Small-caps could be one idea. However, the sector tends to be more volatile than large-caps and has also turned in a strong performance, meaning prices are hardly cheap.

On the expense side, there are some small-cap funds that have low expense ratios, which we defined as 1% or less for this labor-intensive asset class. (A small handful have dirt-cheap expense ratios.) Indeed, expenses are the biggest differentiator in this case, since returns for all funds listed here are separated by less than two-and-a-half-percentage points.

We also screened out any funds with less than $100 million in assets and ranked the resulting list by their five-year returns.

All data from Morningstar.

20. Hartford Small Cap Growth Y (HSLYX)

Expense Ratio: 0.83%

Total Assets (millions): $964

19. Vanguard S&P Small-Cap 600 Value ETF (VIOV)

Expense Ratio: 0.20%

Total Assets (millions): $231

18. iShares S&P Small-Cap 600 Value (IJS)

Expense Ratio: 0.25%

Total Assets (millions): $4,508

17. iShares S&P Small-Cap 600 Growth (IJT)

Expense Ratio: 0.25%

Total Assets (millions): $4,222

16. SPDR S&P 600 Small Cap Growth ETF (SLYG)

Expense Ratio: 0.15%

Total Assets (millions): $1,255

15. SPDR S&P 600 Small Cap Value ETF (SLYV)

Expense Ratio: 0.15%

Total Assets (millions): $970

14. Vanguard Tax-Managed Small Cap Adm (VTMSX)

Expense Ratio: 0.09%

Total Assets (millions): $5,292

13. SPDR S&P 600 Small Cap ETF (SLY)

Expense Ratio: 0.15%

Total Assets (millions): $732

12. Vanguard S&P Small-Cap 600 ETF (VIOO)

Expense Ratio: 0.15%

Total Assets (millions): $1,209

11. DFA Tax-Managed US Targeted Value (DTMVX)

Expense Ratio: 0.44%

Total Assets (millions): $4,241

10. Oppenheimer Small Cap Revenue ETF (RWJ)

Expense Ratio: 0.39%

Total Assets (millions): $534

9. iShares Core S&P Small-Cap (IJR)

Expense Ratio: 0.07%

Total Assets (millions): $29,659

8. Vanguard Strategic Small-Cap Equity Inv (VSTCX)

Expense Ratio: 0.29%

Total Assets (millions): $1,665

7. VALIC Company I Small Cap Agrsv Gr (VSAGX)

Expense Ratio: 0.99%

Total Assets (millions): $114

6. T. Rowe Price QM US Small-Cap Gr Eq (PRDSX)

Expense Ratio: 0.81%

Total Assets (millions): $4,083

5. JPMorgan Small Cap Core R5 (VSSCX)

Expense Ratio: 0.80%

Total Assets (millions): $206

4. Nuveen Small Cap Value I (FSCCX)

Expense Ratio: 1%

Total Assets (millions): $1,428

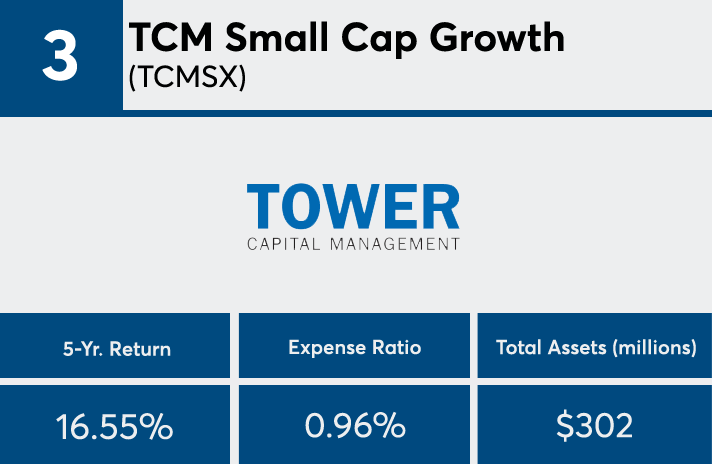

3. TCM Small Cap Growth (TCMSX)

Expense Ratio: 0.96%

Total Assets (millions): $302

2. T. Rowe Price New Horizons (PRNHX)

Expense Ratio: 0.79%

Total Assets (millions): $19,123

1. PNC Multi Factor Small Cap Core I (PLOIX)

Expense Ratio: 0.85%

Total Assets (millions): $359