-

The regional BD also recruited a complex manager from J.P. Morgan.

July 26 -

"We are not going to have a separate robo adviser that would disintermediate our existing advisers," says CEO Paul Reilly.

July 21 -

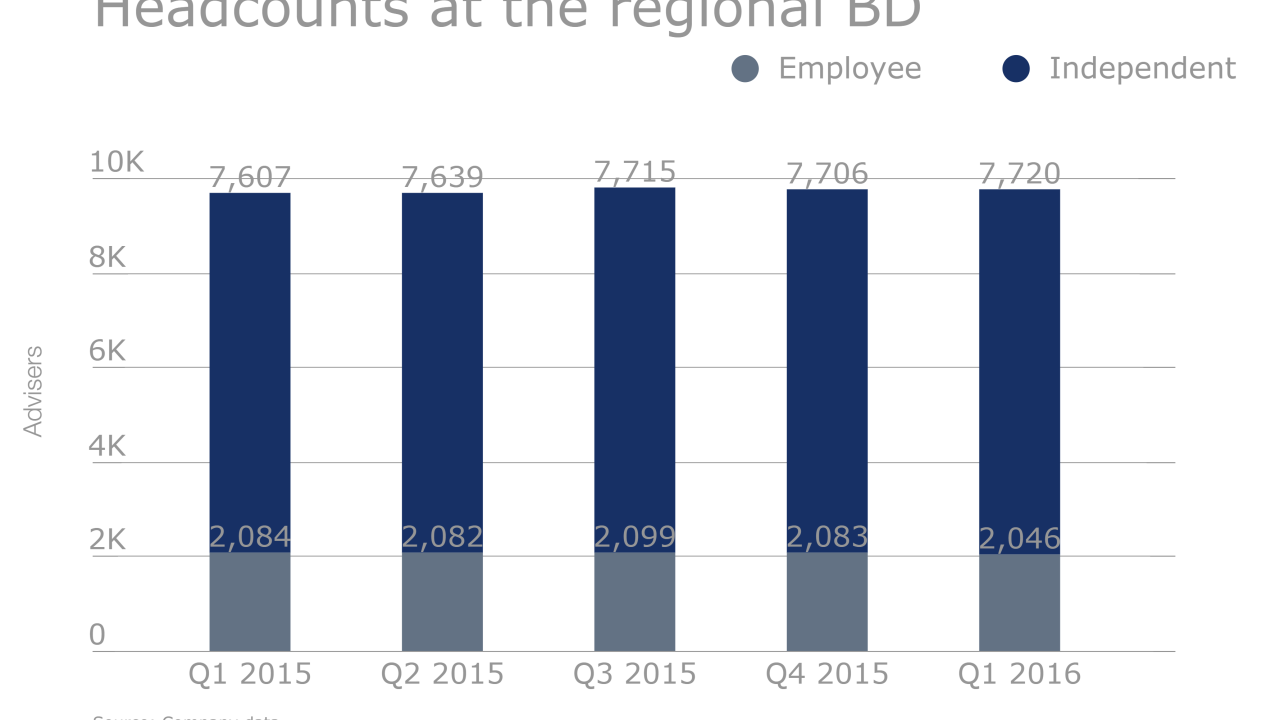

Headcount at the fast-growing firm was up 327 year-over-year.

July 20 -

Advisers join the regional broker-dealer from Wells Fargo and Charles Schwab.

July 11 -

The largest recruits managed more than $17 billion in client assets.

July 11 -

The regional firm also says it recruited a junior Merrill adviser overseeing $39 million in client assets.

July 7 -

The firm bought the unit, which has over 600 advisers, as part of a $150 million acquisition deal to boost its overall broker ranks.

June 27 -

Some call it 'relentless,' but scouting for the best candidates has resulted in a better array of services from the industry's top firms, says leading recruiter Mark Elzweig.

June 22 Mark Elzweig Co.

