-

The cryptocurrency attracts a generation that believes in the power of networks.

December 12 Financial Planning

Financial Planning -

In an industry full of late adopters, being on the cutting edge can win young clients.

December 8 -

Three burgeoning technology movements that might catch advisors by surprise.

December 6 -

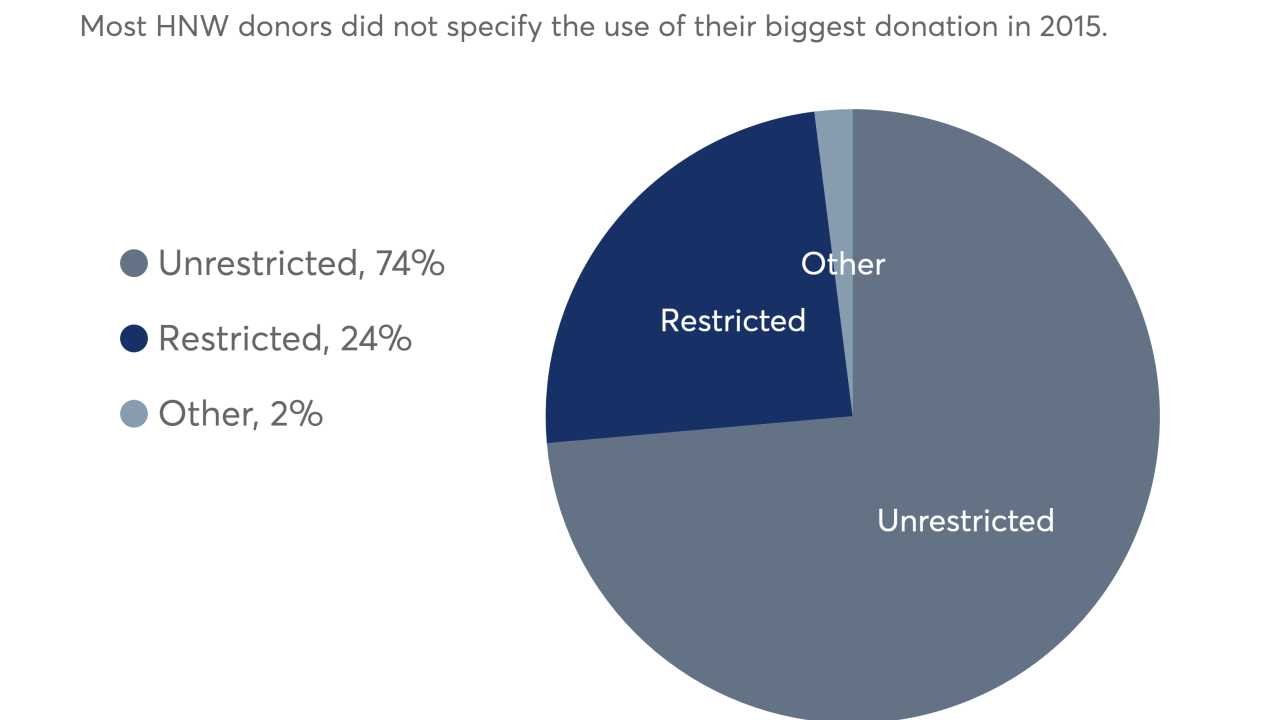

Contributions and grants have recently reached record highs.

November 30 -

The No. 1 competitor for its robo and hybrid platforms is neither Vanguard nor any startup, says Tobin McDaniel, president of Schwab Wealth Investment Advisory.

November 29 -

Top performing planners adopt tech tools at nearly twice the rate of the typical RIA, according to an annual study by Jefferson National.

November 29 Jefferson National

Jefferson National -

The firm will now directly link to Acorns, following its roughly $30 million investment in the microinvesting app.

November 20 -

Indeed they are. Not only are they less healthy, they are more likely to worry about not having enough funds for housing, utilities and other necessities.

November 16 -

AdvicePay from Alan Moore and Michael Kitces is aimed at streamlining payments to advisors.

November 14 -

A TD Ameritrade study asked program directors to give snapshots of what students are experiencing — and what they need from the industry.

