-

Here’s how to decide whether your client should select the traditional or Roth IRA to put away for retirement and boost their savings.

March 24 -

It's possible to use these distributions to preserve clients' savings well past their anticipated lifespan.

March 23 -

Medicare costs count as a deductible medical expense, but only if they exceed 7.5% of adjusted gross income.

March 22 -

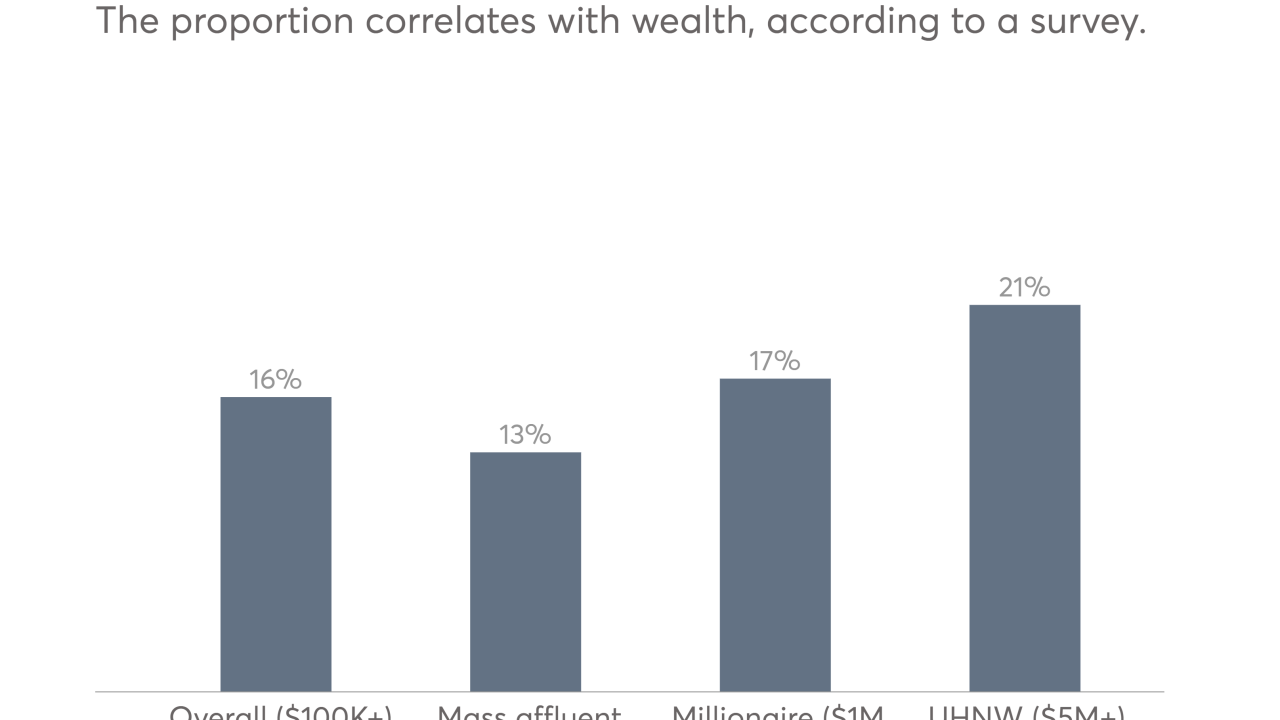

HNW investors and their planners shun the tax-advantaged savings accounts, according to a study.

March 21 -

Education around these rules can prevent an increase in their tax bills.

March 17 -

High-net-worth clients can side-step this Affordable Care Act tariff if they opt to place their investments in an S corporation. Here’s how.

March 10 -

The SEP IRA, Solo 401(k) and SIMPLE IRA are just a few options that may help them prepare.

March 10 -

Here’s one reason why clients should consider maxing out their contributions ahead of claiming deductions this year.

March 9 -

Tax columnists George Jones and Mark Luscombe of Wolters Kluwer put together a list of important changes from this year that will carry over into the next.

March 9 -

-

These products are meant for short- and intermediate-term investing and should carry enough risk to grow and meet the goals over time.

March 6 -

Avoiding these mistakes with a small business is essential.

March 6 -

There's no point in waiting on new policy to initiate preparation that is protective and vital, no matter what the ultimate law may be.

March 2 -

How IRA conversions can come at a steep price for clients. Plus, ways to dodge a surprise bill from the IRS.

February 27 -

When a tax-deferred account is part of an estate, failure to follow the tax rules correctly can result in a financial disaster.

February 17 -

How a couple wrote off cat food and other breaks that boosted refunds. Plus, how charity counts toward an IRA withdrawal.

February 14 -

Clients can fully deduct their IRA contributions if they have no access to a workplace retirement plan.

February 6 -

Clients who make these prohibited transactions can face devastating penalties.

February 1 -

There are ways around having to pay as much as a 50% penalty. Plus, inheriting Roth IRAs and designing more efficient retirement portfolios.

January 31 -

Moving investments into these accounts may optimize returns and boost savings. Plus, know your IRAs and the impact of Trump's proposals on income brackets.

January 25