Regulation and compliance

Regulation and compliance

-

The firm determined that the staffers defrauded the SBA “by making false representations in applying for coronavirus relief funds for themselves.”

October 15 -

At the center is a pledge not to increase rates on those making less than $400,000, and that various changes would only impact earnings above the threshold.

October 14 -

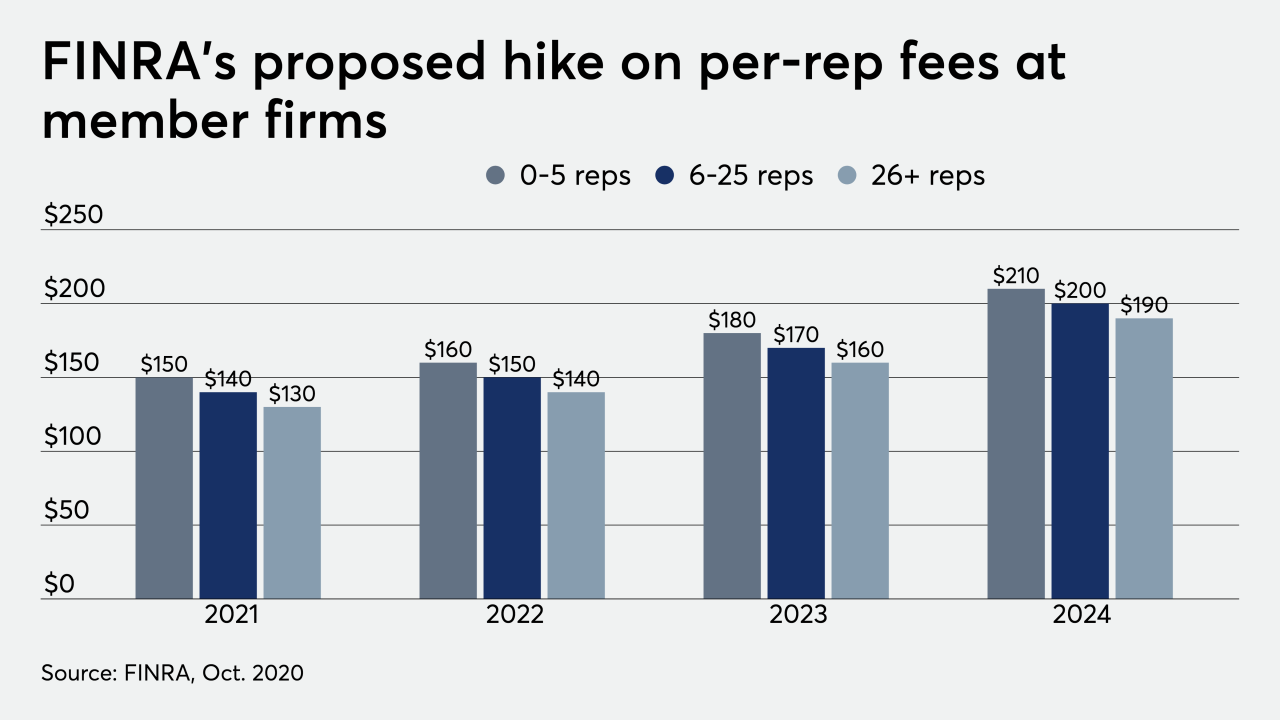

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

The regulator found that the financial services company failed to take precautions in disposing of hardware that contained sensitive customer information.

October 8 -

Insiders see a Democratic administration backing tightened investor protections as industry advocates look to tax legislation.

October 8 -

The agency began digging into the massive tax law addressing issues that needed immediate clarification.

October 8 -

The advisor allegedly carried out a 20-year scheme defrauding at least 15 clients through forgery and misrepresentations.

October 7 -

Whatever the outcome in November, taxpayers and their advisors should prepare for changes, an expert says.

October 6 -

The advisor allegedly used an omnibus trading account to help himself and hurt his clients to the tune of tens of thousands of dollars, according to the regulator.

October 5 -

While the contributions aren’t deductible, distributions such as earnings are tax-free to the designated beneficiary if they’re used to pay for qualified disability expenses.

October 5 -

The Managed Funds Association urged the agency to do more analysis before moving forward.

