Regulation and compliance

Regulation and compliance

-

The question a Cetera advisor says he never wanted to get from a client: "How come this is $88,000 instead of $100,000?"

June 8 -

The new regulations are “arbitrary and capricious," a trade organization asserts.

June 7 -

Converging movements – fiduciary, technological and demographic – mean new realities for how a planner will act like a professional.

June 7 -

Richard W. Davis also took $1.5 million in fees while he was entitled to just $150,000, the commission alleges.

June 6 -

The adviser claimed she was unjustly fired from First Citizens Bank for allegedly making unauthorized bonus payments to her two sales assistants totaling $9,000.

June 6 -

The U.S. Chamber of Commerce, SIFMA, FSI and other groups are asking a Texas court to vacate the Labor Department's new regulations less than a year before the rule goes into effect.

June 2 -

The firm is facing a lawsuit on behalf of investors who lost money in a $350 million Ponzi scheme.

June 1 -

The firm's relatively modest-sized army of advisers is more productive than any of its competitors. In 2015, the average Raymond James adviser produced $387,733, beating Cetera, its closest rival, by more than $56,000.

June 1 -

If an advisor hasn't adopted new technology, the CEO asks, are they putting their own interests ahead of their clients?

June 1 -

The industrywide gain in fee income is a welcome development given the new fiduciary rule--see how firms are preparing for new regulations as well as new competition.

June 1 -

The fiduciary rule flips wealth management on its head, especially in the bank channel. Smaller books will be just one response at Cetera.

June 1 -

The adviser's job is about to get harder, and some old dogs are going to have to learn new tricks in order to survive.

June 1 -

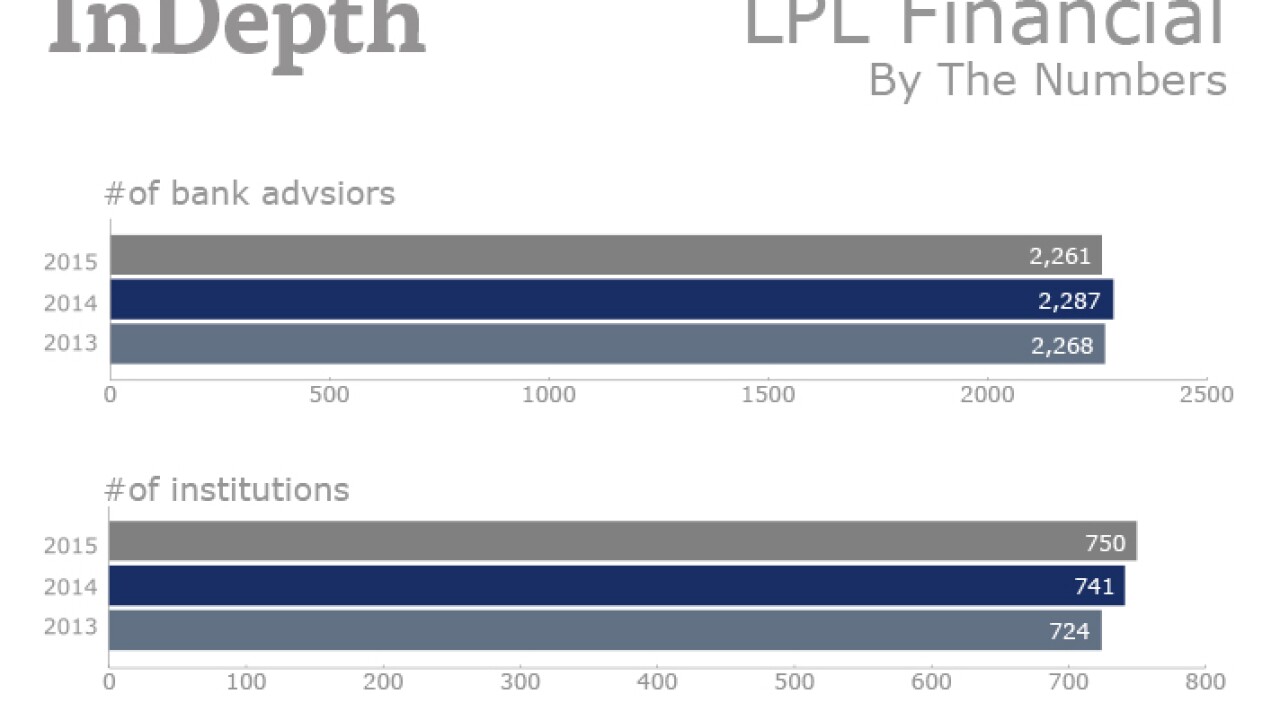

A longstanding obstacle is getting banks to recognize the opportunities in the wealth business, says Arthur Osman, executive vice president and institution service business consultant at LPL.

June 1 -

Quantum Advisors, which picks Indian stocks for Norways $860 billion wealth fund, says investors should stay away from index investing in Asias fourth-biggest market.

May 31 -

Some insiders at big brokerage firms encouraged the DoL to maintain progress. "That kept us going," Assistant Secretary of Labor Phyllis Borzi says.

May 25 -

Sales commissions may decrease, but new assets are expected to come on the platform.

May 25 -

If you're still thinking about a client who may be suffering from diminished capacity or displays other worrisome signs, then you need to say something, says Dr. Nancy Needell.

May 25 -

Careful steps need to be taken so FINRA won't consider it an outside business activity, says compliance expert Alan Foxman.

May 24 -

Are you using a robo adviser with clients? Be prepared to understand the inner workings of your digital tools, says Hardeep Walia, CEO of Motif Investing.

May 24 -

The elderly have called with technology issues, needing assistance with poorly understood account statements and to report scams. The calls also have helped the regulator identify mistakes and instances of abuse.

May 24