-

-

-

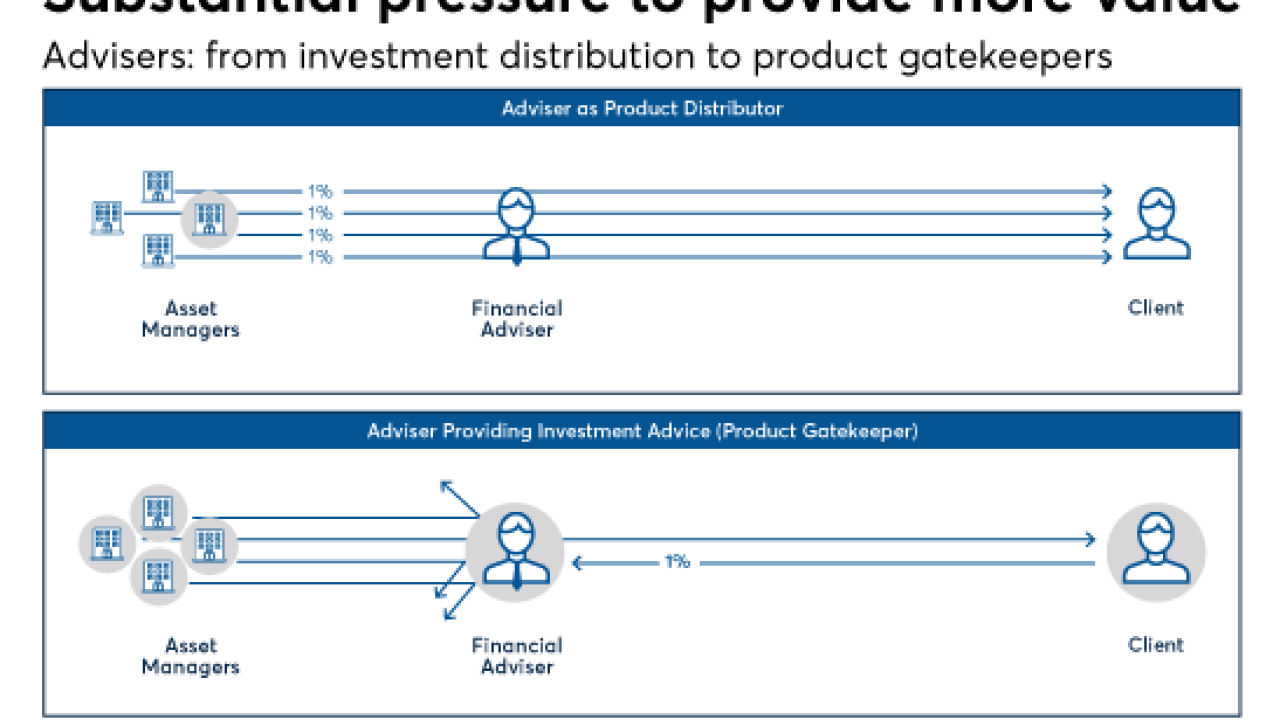

Advisers have turned into the new active investment managers.

August 1 -

-

Actively managed funds saw the majority of the largest outflows this year as investors flocked to less expensive passive alternatives.

June 14 -

Passive investments garnered most of the investor cash so far in 2017, but beyond that it was a wide net: S&P 500, small cap, emerging markets, fixed income — anything that could be structured as an ETF.

June 7 -

Small-caps carry risk, but they don’t have to be expensive too. Here are 20 with the best returns over the past five years and the lowest expense ratios.

May 31 -

When markets are high, everyone feels like genius, but they still have to pay expenses. Help clients keep them low.

May 16 -

Do they really deliver better risk-adjusted returns? A Morningstar panel said yes, but contributing writer Allan Roth disagrees.

April 27 Wealth Logic

Wealth Logic -

This year has been a wild ride for clients and advisers, and it’s only just begun. Here are some things to keep in mind as advisers craft portfolios for the rest of the epoch.

March 29