Mark Elzweig Co. -

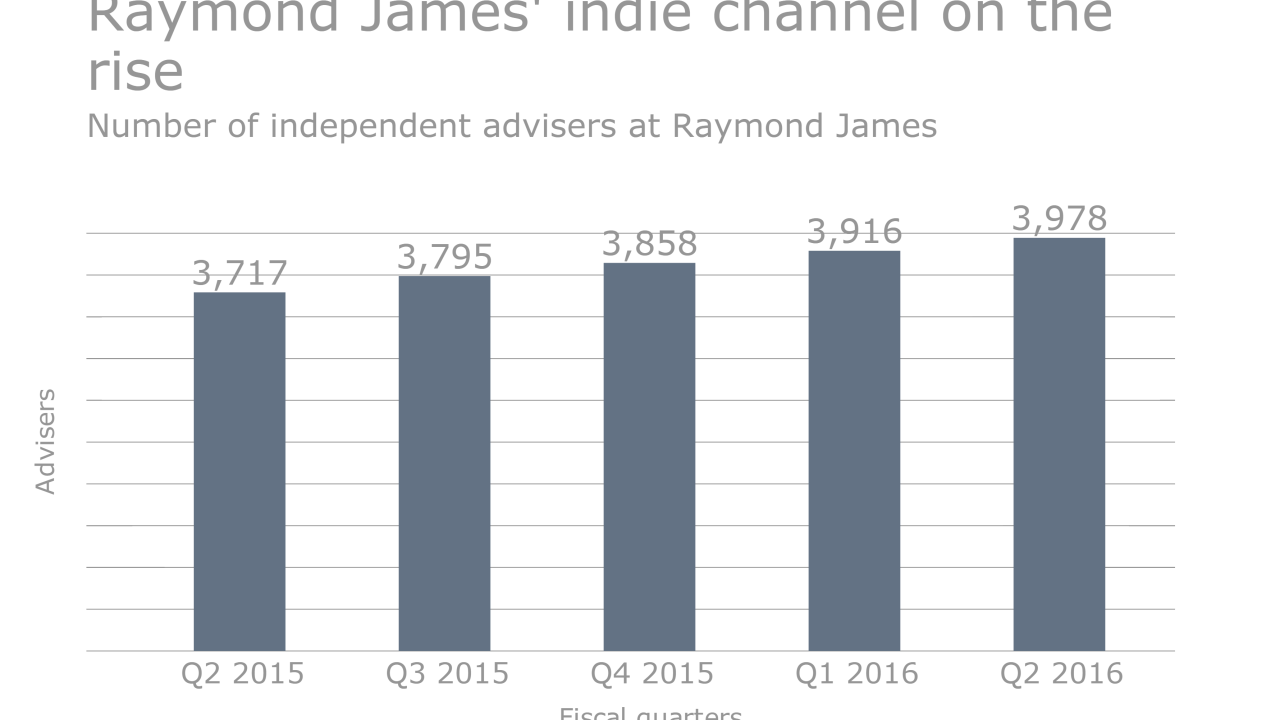

Three industry veterans – one with more than four decades of experience – oversaw more than $205 million in client assets, according to Raymond James.

June 20 -

The Gryphon Group generated $1.3 million in production before leaving the wirehouse.

June 13 -

William Heinzerling, who has led Stifel’s fixed-income business since 2009, is leaving the firm, according to people with knowledge of the matter.

June 8 -

The adviser, who has more than 30 years of industry experience, left to join Noyes.

June 6 -

Why advisers should step up their game as the industry goes robo.

May 31 -

Wealth management leaders are weathering current markets while aiming to jumpstart AUM growth with expanded client services and new tech tools.

May 31 -

Yet that wasn't Merrill's only recruiting success, as the wirehouse also picked up a team overseeing more than $500 million in client assets.

May 26 -

The recruits moved to the firm from Morgan Stanley, Wells Fargo, Stifel and Voya.

May 25 -

The recruit generated $1.7 million in annual production before making the move.

May 23 -

Commission staffers are probing how broker-dealers are handling ETFs and the extent to which investors understand the risks of the funds.

May 20 -

The recruits generated $1.8 million in annual production before making the move.

May 19 -

Recent market and economic headwinds have dampened growth at all three firms, which have been striving to grow through recruiting and acquisition deals.

May 18