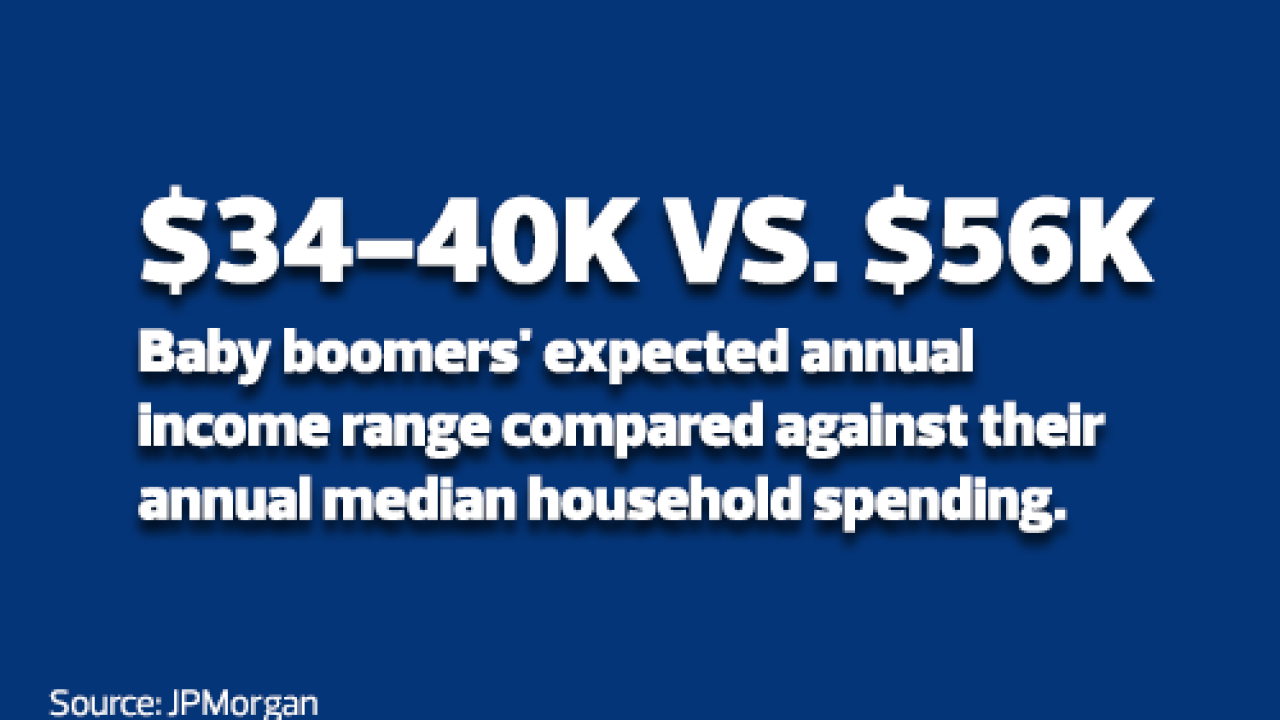

A J.P. Morgan study shows baby boomer spending needs could face funding constraints as they grow older, challenging advisors helping these aging clients maintain their lifestyles.

November 19 -

Advisors can point clients to undervalued investments in the energy sector for tax-loss harvesting. Plus, avoiding the cost of MLPs in retirement accounts.

November 19 -

Sen. Patty Murray, D-Wash., introduced legislation that would enable unmarried, divorced and widowed women to collect bigger Social Security benefits; Plus, protecting your client's portfolio from the downside.

November 18