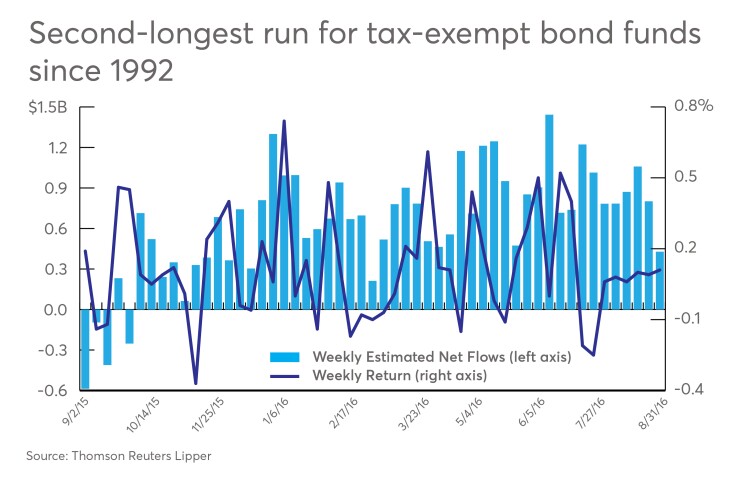

Municipal bond funds have been on a tear, racking up 48 consecutive weeks of net inflows as of the last week in August (the second-longest run since Lipper began tracking weekly flows in 1992). With equities hitting new highs and related dividend yields on the decline, nervous investors — many of whom may believe the recent equity rally is growing stale — have been flocking to the relative safety and high tax-equivalent yields provided lately by municipal debt.

The question is, will the rally in the asset class continue, or are its winning ways nearing an end?

Year to date through the week that ended Aug. 31, taxable and municipal bond funds witnessed net inflows of $97.0 billion and $43.7 billion, respectively, while their equity mutual fund counterparts (including ETFs) have suffered $84.1 billion of net redemptions.

Funds built with these tax-advantaged bonds resulted in strong returns in recent years – and even no fees in a few cases.

ATTRACTIVE YIELD OPTION

Municipal debt issues provide tax-advantaged income for investors in tax brackets generally at or above the 25% income tax rate. Interest payments from munis are not subject to federal income tax (although some clients might still have to pay an alternative minimum tax). Bonds issued by the state and/or city in which an investor resides also have the potential to be exempt from taxation.

While headline returns and yields are reported on municipal bond funds, they generally do not take into account the tax advantages offered to investors. For example, for the three-year period that ended August 31, 2016, the average taxable long-term bond fund posted a three-year average annualized return of 3.96%, while its average three-year preliquidation after-tax return was just 1.80%. And while municipal bond funds’ income distributions have exempt income, these funds still pay out capital gains, suffering tax drag. Nonetheless, the average long-term municipal bond fund posted a three-year annualized return that beat its taxable cousin, returning 6.88% before taxes and 6.34% for the three-year preliquidation after-tax return (assuming the highest marginal tax rate).

Doing headline yield comparisons is also slightly apples to oranges. Contrasting the standard 12-month yield against the 12-month tax-equivalent yield, we see that the average long-term taxable bond fund produced a 3.77% 12-month yield, while its long-term municipal debt fund counterpart posted a 3.12% 12-month yield for the same period. However, looking at the taxable-equivalent yield, assuming a 25% marginal tax rate, we see that the tax-equivalent yield for the average long-term municipal bond fund was 4.16% (3.12%/(1-0.25%)), making it an attractive alternative to its taxable counterpart.

Investors’ interest in income-oriented products has been on the rise since the market collapse of 2008. Since Treasury yields have hit historic lows and global concerns remain on the periphery, investors are still looking for safe-haven bets that have growth and yield opportunities.

-

Investors have once again taken a liking to taxable bond funds — a marked difference from last year. Advisers may find that clients are taking notice, too.

August 4 -

Here's how advisors can help their clients decide whether they want exposure to the commodity or to related equities in oil companies.

April 11 -

Good dividend stocks can pay back their cost if held long enough.

September 7

PARTICULAR CONCERNS

Many people initially thought the Brexit vote that occurred on June 23 would be a major black swan event for global markets, most investors realized after the fact that the exit of the U.K. from the European Union would be a multiyear process, and the recent panic was overhyped. Two particular concerns, however, awaited investors.

With strong improvement in the July nonfarm payrolls report and the Jackson Hole economic symposium complete, investors are now pricing in a 24% probability of a rate hike in September and a 57% chance in December, according to CME’s Fed Watch Tool, which will weigh on returns for fixed-income products. While many pundits believe the rate increase could come as early as September, most are pointing to continued global growth concerns and the U.S. presidential elections in November as reasons not to expect a rate rise before December, with both issues providing a great deal of uncertainty. From a historical perspective the Fed has been reluctant to raise interest rates before a major U.S. election.

