-

The plans cannot be maximized if clients fail to find ways to minimize costs in retirement.

November 5 -

Certain financial moves could push their income above a certain threshold, potentially triggering an income-related monthly adjustment.

November 4 -

A closed-end fund can provide a steady income stream for clients, but advisors often make misleading assumptions about the regularity of monthly distributions. Here’s what to watch for.

-

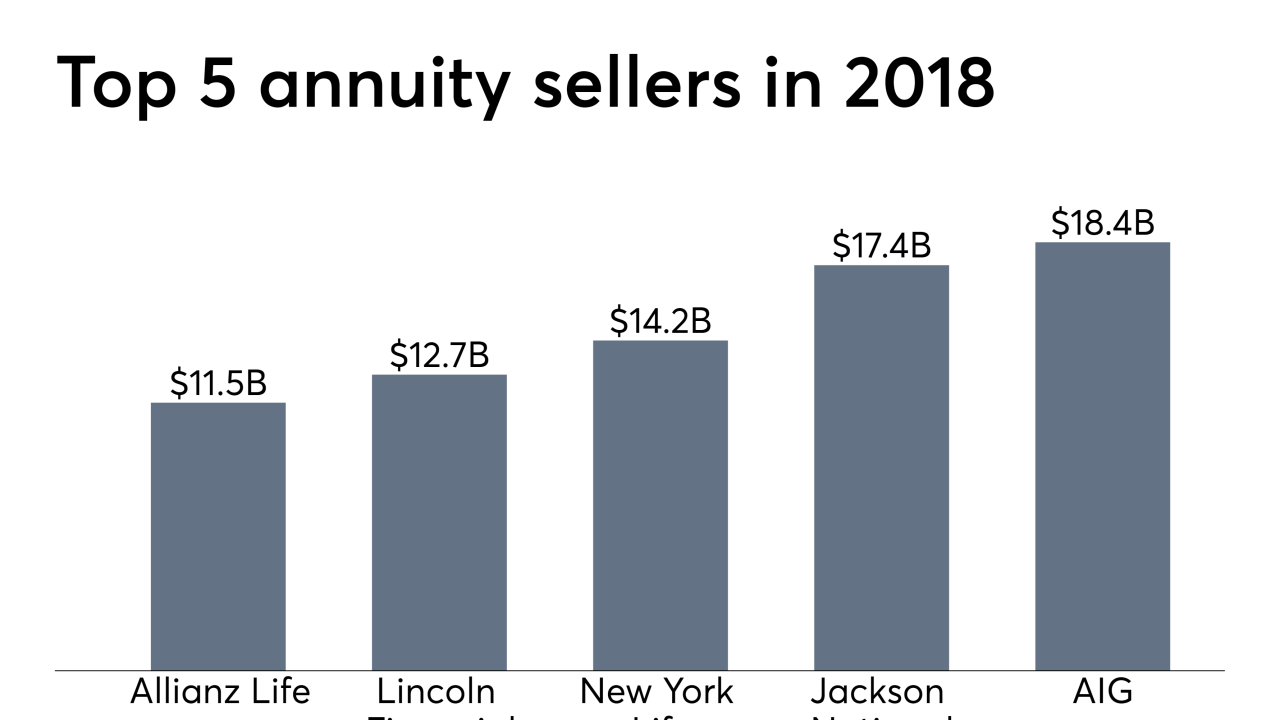

While many workers don’t have access to pension plans, annuities can provide a source of guaranteed retirement income and address longevity risks.

October 28 -

A successful financial plan is contingent on the success of the whole family, according to an expert.

October 24 -

These employers offer plans that pay as much as $6.52 per hour in contributions.

October 23 -

Around 40% blame their lack of preparation on housing costs, according to a report from TD Ameritrade.

October 23 -

Those planning to head back to the workforce are advised to set boundaries at their new jobs and continue doing the things they enjoy in retirement.

October 22 -

“Building and adhering to a budget that accounts for these types of expenses will create long-term security in retirement,” a CFP says.

October 21 -

When searching for the right plan, it is important that retirees assume their health will one day change.

October 18 -

-

Retirees often only take distributions when they are forced to do so because of the IRS’ RMD rules, an expert says.

October 16 -

Securing optimal returns depends on many factors, including the right underlying asset class and close monitoring.

-

Keeping their money invested for a longer period enacts the power of compounded interest growth.

October 11 -

Clients are advised to have an emergency fund, create a monthly budget and repay their high interest debt.

October 10 -

Investing in tax-advantaged accounts and automating contributions are a few strategies that could help.

October 9 -

Clients should think of the years as empty buckets and keep the amount of income into each bucket level per year.

October 3 -

To build their wealth, retirement savers are advised to take advantage of tax-advantaged plans including 401(k)s and IRAs.

October 2 -

With millennial and Gen Z clients expected to have longer lives than their parents, securing an effective retirement horizon can have its challenges.

October 1 -

Just 27% say they expect to have saved enough by the time they retire.

September 27