Jack Oujo admits he may have flubbed the initial call.

The 26-year HD Vest Financial Services advisor and former minor league baseball umpire first balked at the largest tax-focused independent broker-dealer’s clearing switch to Fidelity’s National Financial Services. Upon further review, he says, it looks much better, thanks to tools like eMoney and a new client portal.

“I questioned the whole thing when it happened, but I was wrong,” says Oujo, who has an eponymous New Jersey-based practice and notes he previously “had a bitter taste” toward National Financial. “It's clear now that they've upped their game tremendously.”

HD Vest parent

Blucora has

HD Vest is navigating a closely watched evolution — not just for the parties involved in the deal, the vendors and the 4,500 advisors with the IBDs, but also for the sector as a whole which is adjusting to record consolidation amid increased competition and tighter margins.

Envestnet and Fidelity, noting the clearing migration involved some $22 billion in assets, have acknowledged difficulties for advisors typical in any large-scale transition. Even so, HD Vest roughly doubled its recruited client assets in 2018 to $700 million, while setting record net advisory flows at nearly $1 billion in assets,

Combining firms

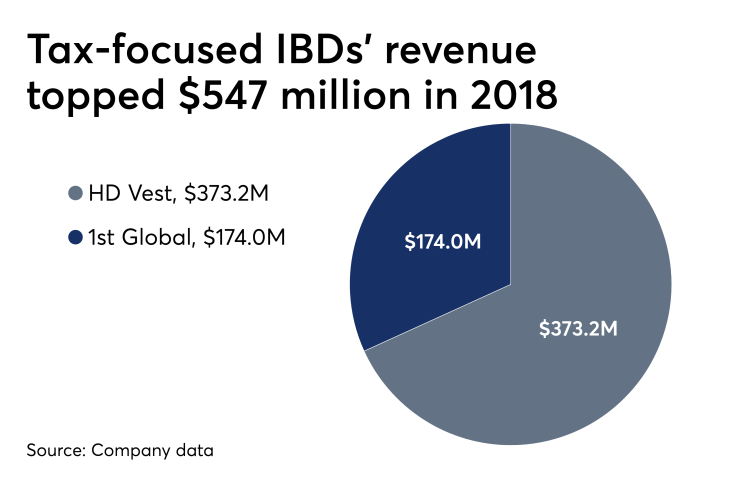

Combining HD Vest with the second largest tax-focused IBD would move Blucora’s wealth management unit near the top 10 firms in the sector based on revenue. The deal would also result in a new brand under Blucora after folding in some 850 advisors from 1st Global.

What’s more, it reverses the long-ago breakaway move that led HD Vest’s largest-producing advisor and a money management executive to launch 1st Global in 1992, says Carolyn Armitage, a former HD Vest employee who is now a managing director at consulting firm Echelon Partners.

She adds that the deal makes sense “from a philosophical standpoint beyond the economics,” given the proximity of the firms’ headquarters in the Dallas-Fort Worth Metroplex and their complementary focus on supporting tax professionals’ wealth management businesses.

“Given how strong both brands are, going with a neutral brand probably helps both sides overcome some of the emotional aspects and legacy issues of the two organizations,” Armitage says. “I'm really encouraged that there’ll be some new leadership and hopefully additional stability to HD Vest through this acquisition.”

In particular, Armitage praises 1st Global President David Knoch — also chair of FSI's board — as a talented leader who “knows this space very well.”

However, the structure of Blucora’s wealth unit after the expected close of the deal later this quarter remains unclear.

In an interview, Knoch declined to discuss plans for the combined unit in detail, including leadership positions, whether the firms will consolidate their headquarters and if one firm will adopt the other’s technology. He noted the deal is in its “regulatory approval phase.”

“We're going to be further empowered to make people's lives better,” says Knoch. “We're very passionate about helping tax-focused financial advisors enrich their communities and also enrich the people who live in those communities.”

In a message to shareholders included in the

The deal “gives us greater scale and new opportunities to leverage efficiencies, capabilities and technology to better serve our combined advisor base,” he said. “We will also be able to better to reinvest in our business and take advantage of the ‘best of breed’ across both platforms.”

-

The IBD's advisors can expect new technology and product offerings, says David Knoch.

April 4 -

Should advisor retention go as planned, Blucora's agreement to purchase the firm would boost its IBD headcount to 4,500 reps.

March 19 -

The tax-focused IBD’s custodial and platform transition is taking longer than the company or its advisors expected.

February 14

Firms’ head counts show how they’re responding to a challenging time in which experts predict the number of advisors to fall in coming years.

Executive moves

In the longer term, Clendening added, the company expects advisors to be able to increase client assets in advisory accounts and potentially bring in more directly held assets. The Fidelity conversion alone will also generate $120 million in additional segment income over the 10-year contract, he wrote.

Before joining Blucora in 2016, Clendening, 56, served for 11 years in executive roles in investor services and other divisions at Charles Schwab. Since he took over in April 2016, the company’s stock value has surged to roughly $35 per share from below $5.

The proxy states that Blucora, which also owns the tax software firm TaxAct, has transformed itself since 2015 from operating a portfolio of internet companies to a tech-enabled financial firm. In that timeframe, the parent firm also moved to Irving, Texas, from the Seattle area.

