-

One fifth of AdvicePeriod's clients have a net worth over $10 million. Many pay an annual fee of around $200,000.

December 1 -

These four experts can help you address any client situation.

November 30 -

Contributions and grants have recently reached record highs.

November 30 -

The uncertain tax and legislative environment means that year-end tax planning is more important than usual. To help clients and businesses prepare for filing season, here are helpful tips.

November 27 -

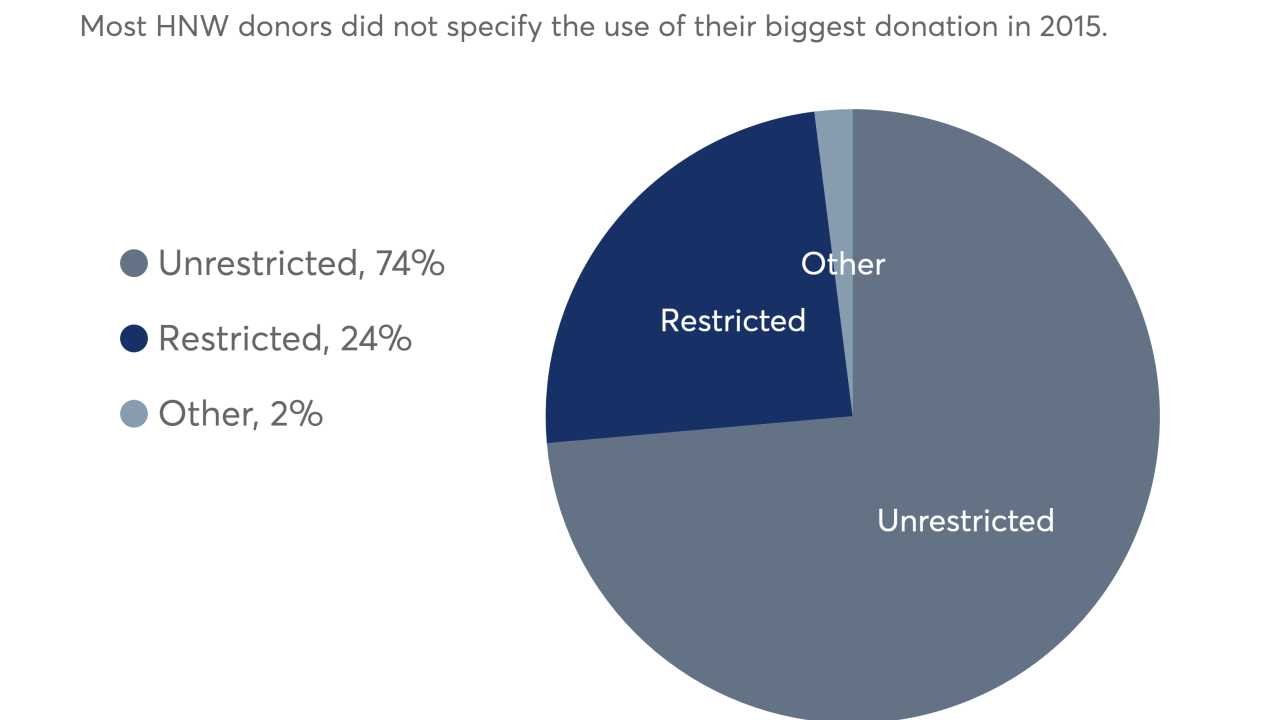

Almost half of wealthy donors don’t have a strategy in place to guide their charitable giving.

November 27 -

Their use has jumped 1,035% with assets topping more than $1 trillion.

November 27 -

Most Americans would prefer to age in place, but sometimes the costs make it impractical. Here's how to help.

November 27 -

The metal has advanced 1.7% this month and is up about 12% in 2017.

November 27 -

"Sun and sand are great," says one analyst, but they're not the only considerations. They certainly didn't help boost the top city in this survey.

November 21 -

It's not just for December, but a smart approach throughout the year.

November 21