From Assets to Profits, Which Regional Is on Top?

Through earnings reports from all the so-called super regional firms, the wealth management industry has a snapshot of how the firms in this arena are faring.

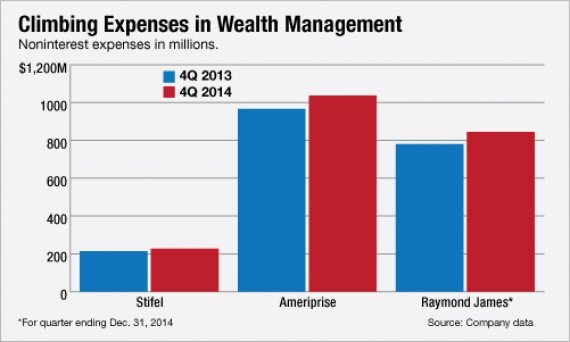

For example, wealth management profits surged 30% or more year-over-year at Raymond James and Ameriprise.

To learn more about how the regionals stack up, click through our slideshow.

To read the single page version, click here.

Image: iStock

From Assets to Profits, Which Regional Is on Top?

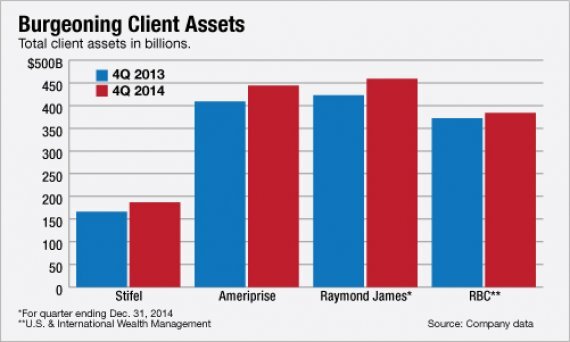

Raymond James' Private Client Group, for example, reported an 8.5% increase year-over-year, as total assets grew to $459 billion for the most recent quarter, up from $423 billion for the same period a year-ago. Fee-based assets increased at a quicker pace, rising 3.6% to $174 billion, up from $151 billion for the year-ago period.

From Assets to Profits, Which Regional Is on Top?

The firm's pretax profits grew to $212 million for the fourth quarter from $160 million for the same period a year ago. For the fiscal year, Ameriprise reported $792 million in profits, up 34% year-over-year.

"Ameriprise delivered another good quarter to complete a strong year, led by our advice and wealth management business," said Jim Cracchiolo, chairman and CEO, in a statement. "We're bringing in significant client net inflows, growing our assets under management and increasing advisor productivity."

From Assets to Profits, Which Regional Is on Top?

The number of employee advisors fell to 2,083 from 2,100 for the prior quarter, and from 2,205 for the year-ago period. The ranks of independent advisors grew year-over year, rising to 7,589 from 7,511.

During a conference call with analysts, CEO Jim Cracchiolo said that productivity remained strong and especially among new hires.

"With the employee channel, we have much more productivity and we are bringing in people who have much higher productivity than the people who have left."

In a press release, the firm said it had picked up 73 experienced advisors across both channels during the quarter. Productivity rose 13% year-over-year, rising to $496,000 in operating net revenue per advisor.

Meanwhile, rival Raymond James has pursued an aggressive recruiting strategy. Headcount was up by 71 advisors from the previous quarter and up by 158 advisors compared with the prior year.

"We are very pleased with the net addition of financial advisors during the quarter, which is a testament to our firms ability to attract and retain advisors in all of our affiliation platforms," said the firm's CEO Paul Reilly, in a statement.

From Assets to Profits, Which Regional Is on Top?

"This investment in the independent advisor business gives Stifel the opportunity to grow this platform. We think we're going to grow and compete in this channel," Stifel CEO Ronald Kruzewski said during a conference call. He added that it's a channel that Stifel has "otherwise ignored."

Industry observers say the acquisition will make Stifel look more like rival Raymond James.

"You can see that Raymond James is working both channels effectively by giving advisors the choice of how they work with the firm," Alois Pirker, research director at Aite Group, says. "It creates appeal for advisors if you can give them a setup that suits them, and not force them to take the one model you offer."

From Assets to Profits, Which Regional Is on Top?