-

I would rather have my clients come back to me saying they had too much money in retirement than telling me they are running out.

May 8 Wealth Logic

Wealth Logic -

Can’t stop, won’t stop. That’s the mantra of some boomers who have no interest in retirement.

May 8 -

Tapping into these plans is one method used to prevent bankruptcy.

April 16 -

-

Clients are increasingly favoring accounts suited for emergency spending, research shows.

April 15 -

Retirees who use a smaller withdrawal rate may amass significant excess wealth. That can mean trouble for advisors.

April 11 -

Advisors who once oversaw portfolios for clients anxious to save a dollar now work more frequently with investors saving to see the world.

April 9 -

New survey reveals low savings rates and poor financial literacy on retirement planning, but advisors can help.

April 9 -

The bill has bipartisan support in the House and Senate.

April 3 -

Advisors need to be willing to take a financial hit for clients

April 2 Retirement Matters

Retirement Matters -

As an alternative to placing restrictions on lump sum withdrawals, clients could provide retirees more distribution flexibility.

March 28 October Three Consulting

October Three Consulting -

Eleven of the 14 dividend-focused ETFs in existence 10 years ago beat a plain vanilla index fund.

March 14 -

-

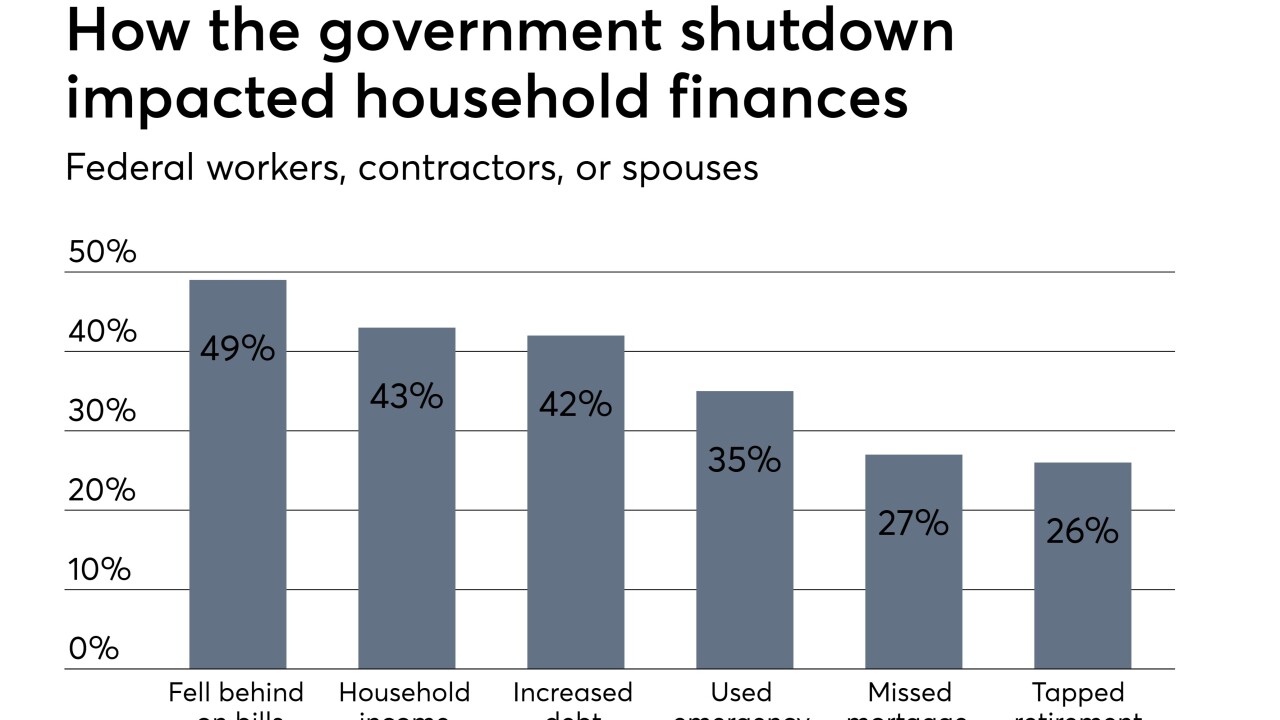

The last government shutdown highlighted how many Americans ignore basic planning lessons.

