-

Voters in 20 states will be asked to weigh in on ballot referendums and measures concerning an estimated total of $3.1 billion in potential tax hikes.

October 30 -

The choice of buyer and the price get the most attention, but a possible merger of equals and the technology side of the transition could loom large in the strategy.

October 27 -

Nearly half of advisors are considering adding this service, according to the Financial Planning's October Financial Advisor Confidence Outlook.

October 27 -

The challenge bedevils many heirs' property owners. Here's why experts say it's such a threat and how financial professionals can help guide families through it.

October 23 -

How charitably inclined taxpayers can use donor-advised funds and other tax strategies to get ahead of the OBBBA's revised rules on charitable deductions.

October 23 Natixis Investment Managers Solutions

Natixis Investment Managers Solutions -

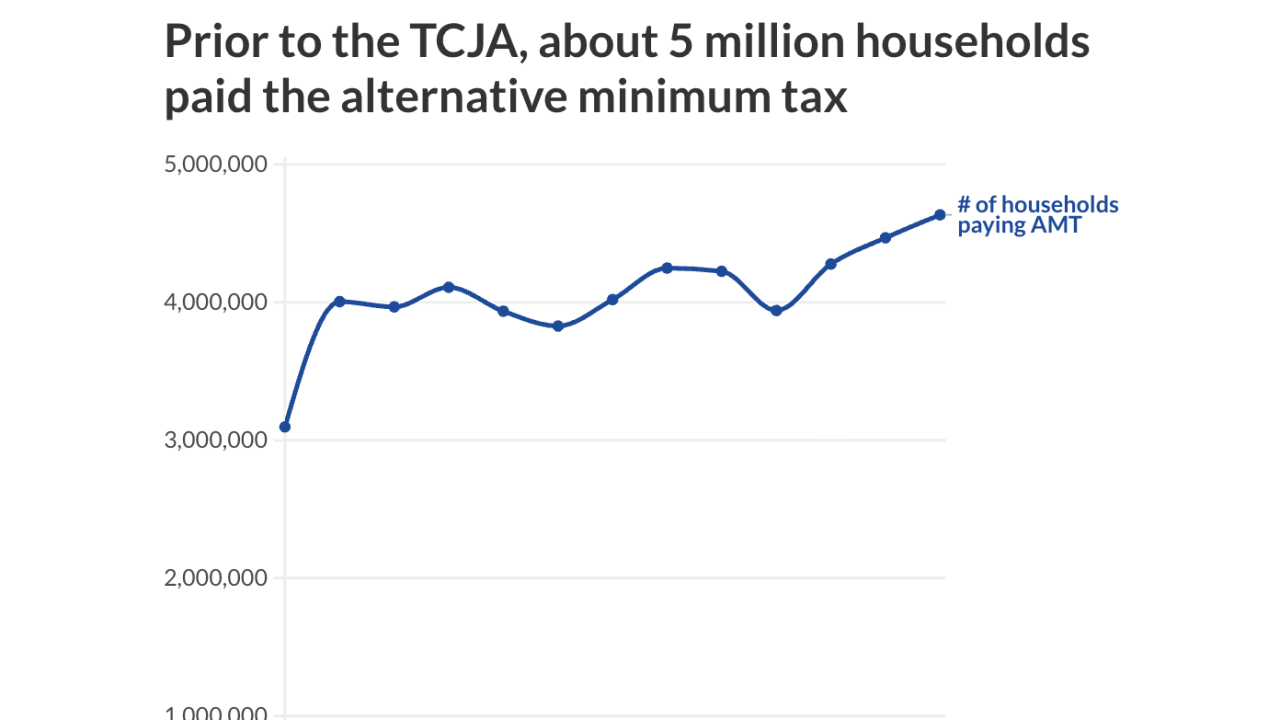

The One Big Beautiful Bill Act will boost the number of filers who must calculate their AMT. But that doesn't mean they're all going to have to pay it.

October 20 -

Starting next year, more households will need to calculate or pay the AMT. The rules are complicated. Here's how financial advisors can prepare themselves — and clients — for the changes.

October 20 -

A clear division is emerging between smaller independent RIAs and their larger billion-dollar competitors, as some firms aggressively pursue a "one-stop shop" model for their clientele.

October 17 -

Video game developers are benefiting from research and development tax credits and recent changes in the rules for deducting R&D expenses.

October 17 -

Tax returns released by his campaign show he made over $4.2 million in capital gains and took a $4.8 million deduction, paying taxes on $5.9 million in income.

October 17 -

The expiration of premium tax credits for health insurance could lead to hundreds of thousands of job losses and billions in reductions to state revenues.

October 16 -

Accountants who advise private equity clients will want to be aware of what these mean for private equity sponsors and their portfolio companies.

October 15 Stout

Stout -

The fact that many financial advisors say they do not provide tax planning belies how much value they may add through that service, according to an expert.

October 14 -

Rev. Proc. 2025-32 from the Internal Revenue Service detailed a number of changes, including a rise in the standard deduction to $32,200 for married couples filing jointly.

October 9 -

With deals like Cetera's purchase of Avantax, Morgan Stanley's of Parametric and JPMorgan's of 55ip, big firms are increasingly able to answer high net worth clients' tax questions without having to send them to outside professionals.

October 8 -

The many technical planning questions may be moot until spouses can find common ground on money and wealth in general, CFP Board conference panelists said.

October 8 -

In this month's Financial Advisor Confidence Outlook, advisors' feelings about the overall economy and practice performance were up. That optimism could be fleeting.

October 7 -

Starting in 2026, high earners over the age of 50 must make 401(k) catch-ups after-tax. Savers may not be celebrating, but advisors say the shift will benefit them over the long term.

October 3 -

The model they want to follow creates an exchange-traded fund as one of the share classes of a mutual fund, a move that ports the famous tax efficiency of the younger structure to the older vehicle.

October 3 -

Along with traditional financial planning, Tushar Kumar includes estate and tax planning services at his firm in order to give clients, especially high net worth ones, a complete picture.

October 3