Regulation and compliance

Regulation and compliance

-

Whatever the outcome in November, taxpayers and their advisors should prepare for changes, an expert says.

October 6 -

The advisor allegedly used an omnibus trading account to help himself and hurt his clients to the tune of tens of thousands of dollars, according to the regulator.

October 5 -

While the contributions aren’t deductible, distributions such as earnings are tax-free to the designated beneficiary if they’re used to pay for qualified disability expenses.

October 5 -

The Managed Funds Association urged the agency to do more analysis before moving forward.

October 5 -

Director tenures, nominations and committees are changing after an independent task force identified weaknesses.

October 1 -

The discrimination case revolves around allegations of disparate treatment in the firm’s agency distribution channels.

October 1 -

The agency issued guidelines scaling back a tax break for client entertainment, following through on an element of President Trump’s 2017 tax overhaul.

October 1 -

The Justice Department filed two counts of wire fraud against the firm but agreed to defer prosecution under a three-year deal that requires the bank to report its remediation and compliance efforts to the government.

September 29 -

Actions hit a nine-year high and restitution climbed to the highest total since 2013 — even before the rule’s heightened scrutiny.

September 25 -

The Labor Department has opened the door to using PE as a component of a target date fund held within a DC plan, writes iCapital Network CEO Lawrence Calcano.

September 25 -

Based on the “forced experiment” of its remote periodic examinations of broker-dealers, the onsite portion “may not be necessary,” Robert Cook said.

September 24 -

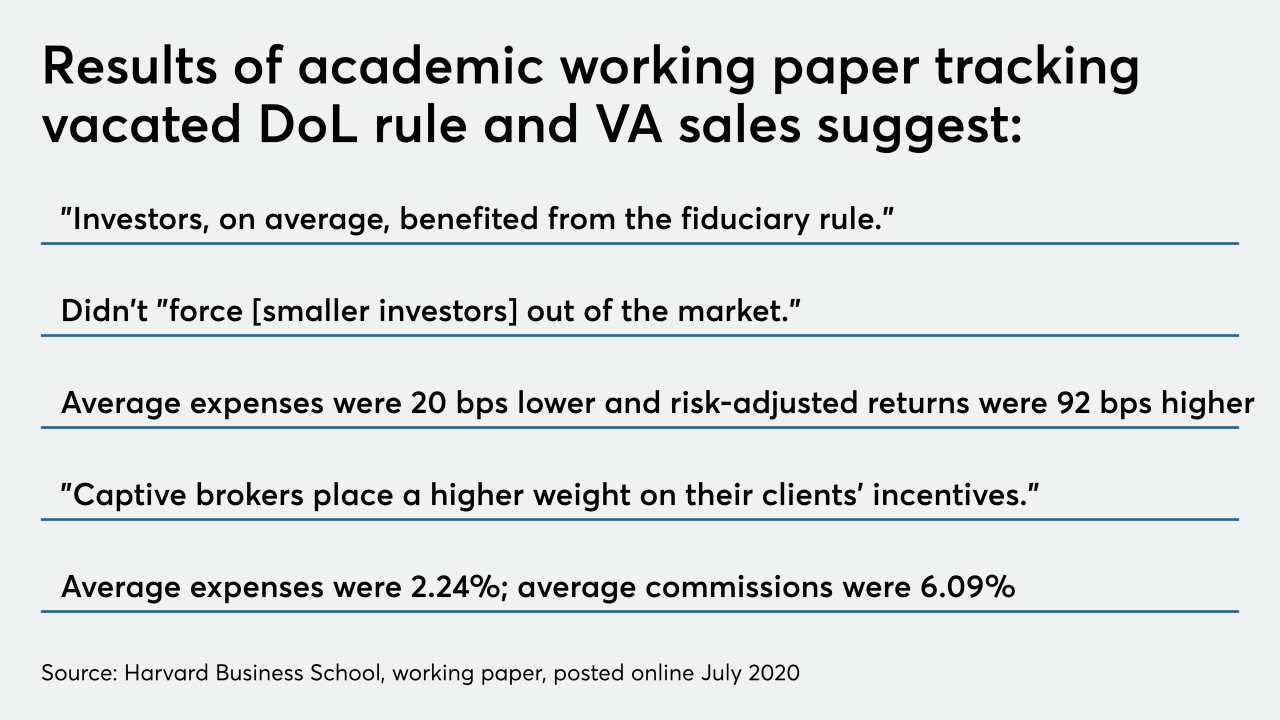

Expenses fell by 20 basis points and risk-adjusted returns climbed 92 bps, according to the study.

September 24 -

Investor advocates, religious groups and proponents of ESG investing argue the changes are a gift to business lobbyists that will muzzle corporate critics.

September 24 -

The agency has 90 days to review files and reach decisions.

September 23 -

The final regulation includes guidance on the requirements needed for properties to qualify for the deduction.

September 22 -

The company's outgoing CFO discussed ways the asset cap is stunting growth, but provided no updates at an industry conference on when the restriction might be lifted or the types of jobs it will cut.

September 15 -

The broker hasn't been registered in over a decade, and was using clients’ usernames and passwords to make trades in their self-directed brokerage accounts, according to the regulator.

September 14 -

The former broker allegedly also used his client’s money to pay bills at gas stations, grocery and hardware stores, according to the regulator.

September 11 -

To protect client nest eggs, advisors must know which savings vehicles are protected — and they’re not all created equal.

September 10 -

The free lunches are over. Sort of.

September 9