-

The firm cannot increase assets until it comes up with a plan to fix its internal controls.

May 14 -

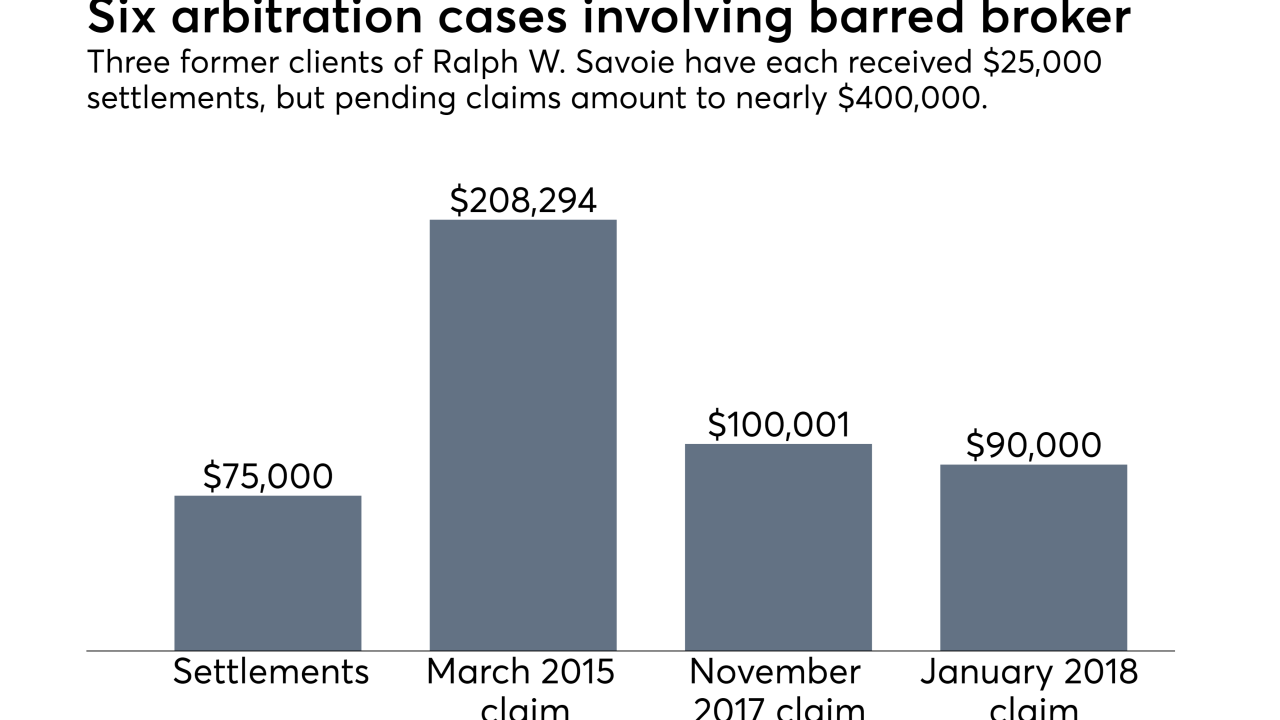

Allegations of undisclosed private securities transactions by a former advisor followed two significant mutual fund cases involving the IBD network’s practices.

May 1 -

The brokerage ranks shrank by 258 from the year-ago period.

April 13 -

The firm warned Friday that it may take a charge of as much as $1 billion to settle a U.S. probe of its consumer business.

April 13 -

David Olson, an advisor of nearly 30 years, worked at Morgan Stanley until his termination in 2016.

April 4 -

The broker misappropriated his clients’ investment money for rent, credit card bills and other personal uses, investigators say.

April 2 -

The two IBDs have agreed to pay restitution in one of the largest securities fraud cases in the advisor’s home state.

March 21 -

Caleb Fackrell repeatedly called his behavior “insane” in his testimony, according to transcripts obtained by Financial Planning.

December 22 -

Advisors should expect more regulatory requirements, enforcement actions and uncertainty in 2018, experts say.

December 11 -

He intercepted checks from her home when she wasn’t there and forged her signature to steal her money, investigators say.

December 7