Awareness of financial planning as a career option is not as mainstream as it could be — both among working advisors and on college campuses. Granted, it is a relatively new phenomenon. Directors report the average age of programs is 10 years old, according to the new TD Ameritrade study. The average program has almost 70 students enrolled. As these programs grow, using them as a recruiting tool for top talent is imperative for firms, particularly because the average age of advisors is climbing. Firms also need to interact with students, TD Ameritrade says.

Read more:

"The war for talent starts at the undergraduate level. To win, RIAs need to get out in front of the next generation on campus and make themselves seen," Kate Healy, managing director of Generation Next at TD Ameritrade Institutional said in a statement announcing the study's release. "If RIAs aren't having conversations about the benefits of their chosen career path, the competition most certainly will."

The recruiting benefit of getting involved with college programs was echoed by Dave Yeske, director of the financial planning program at Golden Gate University and managing director of San Francisco RIA Yeske Buie, in the

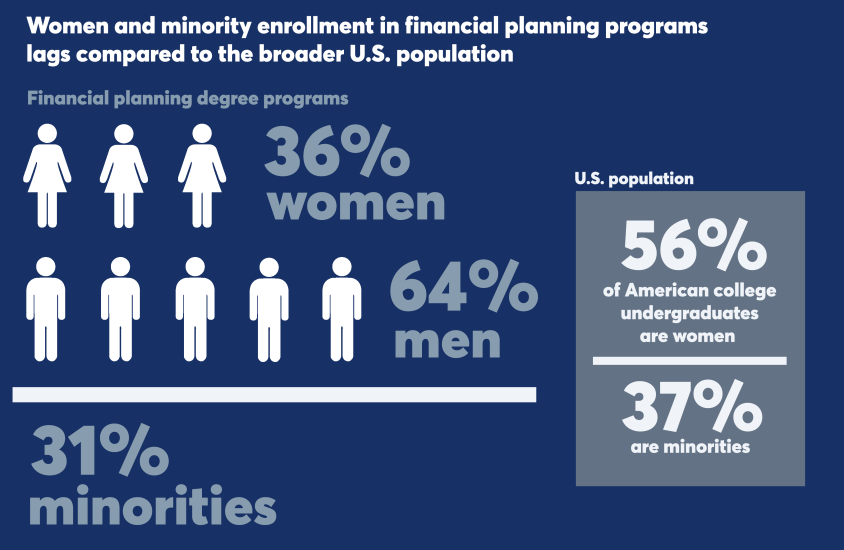

College programs may also need to expand their outreach to become more inclusive. Overall, while the study highlighted growth, it did show that women and minorities are often underrepresented in these programs. Just 36% of financial planning students are women. 31% are minorities. Program directors do believe these ranks will increase overtime, according to the statement.

Of the 105 schools contacted, 37% percent responded.

Click through to see key findings of the study — including enrollment and post-graduation statistics. --Maddy Perkins