February 19 -

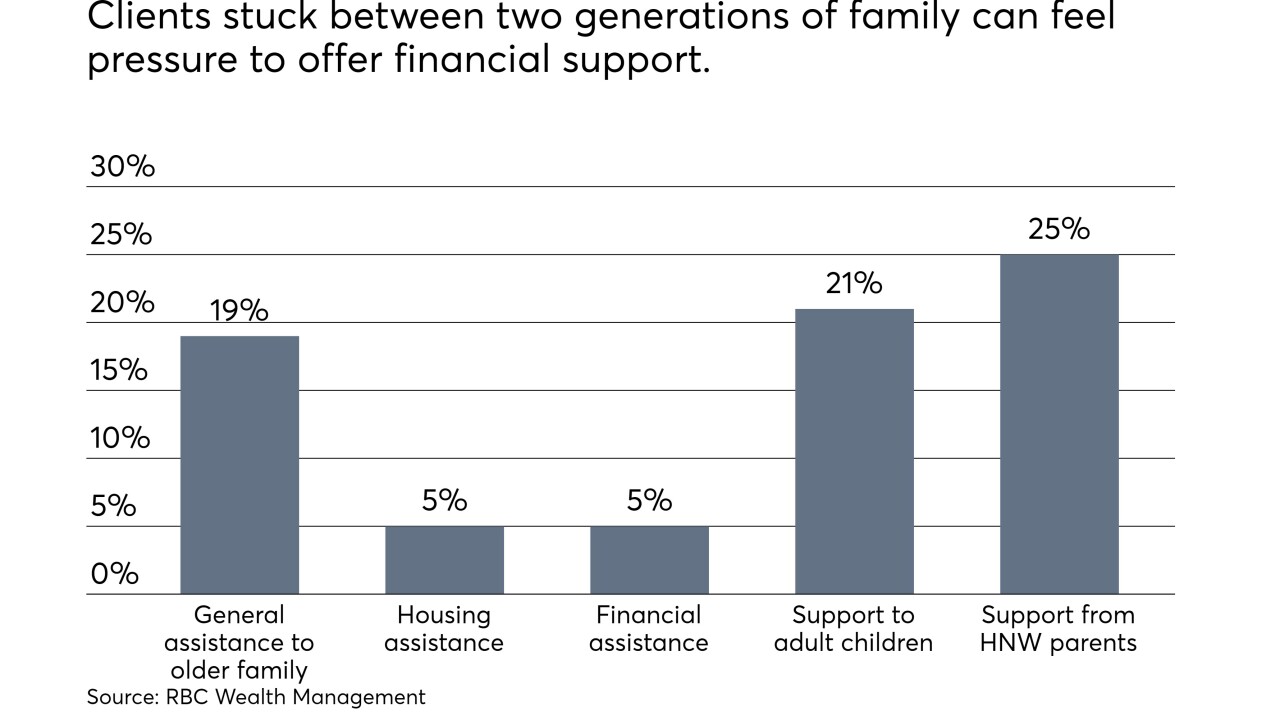

About 19% of adults support elderly family members in some way.

February 13 -

Maryland and New Jersey are among the least-appealing places for employees to spend their post-work years, due in part to affordability, health costs and overall quality of life.

February 12 -

Virginia and Colorado are among the most-appealing locations for retirees to spend their golden years, due in part to top scores in affordability, health-related factors and overall quality of life.

February 11 -

-

Getting clients to think realistically about their post-work years is tough, but this one question quickly gets to the heart of the matter, says Trilogy Financial CEO Jeff Motske.

February 1 -

Benefits are meant to replace just 40% of preretirement income, so many retirees should consider creating new income sources, such as running a small business or renting out a property.

January 10