Regulation and compliance

Regulation and compliance

-

The bipartisan infrastructure bill includes requirements for brokers to report their customers’ cryptocurrency gains to the Internal Revenue Service, but exactly what constitutes a broker is stirring controversy.

September 13 -

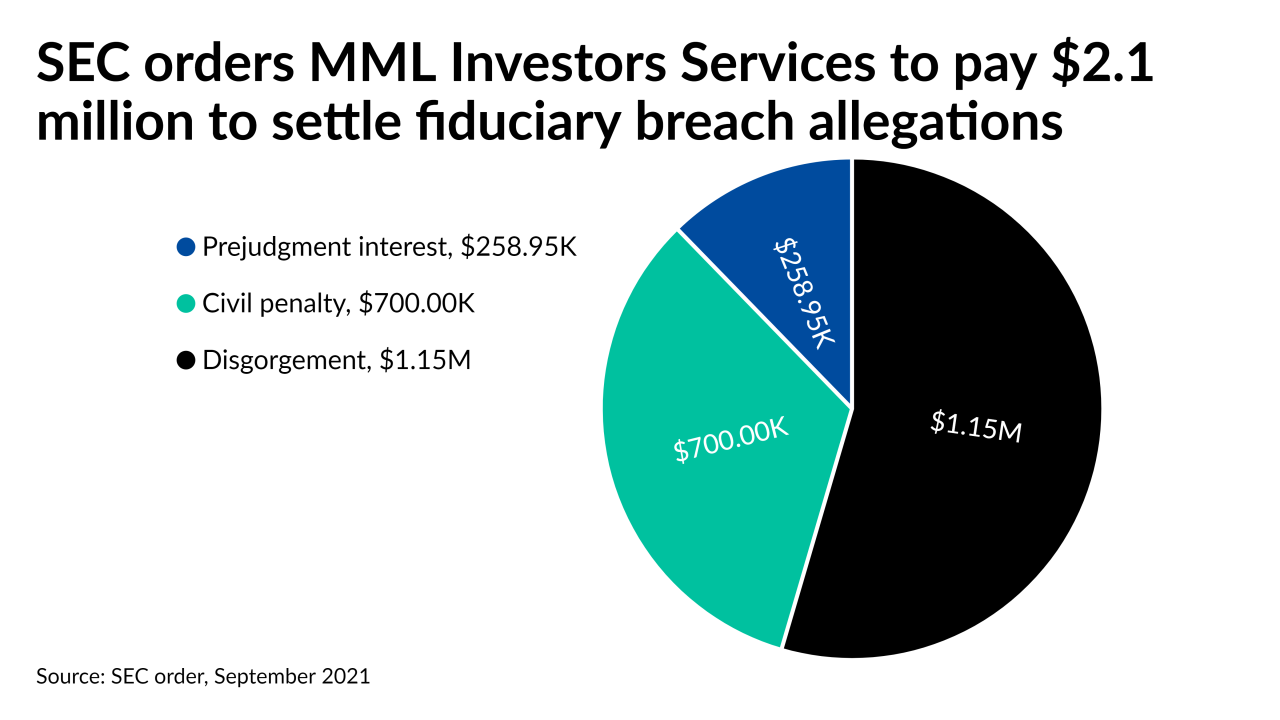

MML Investors Services allegedly breached its fiduciary duty in the same way that the regulator has alleged that more than 100 other firms have in recent years.

September 13 -

The Salt Lake City broker-dealer, under scrutiny by regulators over its exorbitant fees and seizure of client money, lost a court battle seeking to force regulator FINRA to deal with it in person.

September 8 -

The regulator filed a Wells notice, riling the CEO of the country's largest cryptocurrency exchange.

September 8 -

The securities lawyer and former NASD regional attorney explains why cases can be so hard to detect and what the industry can do to help.

September 8 -

A nearly century-old system designed to protect consumers is about to be left behind.

September 7 -

It's the second time in a year that the SEC has scrutinized green and socially conscious labels.

September 3 -

Brokerages that want to hire someone with a checkered past have to undergo a “consultation” with the watchdog and may have to try to renew their memberships.

September 2 -

Federal regulators haven’t yet made substantial moves against the crypto savings accounts but have set their sights on the stablecoin market.

September 2 -

What looked like a shot over Robinhood's bow might be aimed more at market makers, writes Aaron Brown.

September 2 -

Some funds touting their environmental and socially responsible investments may be exaggerating.

September 1 -

SEC fines 3 independent brokerages a collective $750K over email hacks that hit thousands of clients The firms failed to update their cybersecurity policies immediately after client data was exposed.

September 1 -

Feedback could inform a rule impacting how fintech startups and traditional wealth management firms use technology to engage retail investors.

September 1 -

Carrie Tolstedt invoked her right to remain silent about allegations she misled bank customers.

August 31 -

The controversial practice generated 80% of the brokerage app's Q2 revenue.

August 31 -

The ruling could open other similarly closed cases worth hundreds of millions of dollars.

August 31 -

‘Millions unaccounted for’ in an alleged 10-year fraud as court freezes assets of dually registered planner and his fund.

August 26 -

The longtime director of investor protection at the Consumer Federation of America could signal an overhaul of Reg BI under the Biden administration.

August 25 -

Experts and leading practitioners are looking at ways to mitigate the possible affect of the legislation from a tax perspective.

August 23 -

The New York-based advisor is accused of defrauding at least 56 investors.

August 20