Todd Mackay — HD Vest’s interim CEO — spearheaded Blucora’s

Oros had spent less than two years at HD Vest when he left

His separation agreement with Blucora called for him to provide transitional services through March 1 after stepping down Nov. 15, the proxy shows. Oros later “agreed to a general release of claims in favor” of Blucora, and the company waived nearly $220,000 in expenses, it states.

Oros would have been required to repay the costs of commuting, relocation and other expenses under his employment agreement. While he received none of his targeted $487,500 bonus, since he didn’t finish the year, Oros received $1.5 million in total 2018 compensation.

Representatives for HighTower — which previously stated it

Blucora spokeswoman Andrea Dorsett said in an email that the company and Oros "separated with a mutual understanding and on amicable terms," calling the proxy disclosure a "routine update" made in keeping with public companies' standard reporting practices.

HD Vest didn’t make executives available for an interview nor did it provide responses to other questions.

'Heated calls'

The acquisition would combine 1st Global’s specialty in serving large accounting practices with HD Vest’s focus on individual CPAs and enrolled agents. Tony Batman, the majority owner of 1st Global, had sought out “higher-end producers” in breaking away from HD Vest, Henschen says.

One advisor told Henschen he couldn’t process any business for two weeks because of the Fidelity conversion. Henschen says he's taken some “pretty heated calls” from HD Vest representatives in the past six months amid the array of changes.

“It used to be a rep-driven broker-dealer; now it's like they're an employee of Blucora,” Henschen says. “They need to do a one-eighty on the culture. If the current management seems befuddled on how to do that, then put 1st Global's management in there.”

On the other hand, two of HD Vest’s largest practices expressed support for the firm and the pending deal. Oujo and Kyle Brownlee of Oklahoma-based Wymer Brownlee Wealth Strategies both say they look forward to collaborating professionally with the 1st Global advisors.

“When you're doing a major conversion at that level, you have to expect that it's not going to be completely smooth,” says Brownlee. “Due to that investment and capital and time to convert, we're really in a position where this merger makes a lot more sense.”

Brownlee has been affiliated with HD Vest for 20 years, and the practice spans six locations with nine reps managing some $600 million in client assets. The 50-year-old business aims to double its client assets in the next six to eight years under a strategic growth plan.

Oujo’s practice has six advisors managing $440 million, including the accounts of many Major League Baseball umpires who came up in the minors with him. Through multiple ownership structures, HD Vest’s culture remains centered on accountants who are advisors, Oujo says.

“There's a meeting of minds that takes place between a rep force that has to stay modern, and an ownership group that has to appeal to a rep force,” he says. “There's a lot of moving parts here, and the clients can handle change as long as they're coached through it.”

Conversion process

As for the Fidelity conversion, Oujo credits his team for being well prepared, saying “a lot was thrown” at smaller practitioners who didn’t have as much bandwidth or, in some cases, didn’t even know about it or didn’t approach it with positive or proactive attitudes.

HD Vest’s move to Fidelity spanned 15 months of close work between the firms, Fidelity spokeswoman Nicole Abbott says. The custodian’s preparation included training, resources in the field and an app for communicating directly with advisors, she said in an emailed statement.

“Conversions are always a process and questions inevitably come up during times of change, particularly when advisors are shifting to an entirely new platform, so Fidelity had up to 40 team members onsite for the four weeks around the conversion and will continue to work with the team at HD Vest,” Abbott said in a statement.

Any conversion, especially one involving switching wealth technologies and custodians simultaneously, requires time to adapt, agrees Lincoln Ross, Envestnet’s executive vice president of product and operations. Envestnet supports client firms and their advisors during such moves.

“Firms that make transformative changes to their infrastructure like this are pointing themselves toward the future,” Ross said in an emailed statement. “Once the change is absorbed, these firms experience accelerated growth.”

In February, Envestnet, with launch partner 1st Global,

Additionally, 1st Global started a client texting tool under MyRepChat that integrates with Redtail customer relationship management software and reached an agreement with Broadridge to develop an enhanced advisor compensation system,

New blood

The firm has also tapped four new executives to lead its ongoing enterprise projects and recruiting. 1st Global has added at least one new CPA advisor per month since the fall, and the company sees the new tax law as a growth driver, Knoch says.

“CPA wealth management firms are really positioned to give great advice to their clients,” Knoch says. “We think that now is probably the best time that we've ever seen in that regard. We have been and we remain really excited about this market.”

For its part, Blucora came within a percentage point, met or surpassed eight stated performance goals around metrics like EBITDA and revenue in 2018, the proxy says. The wealth management unit’s net advisory flows soared above a target of $900 million to $957.3 million.

HD Vest also brought in more than $700 million in recruited assets from 75 experienced advisors and 120 tax professionals it trained as wealth managers. The firm is only in the early stages of its efforts, but production per advisor jumped 20% in 2018, the proxy states.

“Last year we actively pruned the advisor base by setting engagement requirements, which led to the termination of hundreds of advisors,” Clendening wrote. “This has created more capacity for our team to focus on our highly engaged advisors while enhancing our ability to support our most productive advisors and teams.”

About 150 advisors at HD Vest, including Brownlee, are also beta testing a new tax-smart investing platform which is designed to automate their strategies. He says he’s thankful for Blucora’s investments in the wealth unit, including in technology and the 1st Global deal.

“It's a much more powerful company going forward,” Brownlee says. “Anytime you can have peer collaboration for the betterment of the clients that we serve, I think everybody wins.”