-

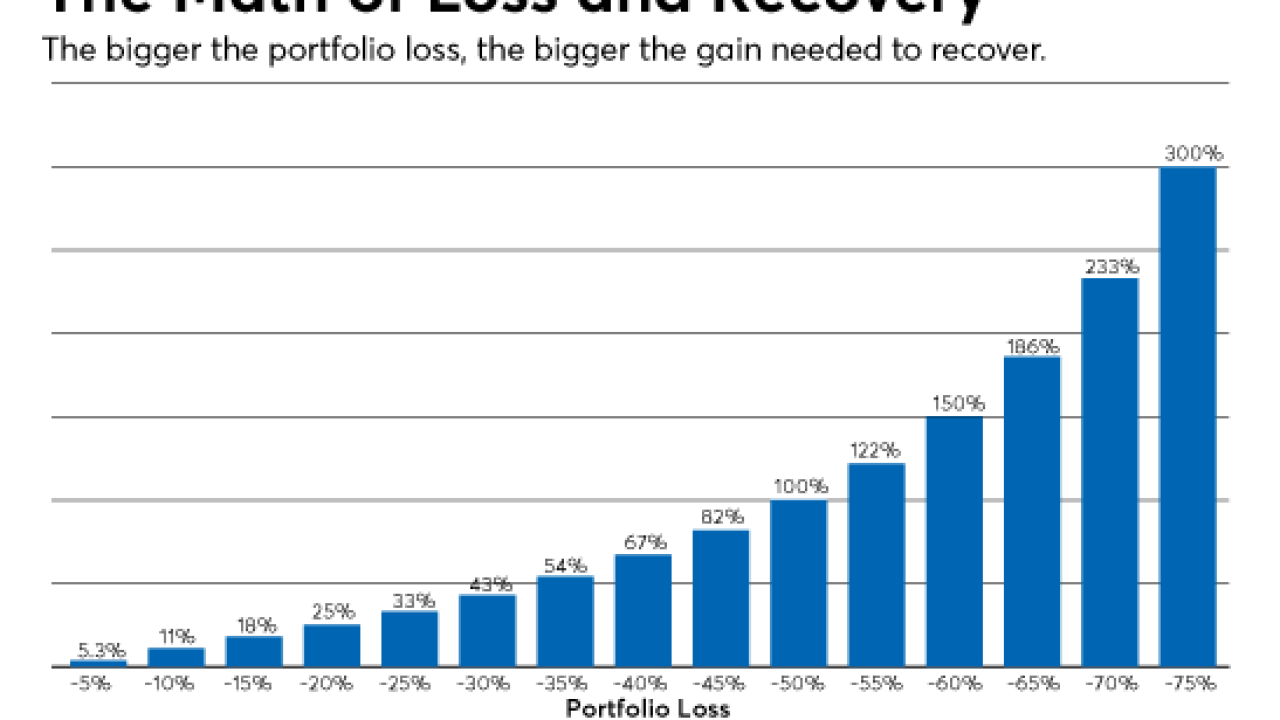

Clients — even some advisors — overreact to market losses. Are they on to something?

October 20 -

Bond funds go mano a mano in the last installment of this 3-part series on maximizing total-market index funds.

October 12 -

Let wealth planning, CRM and portfolio rebalancing software do the grunt work.

