-

Wealth managers acting as “downstream broker-dealers” allegedly made $187 million in commissions and other selling fees on GPB Capital investments.

February 4 -

A dead client, an advisor accused of murder and fraud, and an industry that didn’t see it coming.

February 2 -

The firm’s use of third-party compliance vendors came under scrutiny after an ex-rep pleaded guilty to bilking clients out of $5 million.

January 5 -

Fake name, phony credentials, Ponzi-like payments but real victims — this is what authorities are saying about this business.

December 3 -

James Booth’s seven-year fraud bilked investors out of nearly $5 million.

November 24 -

The advisor allegedly carried out a 20-year scheme defrauding at least 15 clients through forgery and misrepresentations.

October 7 -

The advisor allegedly used an omnibus trading account to help himself and hurt his clients to the tune of tens of thousands of dollars, according to the regulator.

October 5 -

The Justice Department filed two counts of wire fraud against the firm but agreed to defer prosecution under a three-year deal that requires the bank to report its remediation and compliance efforts to the government.

September 29 -

Actions hit a nine-year high and restitution climbed to the highest total since 2013 — even before the rule’s heightened scrutiny.

September 25 -

The broker hasn't been registered in over a decade, and was using clients’ usernames and passwords to make trades in their self-directed brokerage accounts, according to the regulator.

September 14 -

The former broker allegedly also used his client’s money to pay bills at gas stations, grocery and hardware stores, according to the regulator.

September 11 -

The advisor sold securities out of one account to buy a Camaro ZL1 — then resold the car to the same victim, the regulator alleges.

August 31 -

The firm will also pay a penalty and offer to buy back variable annuities the former broker sold to 21 other investors.

August 11 -

During rapid growth, the firm allegedly failed to detect a cascade of red flags.

August 10 -

To thwart a multifactor verification system, he once used a victim’s home phone to authorize transactions.

July 22 -

After the client died at age 98, the advisor allegedly moved on to bilk another elderly investor, authorities say.

June 16 -

After serving 18 months in jail, Craig Rothfeld knew “other people would need help too.”

March 19 -

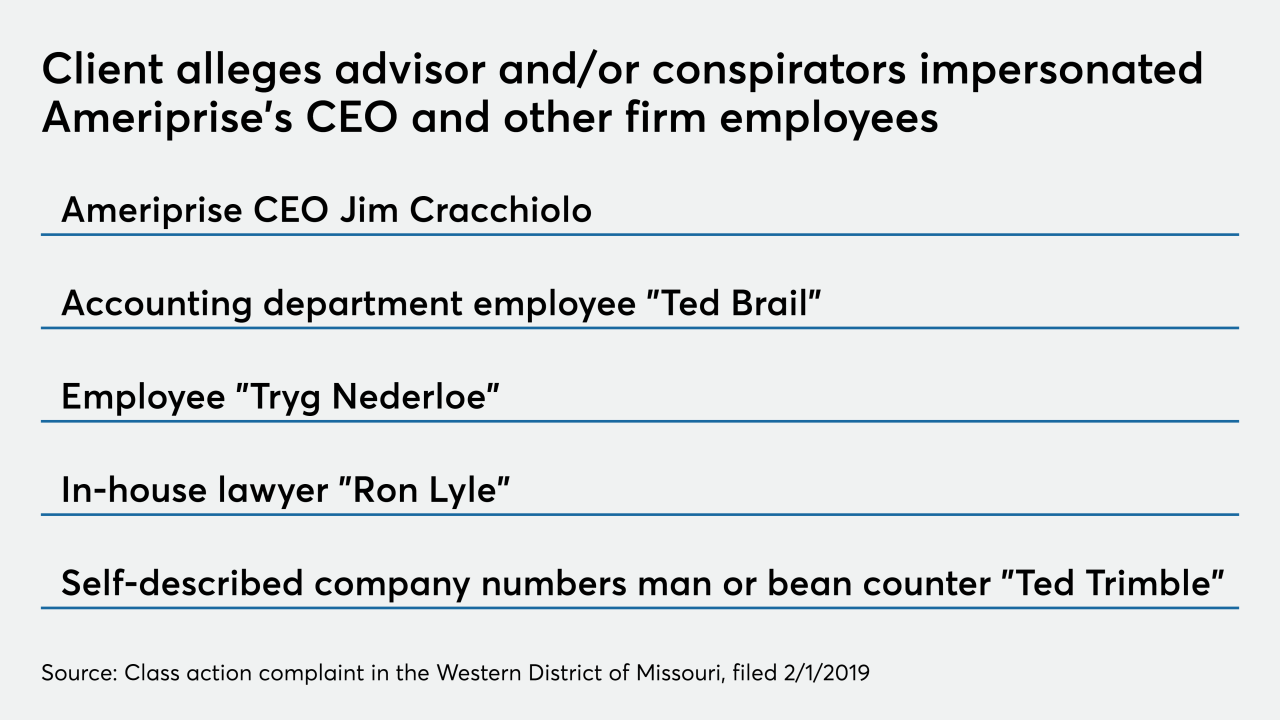

Five years of alleged promises, checks that never arrived, and a mysterious employee named “Tryg Nederloe” add up to a bizarre saga with wide ramifications.

March 2 -

The major custodian lost its second arbitration case — with even more filings likely — over the services it provided to a brokerage later proved to be engaged in massive fraud.

February 27 -

The former investment advisor, convicted of running one of the biggest Ponzi schemes ever, says he suffers from terminal kidney failure and other ailments.

February 6