-

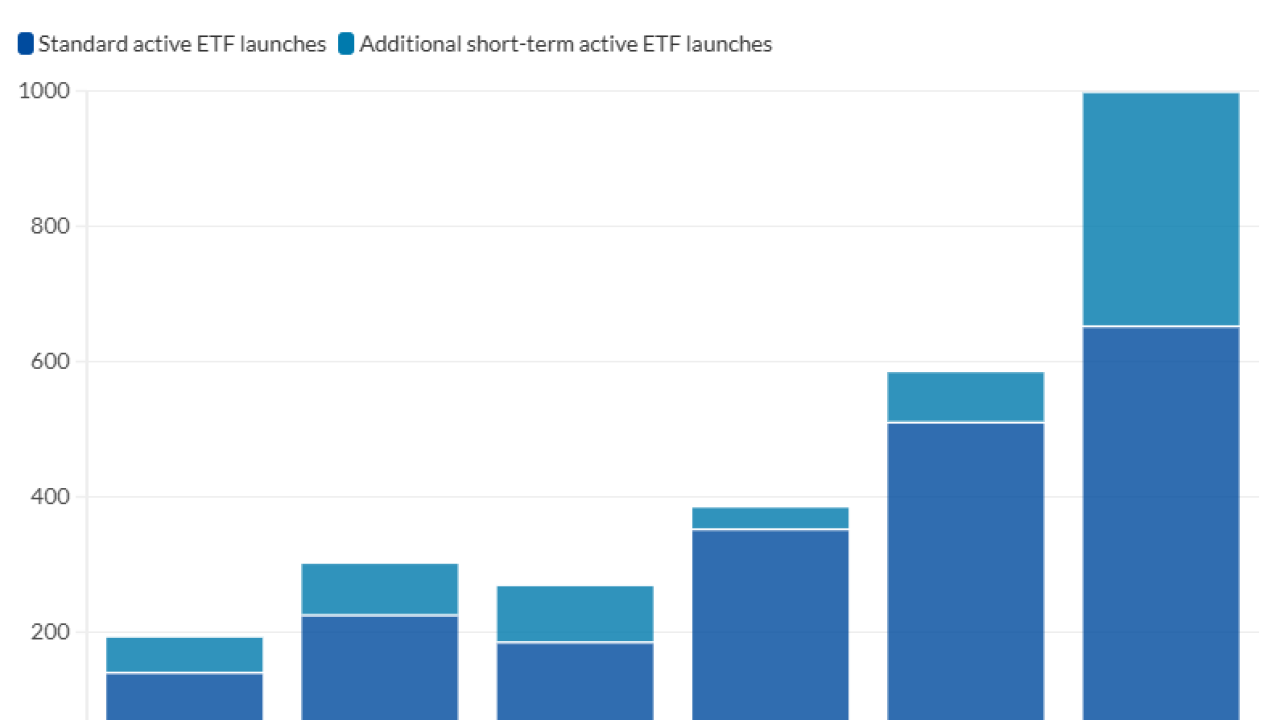

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Tax-loss harvesting's overlooked cousin can pay off for clients with low-earning years, concentrated positions or UTMA accounts.

January 14 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

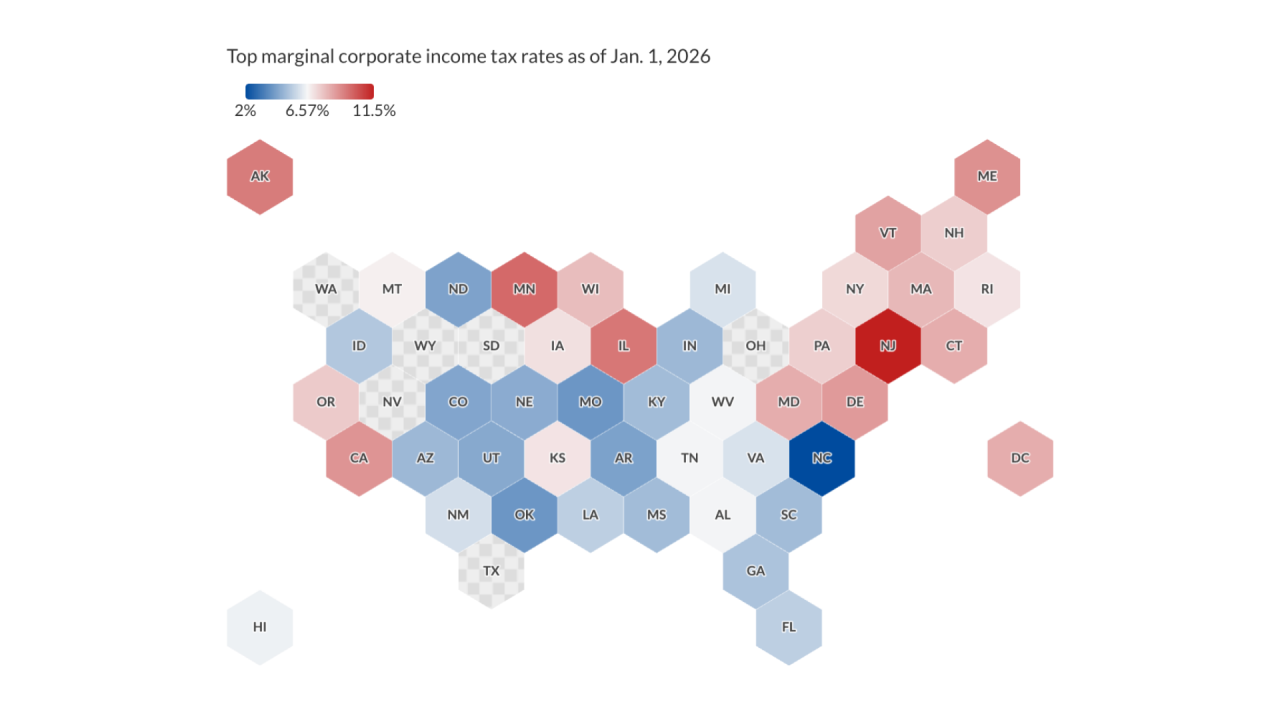

Corporate tax rates vary widely by state, affecting client business decisions around relocation, expansion and growth planning. Here's how the landscape is changing in 2026.