October 6 -

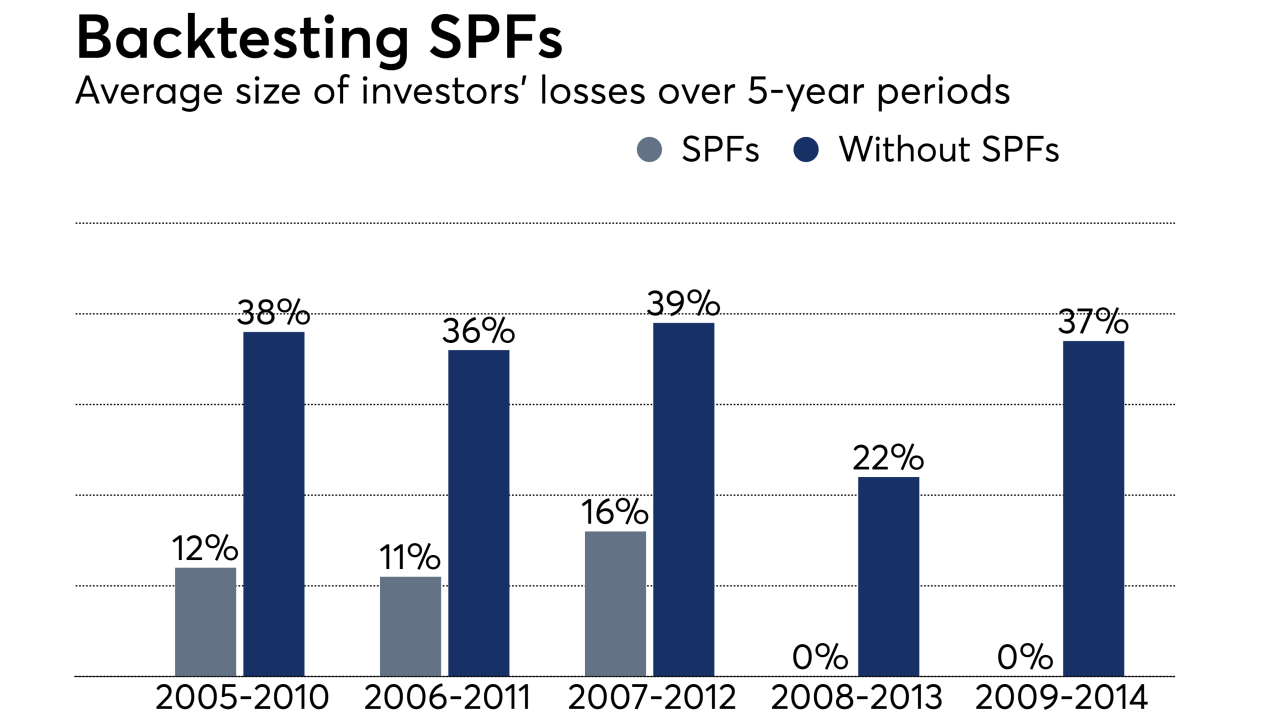

Stock Protection Funds could mitigate single-stock risk, but are they worth the fees?

October 5 -

In light of the strength of the economy and the banks, does it make sense for advisors and their clients to avoid financials when looking at dividend-paying stocks?

September 29 -

Non-traditional asset classes include structured credit, reinsurance and alternative lending.

September 29 -

Advisors must show how to consider the total cost of ownership.

September 28 -

A look at an 18-year period shows which is the better approach.

September 27 -

The options include indexes encompassing domestic, global and country-specific stocks.

September 26 -

Some investments are harder to advise on than others — think of rare coins and art — but advisors can distinguish themselves.

September 25 -

Smart beta and other factor investing often leads to more complexity than necessary.

September 22 -

The performance is different depending on the index provider used.

September 22 -

Asset allocation is the glue that connects and aligns an investor’s goals and strategies.

September 21 The Bapis Group at HighTower

The Bapis Group at HighTower -

Doing homework and knowing how to enter and how to exit are essential.

September 20 -

The key is creating a portfolio that clients will stick with through thick and thin.

September 19 -

The probability of success with stocks and bonds is higher and much easier.

September 18 -

Figuring out how to build client portfolios now may leave advisors scratching their heads.

September 15 -

Why gaining short-term bond exposure through mutual funds isn’t a smart bet.

September 14 -

How to discuss risk when they become restless.

September 13 -

The firm wants to adopt a new benchmark that would add specialty REITs to the mix.

September 13