Regulation and compliance

Regulation and compliance

-

The Financial Industry Regulatory Authority is probing broker-dealer firms involved in taking small foreign companies public, the latest effort by a regulator to crack down on pump-and-dump schemes.

October 23 -

Industry compliance experts say there are few more complicated decisions than knowing when to leave a firm and start your own advisory practice. The government shutdown is making it worse.

October 22 -

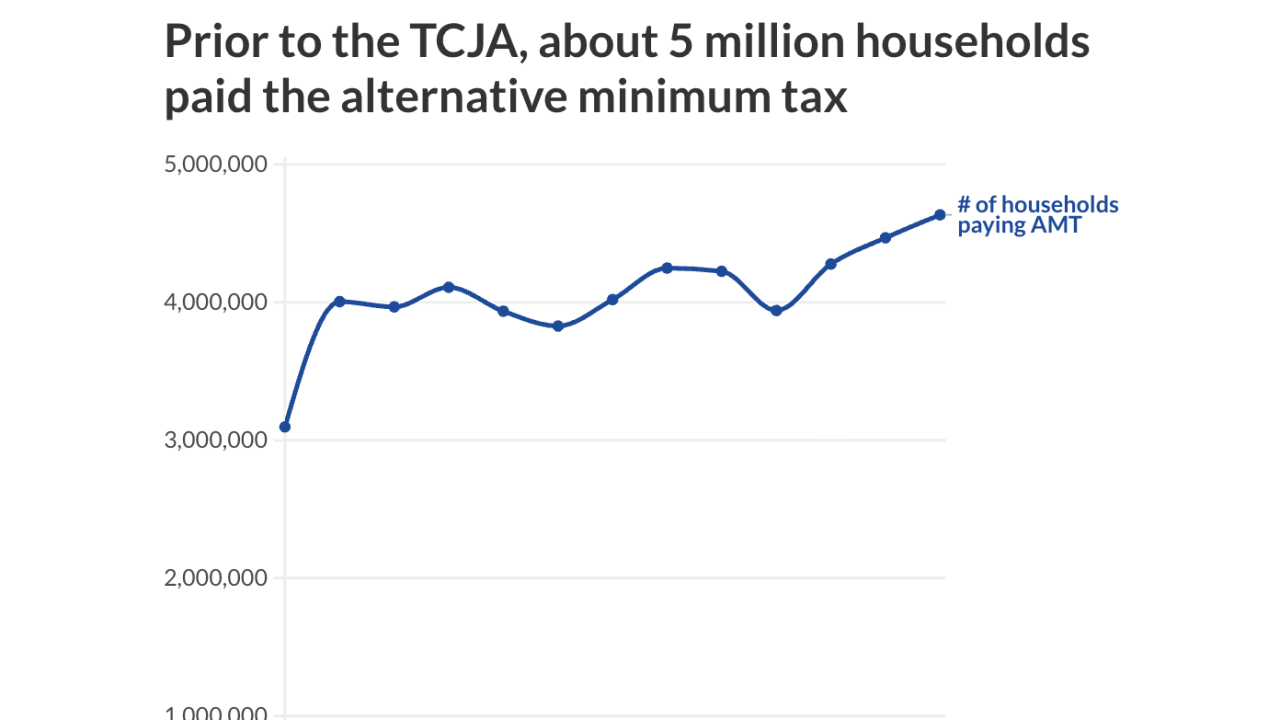

The One Big Beautiful Bill Act will boost the number of filers who must calculate their AMT. But that doesn't mean they're all going to have to pay it.

October 20 -

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

The expiration of premium tax credits for health insurance could lead to hundreds of thousands of job losses and billions in reductions to state revenues.

October 16 -

The fact that many financial advisors say they do not provide tax planning belies how much value they may add through that service, according to an expert.

October 14 -

Some financial advisors may still hesitate to get on LinkedIn, Facebook, Instagram, YouTube or TikTok. But experts say growing firms need to be on the social platforms.

October 9 -

Rev. Proc. 2025-32 from the Internal Revenue Service detailed a number of changes, including a rise in the standard deduction to $32,200 for married couples filing jointly.

October 9 -

Financial Planning's AI Readiness Survey found that advisors are already using AI for creating legal document summaries and seeing results, but legal experts warn that undisclosed, unmonitored use could open firms up to liability.

October 9 -

Former Morgan Stanley broker Kathy Frazier sued the firm in 2015 and was later joined by six other Black plaintiffs who also alleged they had been systematically excluded from the best advisory teams and client leads.

October 7 -

The model they want to follow creates an exchange-traded fund as one of the share classes of a mutual fund, a move that ports the famous tax efficiency of the younger structure to the older vehicle.

October 3 -

The massive law filled in some important answers for financial advisors and tax pros' many questions coming into the year. Here's a roundup of FP's coverage.

October 3 -

Compliance and former SEC lawyers say remaining industry regulators will prioritize preventing imminent investor harm while putting off some paperwork and routine tasks.

October 2 -

Co-founded by four Orion veterans, new wealthtech startup Hamachi.ai seeks to embed AI-powered compliance into client communications.

October 2 -

Francisco Gil tried to claim his status as an independent contractor entitled him to tax deductions for travel, meals and marketing expenses. The IRS and a federal judge said he was in fact an employee.

October 1 -

A government shutdown disrupts federal agencies and markets. Here's what advisors need to know to guide clients through the uncertainty.

October 1 -

Merrill had sought a temporary restraining order to prevent members of a large Atlanta-based team who left last week from soliciting former clients for their new firm.

September 30 -

The Treasury and the IRS issued guidance on qualified OZ investments in rural areas under the One Big Beautiful Bill Act.

September 30 -

Also this month in our disciplinary digest, a now-barred 'problem broker' for Stifel lands his former firm another hefty settlement, and an advisor is accused of fraud for trying to poach clients from his old firm.

September 29 -

In a lengthy court reply, advisors who left Merrill this week to form an RIA with Dynasty Financial Partners accuse Merrill of "bad faith" for putting them on administrative leave and failing to reinvest in their business.

September 26