January 13 -

Spot bitcoin ETFs simplify custody, but they cost clients a major tax advantage. Here is why direct ownership still wins for HNW and UHNW clients.

January 7 -

The tax shield on student loan forgiveness has expired. Here is how advisors can help clients lower their burdens.

January 6 -

The "in-kind" method allows investors to diversify highly appreciated stock without handing over a chunk of the profit to the IRS.

January 6 Exchangifi

Exchangifi -

The U.S. and more than 100 other countries finalized an agreement that would exempt American companies from some foreign taxes.

January 5 -

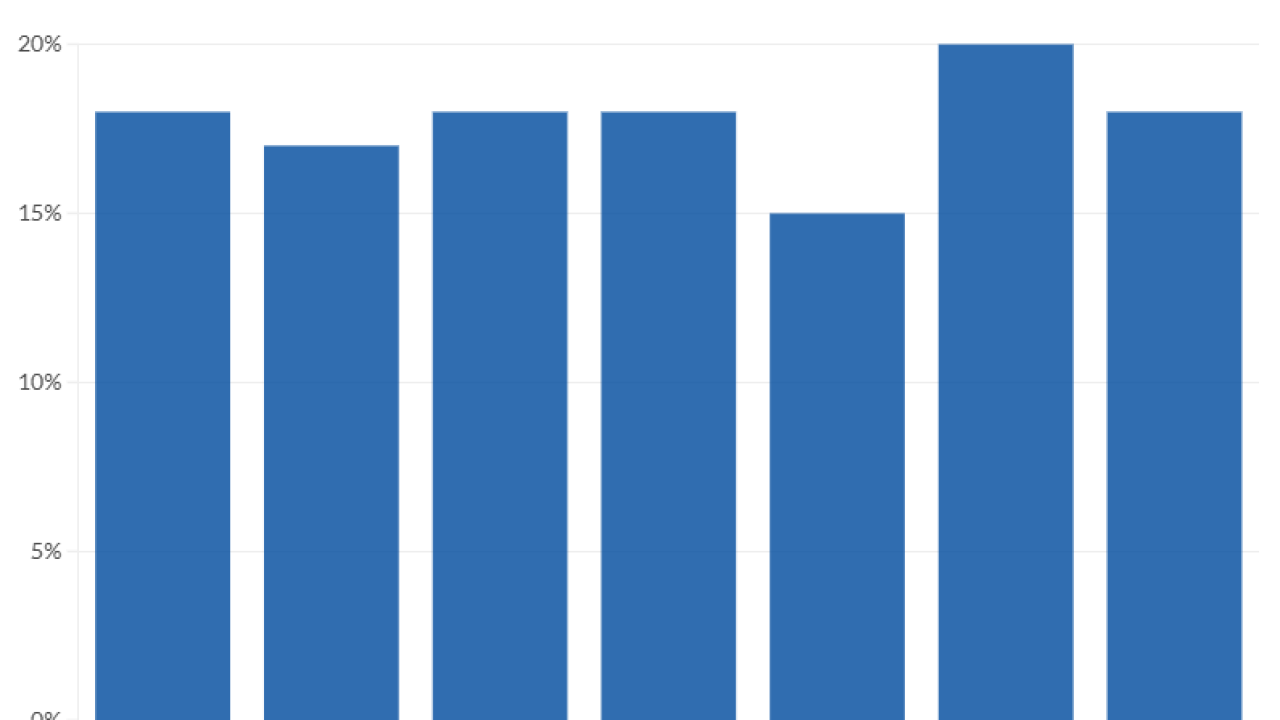

Fixed-income represented a surprising bright spot in 2025, despite the warnings of "bond vigilantes" and inflation pressure. Here's the outlook for 2026.

December 30 -

From AI advancements to greater access to private markets to the forces shaping retirement, six experts share their hot takes on what's just over the horizon in wealth management.

December 30 -

Financial advisors and their clients have a range of options to consider for traditional IRA holdings — but also a finite deadline.

December 29 -

Treasury Secretary Scott Bessent outlined how Trump accounts could be opened, managed and used for children's savings and future retirement. Here's what advisors should know.

December 26 -

The IRS Criminal Investigation unit cited its top cases that led to multiyear prison sentences and multimillion-dollar financial settlements for tax crimes.

December 26 -

Unlike equity investors, who must plan around the 31-day exclusion window, cryptocurrency holders can sell and repurchase in the same session.

December 26 -

The epic OBBBA tax law brings glad tidings to most families, but complacency can lead to costs for financial advisors and their clients.

December 23 American College of Financial Services

American College of Financial Services -

Amanda Reynolds filed a complaint asking the court to determine whether pets can be recognized as non-humans dependents.

December 19 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

President Trump's signature tax law drew the most headlines, but FP covered the "T" intersection with wealth management from many angles.

December 17 -

An industry lawyer warns that RIAs often don't do enough to delineate their responsibilities and shield themselves from liability when they add tax preparation to their service offerings.

December 16 -

With no guidance available, tax practitioners and their clients have to figure out how much risk they want to take.

December 16 -

An increasingly popular form of lending enables financial advisors and their clients to offset capital gains and find other tax savings.

December 15