Regulation and compliance

Regulation and compliance

-

The increasingly popular Section 351 process offers many low-basis investment portfolios an exit ramp — without incurring any capital gains.

May 21 -

Regulators discovered Julie Darrah had been siphoning millions from elderly clients after WEG bought her practice in 2021.

May 21 -

The broker-dealer alleged that a FINRA arbitration panelist who helped hand down the landmark penalty should have recused herself after reaching a similar conclusion in a case involving the same embattled broker.

May 20 -

The bill would levy a 5% tax on remittances for noncitizens and foreign nationals, on top of a roughly 5% to 10% fee already charged on the payments.

May 20 -

The new rules, set to take effect May 23, will allow CFP applicants to forgo a more intensive review process in certain circumstances.

May 19 -

Industry groups argue a new rule under consideration would give brokerage firms new oversight responsibilities over unaffiliated RIAs — a contention FINRA denies.

May 19 -

Rulings from the Financial Industry Regulatory Authority included a $360,000-plus payout from JPMorgan, scrutiny of B. Riley operations and more in April.

May 16 -

Wealthy Americans and business investors are among the big winners while targets of Trump's ire such as immigrants and elite universities were hammered.

May 14 -

The numbers on fraud, long-term care costs and aging in America are daunting. Here's how financial planners can help clients prepare.

May 13 -

Regulators say they are seeking fairness, noting that firms that reached deals with the SEC before the start of the year are under fewer regulatory mandates.

May 12 -

Morgan Stanley is among a long list of wealth managers facing questions about whether their handling of uninvested cash is really in clients' best interest.

May 7 -

After joining Raymond James last year, Lynette Ancona contends she was virtually forced out of Schwab by a branch manager who tended to favor "younger, male" colleagues.

May 7 -

Only two out of nine firms included the total amount of money involved in revenue sharing — a practice critics say should be ended entirely — in their disclosures.

May 7 -

The Internal Revenue Service announced the inflation-adjusted amounts for health savings accounts in 2026.

May 7 -

The industry conflict of interest takes many common, controversial or outright confusing forms. Here's what financial advisors and investors should know.

May 6 -

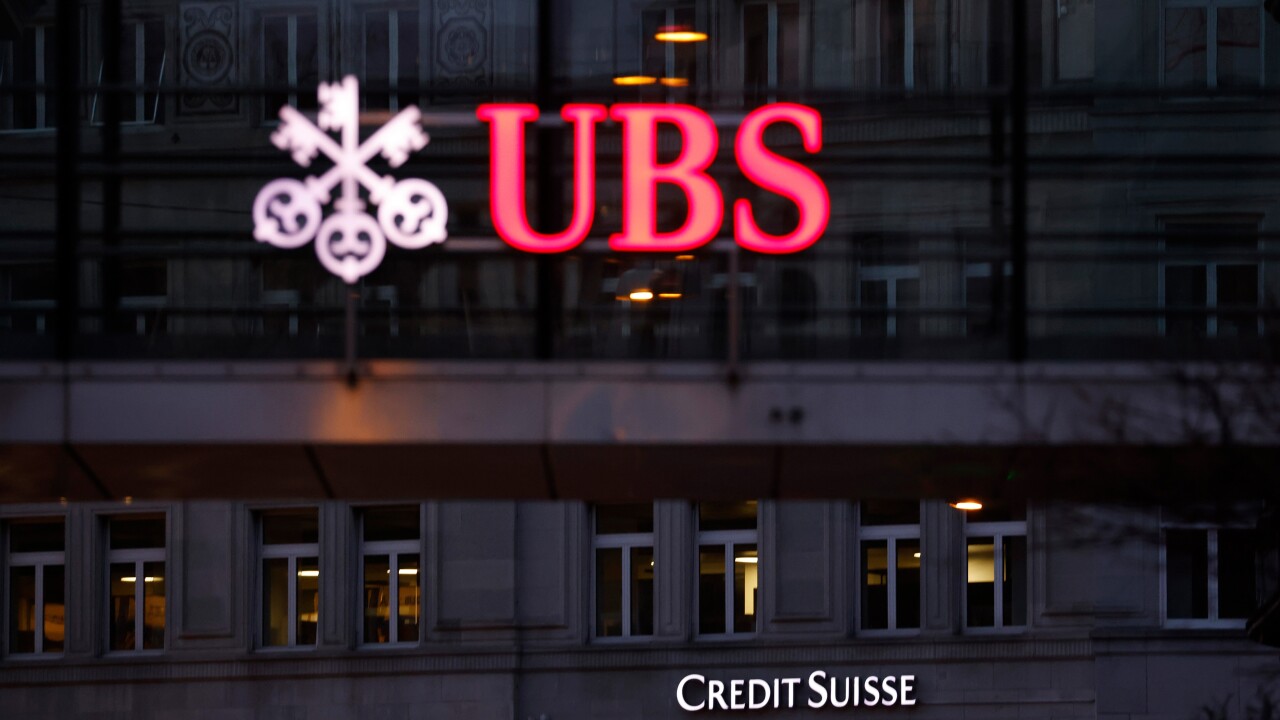

A unit of the bank bought by UBS in 2023 pleaded guilty to conspiring to help its customers hide more than $4 billion from the Internal Revenue Service in at least 475 offshore accounts

May 6 -

Check out a compliance expert's emoji-onally intelligent tips for decoding the omnipresent icons. (Hint: context is 🔑.)

May 6 -

The firm characterizes the cause examination, a procedure that typically originates from a customer complaint, as a routine matter.

April 30 -

Novel legal theories and a lower bar for plaintiffs could unleash an explosion in ERISA-based lawsuits against 401(k) plan providers.

April 29 -

A judge found that the alleged victims of a scam run by a now-disgraced representative of Oppenheimer furnished no evidence of having direct ties to the firm.

April 28