November 10 -

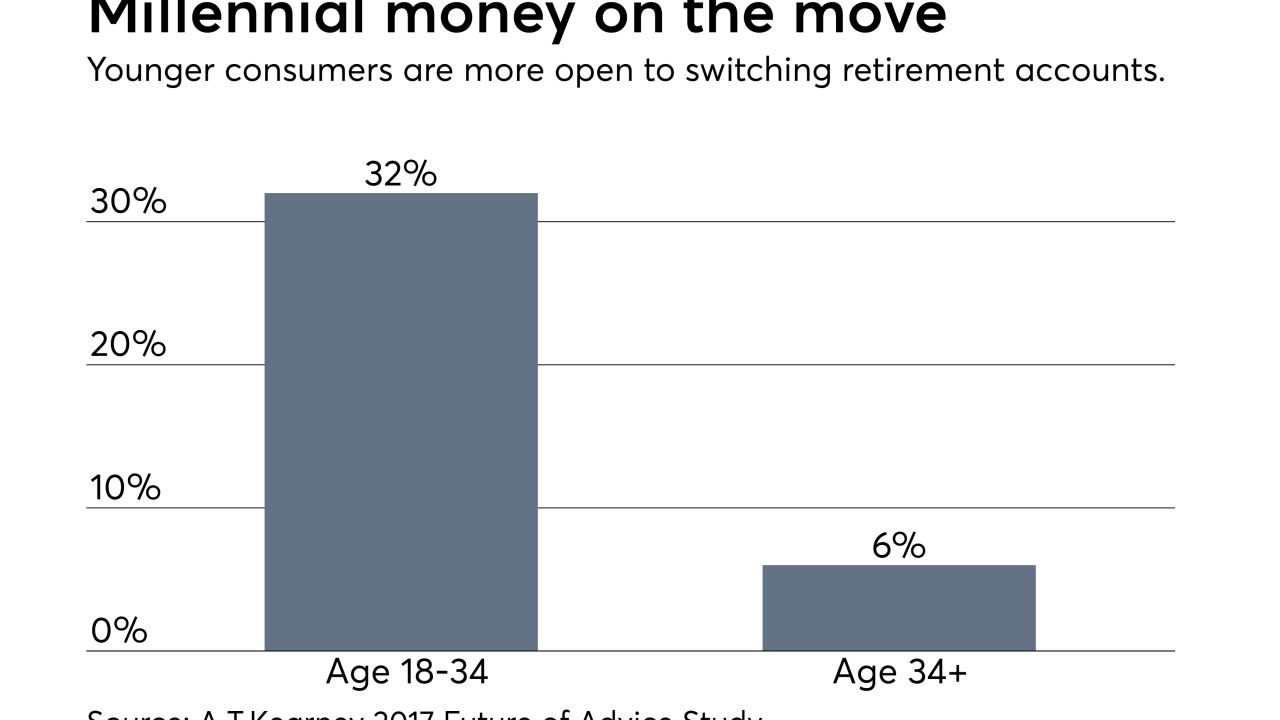

Acquiring a retirement savings tool provider allows the app to broaden its offerings to millennial clients.

November 8 -

The Roth 401(k) is more flexible than a Roth IRA, and it is funded with after-tax dollars, which can help "diffuse the potential tax bomb."

November 6 -

The 22 million Gen X and Gen Y clients banking with Wells are a competitive advantage for its digital advice platform, executives say.

November 6 -

Customers were shut out from accounts for days on the millennial-focused personal finance platform owned by Northwestern Mutual.

November 1 -

Experts say 18-to-36-year-olds should take advantage of workplace 401(k) and Roth IRA tax benefits now and shop around for the best savings rates later.

October 30 -

Step 1: Attract Gen X and Gen Y clients. Step 2: Reach their baby boomer parents.

October 30 Archer Investment Management

Archer Investment Management -

After the tech bubble and the 2008 financial crisis, the younger generation has little reason to trust the markets.

October 30 -

Oct. 30: After experiencing two major bear markets, younger generations are demanding products that are easy to understand and offer transparency.

October 27 -

Catering to young clients, Finn by Chase blends instant account access, emojis and PFM tools.

October 24 -

Communicating about life goals and managing expectations will be crucial to how planners advise the next generation of clients.

October 20 Broadridge

Broadridge