While there is an inverse relationship between price and yields, and rate hikes will have a negative impact on the price of bonds, the question really remains at what pace and scale will the Fed raise rates. If the recent past is any example, the Fed appears to be very cautious and methodical in its approach to normalizing interest rates, applying slow and small bumps to existing rates to avoid any crippling influence on the economy. If the Fed continues to use kid gloves in its approach, the forthcoming rate increases should not have much of an impact on bond fund returns because, while increasing rates will weigh on price returns, higher yields provided by the new bonds entering a portfolio should be able to offset those declines via greater interest income. Pace and scale, though, is very important here.

Fed policymakers began 2016 hinting it could be a year of multiple rate increases, but backed off as global growth stagnated. Markets are now waiting to see whether the Fed will follow through with rate hikes after Fed Chairwoman Janet Yellen said at the global banking conference in Jackson Hole, Wyoming, that the case for another interest-rate increase is strengthening.

Interestingly, some believe the rate increases won’t have as big an impact on municipal bonds as on their taxable counterparts. Many municipalities have already issued new bonds to lock in the low interest rates before the imminent interest rate hike, causing future inventory to be down for the coming months and year, and thus providing some pricing pressure because of supply-and-demand issues. Tax-exempt debt issuance has been on the decline since 2010 and has shown no real sign of improvement recently. In July, new supply was down some 26% from 2015, making for the lowest July issuance since 2011, according to BlackRock.

If the Fed continues to use kid gloves in its approach, the forthcoming rate increases should not have much of an impact on fund returns, writes Tom Roseen.

ISSUERS MAKING HEADLINES

Municipal bond issuers have been headline news over the last several years, with the municipalities of Jefferson County, Alabama; Stockton, California; Detroit and Puerto Rico filing for bankruptcy or defaulting on their municipal bonds. Nonetheless, default rates remain low compared with those of their taxable fixed-income counterparts. However, selecting good municipal bonds is not as easy as before the spate of defaults occurred. That, along with anticipation of imminent higher rates, is the reason many investors currently prefer shorter-dated issues to longer. Interest-rate increases aside, issues around unfunded pension liabilities and the general ability to pay bondholders bring into question some municipalities’ ability to meet future obligations.

Most of the issues facing the recent wave of defaults did not occur overnight and were generally well-known in advance of the event. Looking at Standard & Poor’s U.S. State Pension Roundup, 2015 Outlooks, one can see potential problem areas; Illinois, Kentucky, and Connecticut sport the lowest-funded pension ratios (less than 50%), which has an impact on their ratings and should concern potential investors. However, the city of Chicago recently proposed a water and sewer tax to help alleviate its underfunded pension status, and its board of education proposed a balanced budget for fiscal year 2017.

So, while municipal bond investors should always keep an eye on pensions when they are assessing the creditworthiness of an issue, they need to also keep abreast of initiatives to improve those threats to the bonds. If investors have the time and know-how to research individual bonds, along with the cash to create a well-diversified portfolio, there are advantages to buying individual municipal bond issues: investment control, cost advantage, perhaps lower interest-rate risk and predictable cash flows.

However, many municipal bond investors might be better served by the advantages offered by municipal bond funds: professional management, diversification, automatic reinvestment of income, and liquidity. Many of us just don’t have the time or wherewithal to keep track of all the changes going on in multiple municipalities.

FUNDS, ETFs OR CEFs?

For investors with a long-term time horizon and limited time for research, there are advantages to using different fund types. Investors interested in getting a bigger bang for their buck can look into closed-end funds, which often trade at a discount. One can receive similar cash flows to those of a traditional open-end fund but based on a lower-cost basis—thus increasing the relative yield. However, at the end of July, the median discount for municipal bond closed-end funds was a paltry 0.23%, while a year ago it was 8.32%. The recent interest in closed-end municipal bond funds has taken much of the discount advantage away from investors. Some caution should be used when evaluating the yields of closed-end funds because many use leverage to give them an added boost to their return, which can be great in up markets but downright depressing in bad markets, amplifying losses.

If your clients are looking for income, these funds have the highest expected dividend payments compared to current prices.

The use of ETFs and traditional open-end funds can be an option as well. While low-cost ETFs can help add additional yield for investors (less expense drag), their passive index-based portfolios can be forced to purchase out-of-favor issues. Actively managed municipal bond funds, while often more expensive and weighed down by loads, are certainly an option for most investors. These funds frequently keep an eye on issues of exposure to bonds that might be subject to AMT, and they generally keep a constant maturity that can help investors better manage their duration exposure.

Investors with a longer time horizon and who anticipate slow and measured rate increases in the near future might be interested in the advantages municipal debt securities can offer for their taxable portfolios. Ignoring the high-yield tax-exempt products, high-quality munis are generally perceived as safe-haven instruments. Ahead of the uncertainty surrounding the upcoming presidential elections, a multiyear bull market, continued global growth concerns, and the Fed’s wishes to normalize interest rates, munis may still offer attractive taxable equivalent yields that rival those of their taxable fixed-income holdings.