-

A 20-year veteran advisor sold more than $7 million worth of investments pitched by an accused fraudster connected to his friend from Bible study, the regulator said.

April 6 -

The $2.4 billion request for the Wall Street regulator would put 1,434 officers on the compliance beat, up 4% from seven years ago.

April 4 -

Exchange-traded funds focus on natural gas and technology did horribly last year, but they're still drawing in new money.

April 4 -

Wealth managers are increasingly pledging to address diversity, equity and inclusion in their businesses.

April 4 -

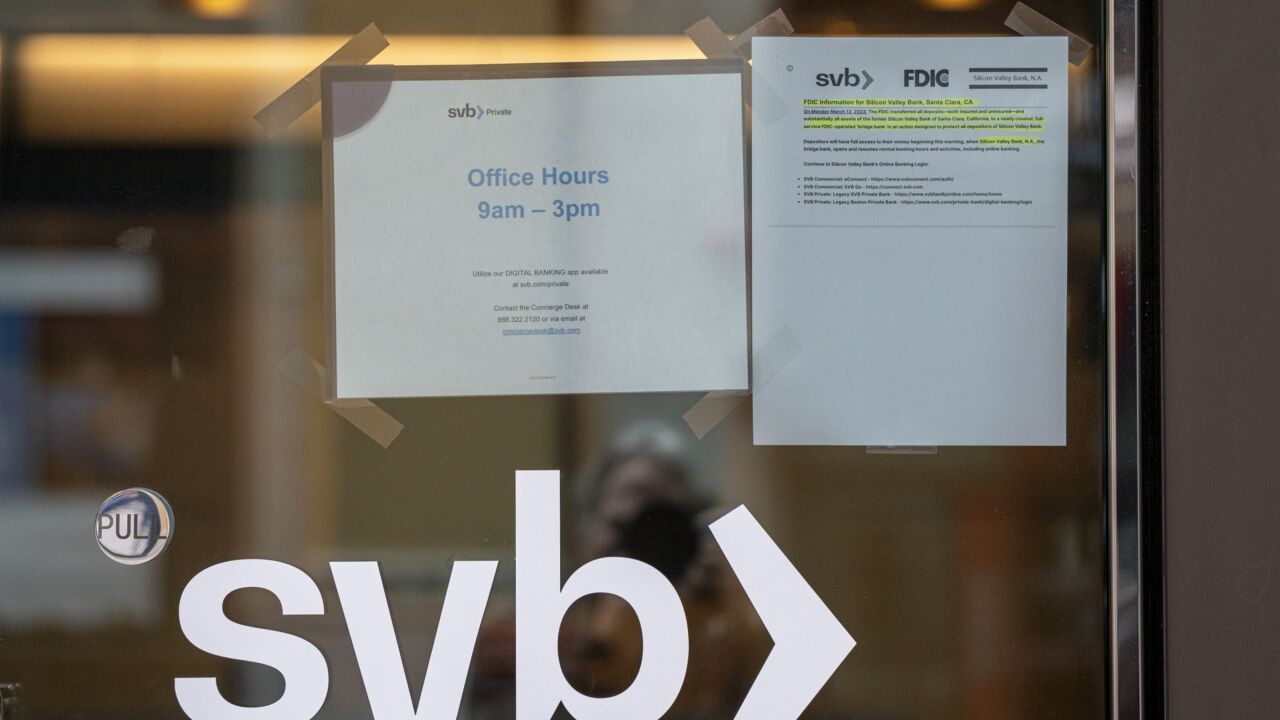

Taxable bond exchange-traded funds have drawn floods of cash ever since two banks collapsed in March and deepened fears of an economic downturn.

April 4 -

The case shines light on the risks of betting against a company's stock when merger or privatization deals are afoot.

March 31 -

Collectibles worth up to millions of dollars are securitized into thousands of shares that trade for as little as $10 a pop.

March 30 -

A Hornor, Townsend & Kent broker pitched "Future Income Payments" that turned out to be part of a $300 million scheme targeting veterans, investigators said.

March 30 -

Wealthy individuals, not institutional investors, will drive money into alternative assets, data provider Preqin says in a new study.

March 28 -

Only 13% of 242 active manager portfolios across the world had a woman as lead or co-lead in 2022, according to new research. The number has hardly changed over the past two decades.

March 28 -

The cash-like instruments have garnered hundreds of billions of dollars since the banking crisis began.

March 28 -

Understandable expenses came out ahead of every other "want" among customers, displaying how transparent costs are an important differentiator for advisors.

March 24 -

The active ETF firm's managing partner talks about the potential for options-based strategies in times when stocks and bonds are plunging.

March 23 -

In an unusual case, regulators have accused a Boston investment advisor of violating his fiduciary duty by putting his clients into high-fee retirement products.

March 21 -

An advisor group warns the cybersecurity regulation is coming amid a flurry of proposals that could leave firms buried.

March 17 -

After three banks collapsed, a New York teacher wonders if the wreckage could reach her nest egg. Should she be worried?

March 16 -

The stalwart allocation has a logic to it, but its simplicity hides two significant problems.

March 15 GenTrust

GenTrust -

After being caught on the wrong side of Vladimir Putin's war in Ukraine and the Adani scandal, hundreds of ESG fund managers are now dealing with the sting of having misjudged Silicon Valley Bank.

March 14 -

The test for independent advisor representatives will have novel sections on IPOs and SPACs.

March 10 -

The industry's fastest-growing business model puts two very different functions under one roof. Are investors — and advisors — clear on the differences?

March 9