-

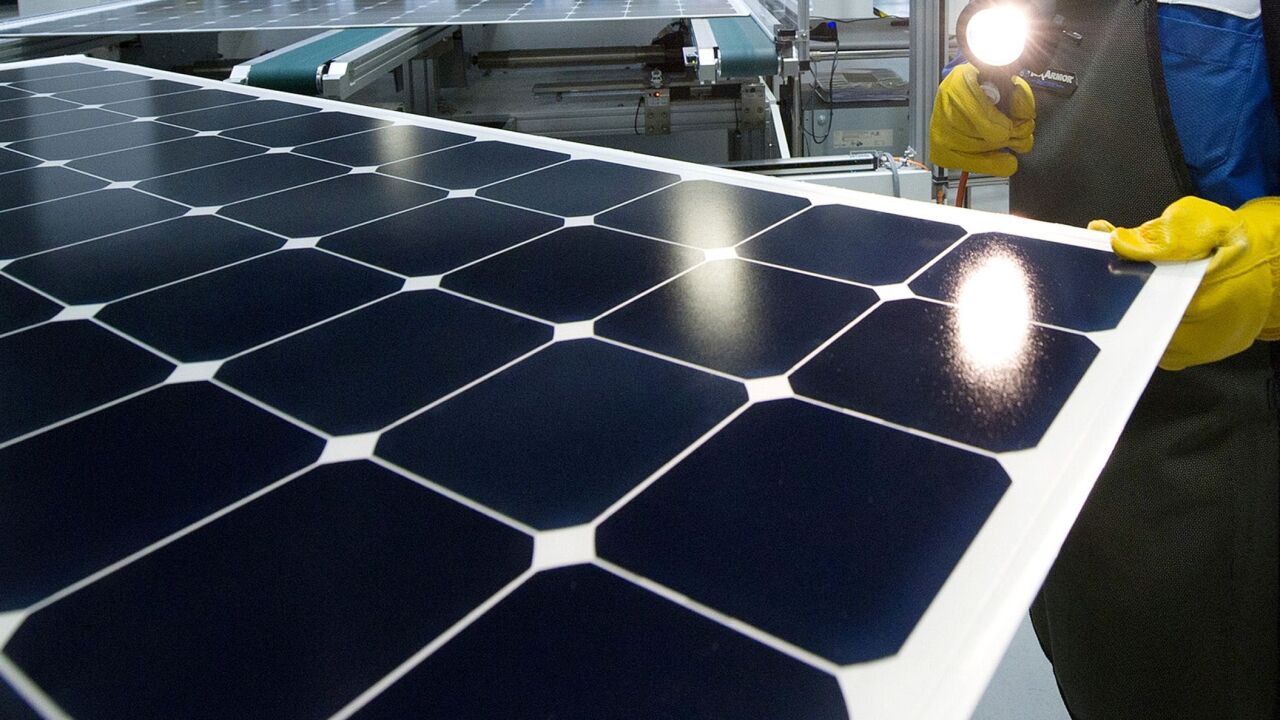

A range of factors have been cited for the clean-tech rally, including maturing wind and solar industries after a collapse in oil prices earlier this year.

August 26 -

Fees for the category's best performing mutual funds and ETFs are much like the price of bullion: expensive.

August 17 -

“How many minority-owned ETFs do you know?” an advisor asks.

August 17 -

Innovator ETFs, an asset manager, will debut its so-called buffer funds at a time when Treasury yields are hovering near historic lows and duration risk climbs.

August 14 -

“If you decide to make the portfolio more conservative, make sure you have a plan — an exact plan — on when to come back,” an expert says.

August 13 -

While Guinness Atkinson pursues the first full mutual fund-to-ETF conversion, similar moves have begun elsewhere in the fund industry.

August 12 -

The fund industry's latest arrivals underline the seismic shifts underway in the business of asset management.

August 12 -

Ben Meng’s downfall raises questions about who would succeed him in a job that attracts so much unwelcome attention, not to mention navigate a pandemic.

August 10 -

A significant push to use the precious metal as portfolio insurance may create a self-reinforcing spiral that upends its appeal as a hedge.

August 6 -

The framework provides asset managers with a set of recommended actions, metrics and methodologies to help them meet the “net-zero emissions” goal by 2050.

August 5 -

The “set it and forget it” balanced approach may not work as well anymore, an expert says.

August 3 -

Despite growing to about $1.1 trillion in AUM, senior executives made a series of bets to keep pace in a changing industry that have yet to pay off.

July 29 -

An iShares ETF investing in companies it says has “positive environmental, social and governance characteristics” has more than tripled gains of the S&P 500.

July 28 -

At the height of pandemic-related job losses, 18.9% of Americans with disabilities were unemployed, data show.

July 27 -

A typical investment for Nuveen's $5.8 billion impact investing unit these days ranges from $20 million to $60 million, says its co-head.

July 27 -

There has been increased demand for havens amid a resurgence in coronavirus cases, flaring political tensions and a weaker dollar.

July 23 -

The fast money has more than three times the impact on equity valuations than long-term investors like pension funds, according to a recent paper.

July 22 -

The firm announced plans in March to acquire $200 million of its stock and has been in the market on average once every three trading days since.

July 9 -

Some of the industry’s biggest players are taking a wait-and-see approach as active, non-transparent funds take their crucial first steps.

July 2 -

The manager is still recovering from losses that started in 2015, when his main fund fell 20%, and deepened with a record 34% decline three years later.

July 1