-

The cryptocurrency is viable, more private and more secure than the world’s major reserve currencies, proponents argue. They are wrong.

November 28 Mercer Advisors

Mercer Advisors -

The seven funds are expected to begin trading in the first quarter.

November 28 -

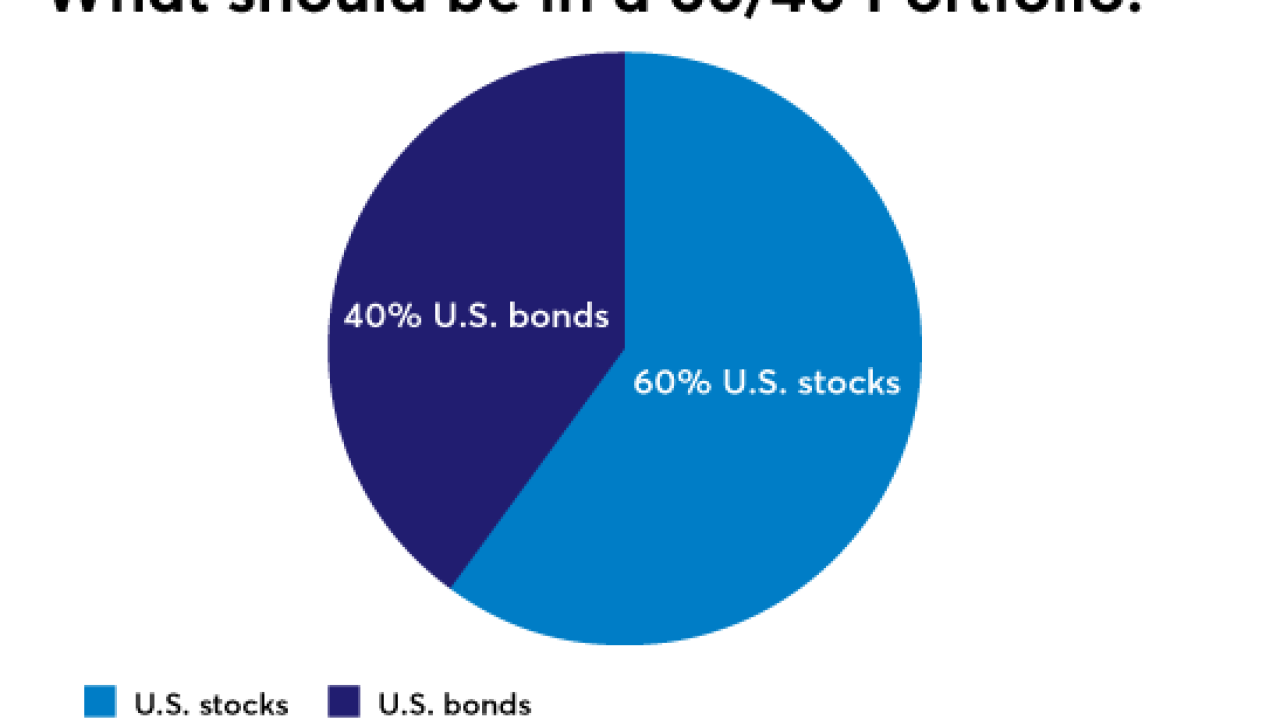

Conventional wisdom is that 60/40 portfolio is highly effective. But there could be a better way to accompany large-cap U.S. stocks than U.S. bonds.

November 27 -

-

Target date funds assume that the path to one’s golden years is linear and predictable.

November 22 Clarfeld Financial Advisors

Clarfeld Financial Advisors -

It is "not for the faint of heart; it's a very fickle market," one advisor says.

November 22 -

Sometimes, a total non-U.S. stock index offering may backfire.

November 22 -

It's not just for December, but a smart approach throughout the year.

November 21 -

The firm will now directly link to Acorns, following its roughly $30 million investment in the microinvesting app.

November 20 -

After building an empire on passive funds, the world’s largest asset manager is readying a suite of actively managed funds.

November 20 -

How do advisors navigate all the client portals?

November 17 Totum Risk

Totum Risk -

They have become increasingly attractive as real estate prices climb.

November 17 -

Most of the barriers protecting wealth management from tech competitors have been chipped away, executives say.

November 17 -

There will still be several different methods to have the fee waived.

November 16 -

Equine exposure should be done outside the core portfolio, using discretionary funds.

November 16 -

The majority of public and private funds using the strategy launched in the last three years.

November 16 -

-

The standard process for launching exchange traded funds is flawed, argues Allan Roth. He proposes a better way.

November 15 -

The robo advisor adds a longstanding tax strategy to its offerings.

November 15 -

High-risk, highly concentrated funds may not be for everyone, but they can fill a niche.

November 14