-

The Small Business Administration stopped approving loans when the Paycheck Protection Program hit its cap.

April 16 -

Jay Clayton talked up the commission's latest enforcement efforts and defended Reg BI before skeptical lawmakers.

December 12 -

Prosecutors said Robert Shapiro used investor money for his $6.7 million home and $3.1 million for chartering planes and for personal travel.

August 9 -

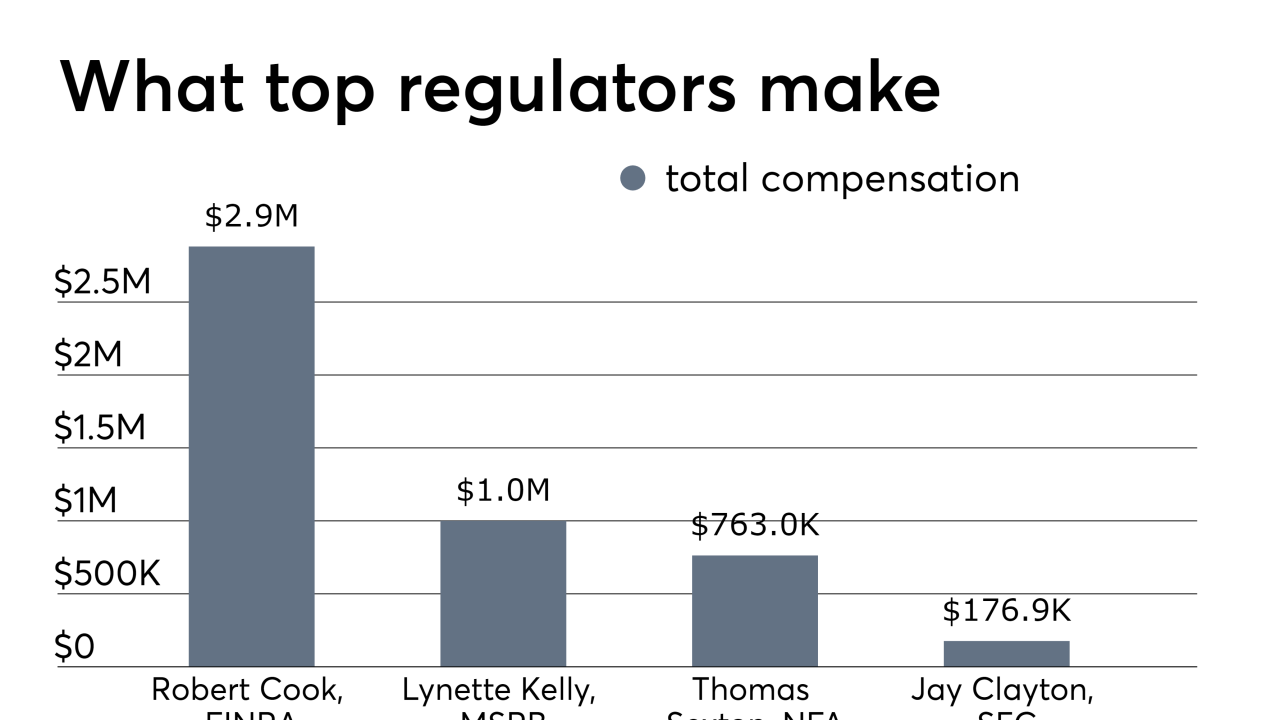

Robert Cook’s pay far outshines that of other SRO chiefs.

July 2 -

It's the first regulatory ding for the influential advisor and entrepreneur in almost 15 years.

February 13 -

A niece thought her aunt’s caretaker was stealing. How much can an advisor do?

December 24 -

The regulator says it will keep an eye on issues like cybersecurity and cryptocurrencies.

December 21 -

Advisors from across 79 branches were involved in selling offerings to family members and other brokers, including stock in Facebook, General Motors, LinkedIn and Twitter.

December 20 -

New York legislators are set to reconsider a previously stalled fiduciary bill.

November 7 -

Not all firms have procedures in place. Of those that do, about 20% aren’t enforcing them.

October 2 -

An advisor kept working with clients, and impersonated others on phone calls with Schwab, the SEC says.

September 6 -

The fees affected hundreds of thousands of customers and the total cost could climb to more than $180 million, according to a report in The Wall Street Journal.

July 20 -

Passive income held offshore may benefit from an arcane provision signed into law by President John F. Kennedy.

July 12 -

Six fiduciary groups call on advisors press SEC to clarify the differences between advisory and brokerage business models.

June 28 -

Lawmakers praise the spirit of the rule, but want to see a true uniform fiduciary standard.

June 21 -

The firm agreed to settle and admitted wrongdoing, according to the regulator.

June 20 -

FINRA plans to unveil a new user interface for its central registration depository system on June 30.

June 15 -

Critics say the SEC isn’t living up to promises made when Jay Clayton became chairman.

June 7 -

Investors may support the pay hikes, but protesters says the bank owes customers more.

April 26 -

The payout brings the distribution to more than $1.2 billion, a fraction of the more than $50 billion scam.

April 12