October 5 -

Director tenures, nominations and committees are changing after an independent task force identified weaknesses.

October 1 -

The discrimination case revolves around allegations of disparate treatment in the firm’s agency distribution channels.

October 1 -

The agency issued guidelines scaling back a tax break for client entertainment, following through on an element of President Trump’s 2017 tax overhaul.

October 1 -

The Justice Department filed two counts of wire fraud against the firm but agreed to defer prosecution under a three-year deal that requires the bank to report its remediation and compliance efforts to the government.

September 29 -

Actions hit a nine-year high and restitution climbed to the highest total since 2013 — even before the rule’s heightened scrutiny.

September 25 -

The Labor Department has opened the door to using PE as a component of a target date fund held within a DC plan, writes iCapital Network CEO Lawrence Calcano.

September 25 -

Based on the “forced experiment” of its remote periodic examinations of broker-dealers, the onsite portion “may not be necessary,” Robert Cook said.

September 24 -

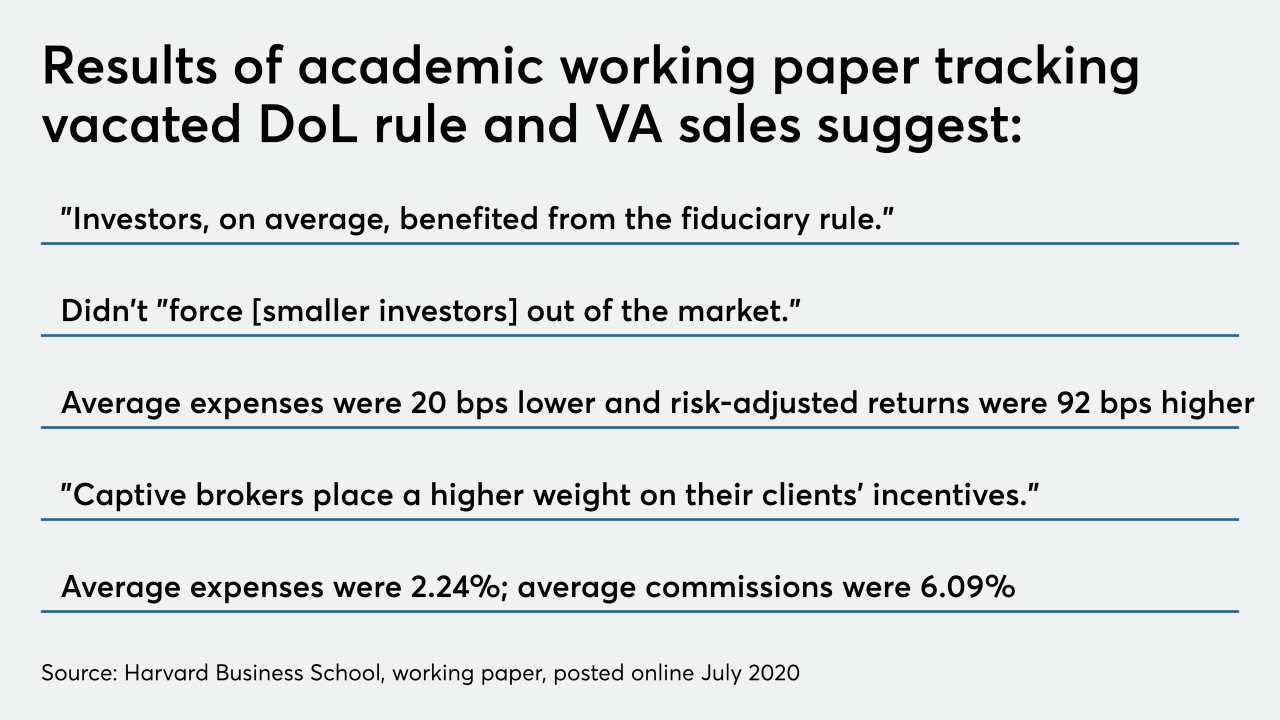

Expenses fell by 20 basis points and risk-adjusted returns climbed 92 bps, according to the study.

September 24 -

Investor advocates, religious groups and proponents of ESG investing argue the changes are a gift to business lobbyists that will muzzle corporate critics.

September 24