-

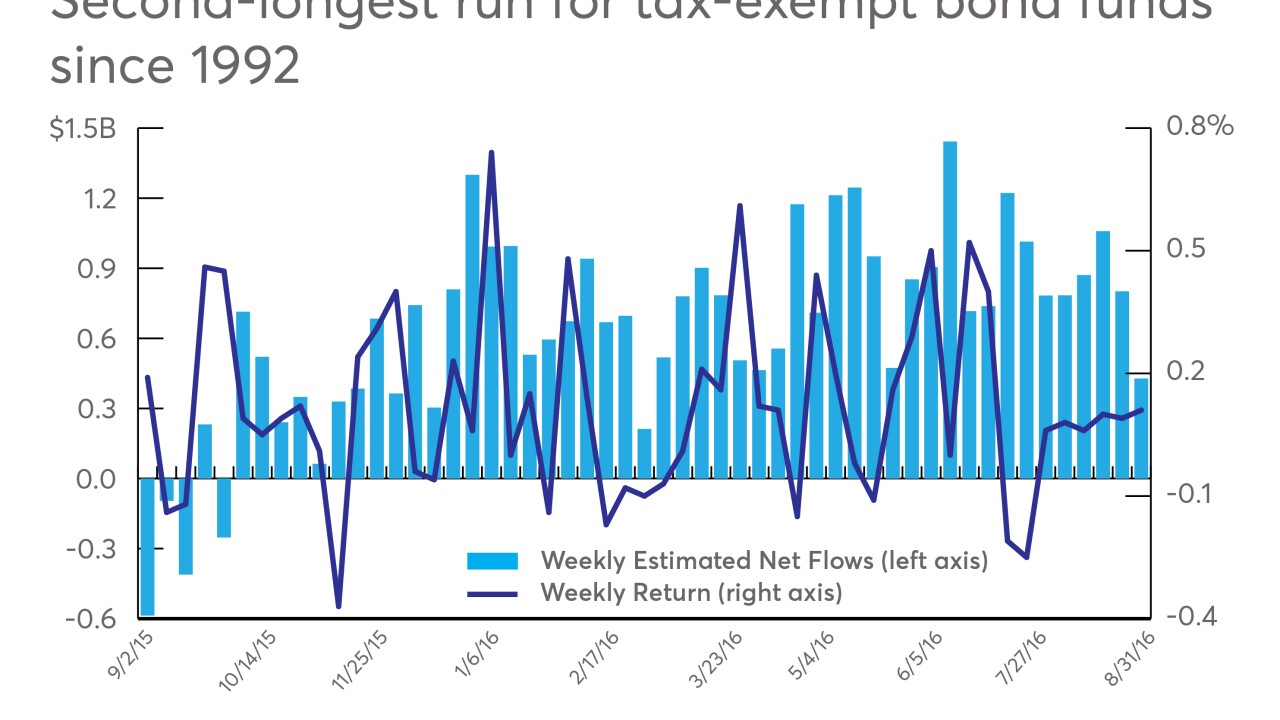

Data reported by the Investment Company Institute.

August 4 -

Aug. 7: The firm aims to mix innovation with old fashioned salesmanship, and is even considering a robo, according to the president of its broker-dealer.

August 4 -

Data reported by the Investment Company Institute.

July 14 -

Lawmakers are considering scrapping individual deductions, including tax breaks for certain plan contributions.

June 30 -

June, July, and August are projected to reach new highs, generating more than $100 billion of proceeds from called and maturing bonds.

May 31 -

Many are unaware that fostering a pet or installing a swimming pool can help them qualify for a deduction.

April 24 -

Non-U.S. purchases of municipal bonds are up 32% from 2014. But not everyone is impressed.

April 21 -

If your clients pay the alternative minimum tax, these funds can help lower their tax liability.

March 29 -

The firm previously shuttered a wealth management unit last year that failed to take off despite some high profile hires.

March 7 -

A FINRA panel ordered the wirehouse to pay damages to two former clients who invested in Puerto Rican municipal bonds and closed-end funds.

November 29 -

Clients fare just as well, and possibly better, with their other investments by developing the same savings habits of these retirement accounts. Plus, getting more out of munis.

November 8 -

A bond subsector worth looking at. Plus, help clients keep what they owe the government to a minimum with a roadmap for drawing down assets.

October 21 -

If equities languish, one adviser says be more cautious on muni fixed income.

September 30 Wealth Logic

Wealth Logic -

Market valuations are generally high this year partly due to a lack of rate increases, but fourth-quarter positioning can still present opportunities.

September 27 -

Will the rally continue, or are the winning ways of this asset class nearing an end?

September 9 -

Republican presidential candidate Donald Trump described an economic plan that he said would create “the biggest tax revolution since the Reagan tax reform” and “cut regulations massively.”

August 8 -

Municipal debt has become more concentrated in the hands of the wealthiest investors, which may prompt lawmakers to rethink the tax-exempt benefits.

July 15 -

Consider high-yield muni bond funds to combat a client's fears after the UK's leave vote. Plus, a benefit couples should consider before getting divorced.

June 30 -

Despite market volatility at least one expert expects "business as usual for munis after the dust of today's rally settles."

June 24 -

Funds built with these tax-advantaged bonds resulted in strong returns in recent years – and even no fees in a few cases.

May 24