If you regularly engage in comprehensive financial planning, odds are you gravitate to one of the three leading providers of comprehensive planning software: Advicent, eMoney or MoneyGuidePro.

If your advisory services are limited to retirement projections and education savings, however, or if you are dealing primarily with millennial clients who need help with budgeting, perhaps you are attracted to a planning lite application like Advizr, which specifically targets millennials.

But what happens if Advizr is too limited and comprehensive applications are too much? That middle ground is exactly the niche that RightCapital is targeting, according to co-founder Shuang Chen. Chen says his software is more powerful than the more narrow applications on the market, without sacrificing ease of use or a great client experience.

He says it is appropriate for professionals who have not done much comprehensive planning in the past, but who are gearing up to do more as a result of the Department of Labor fiduciary rule. The software is most appropriate for clients with less than $2 million in liquid assets, he says, adding that it is not ideal for high-net-worth clients or those with complex planning needs.

I hadn’t had a chance to look at RightCapital since I tried the beta version more than a year ago, so I recently took a closer look.

THE CLIENT SECTION

When you log in, you land on the client section, which consists of three tabbed pages. The first contains a list of clients, as well as a button to add new clients. Click on a client, and his or her personal info screen appears to the right.

The next tab is the Client Access tab. This provides control over what your clients can see when they log in. There are seven sections of the application that the client can have access to: Dashboard, Investments, Retirement, Insurance, Education, Tax, Estate. Many sections have subsections. Checking the box for a section grants access to all the subsections, but you can check or uncheck individual subsections to achieve the exact level of client access you wish to grant.

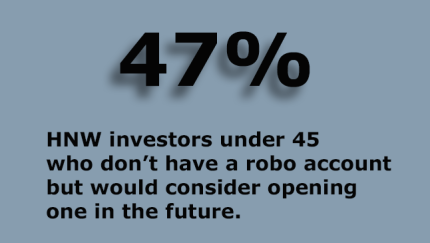

With automated advice platforms now a standard offering, the easy assumption is that technology is being universally adopted by advisers. Key insights from our annual Tech Survey, though, challenge that notion.

The Plan Settings tab allows you to select a planning method and an asset allocation method. In addition, you can create custom categories. Users can select one of three planning methods: a cash-flow-based plan, a goal-based plan, or a modified cash-flow-based plan. The cash-flow plan assumes that excess cash is invested in a taxable account. The modified-cash-flow method assumes any excess cash flow is spent.

Asset allocation can be done on a traditional fixed allocation method, or using a glide path, where the allocation changes at predetermined intervals over time. This method usually moves from a more aggressive allocation to a more conservative one as the client ages.

-

There is still work to be done, but the firm's platform empowers advisers and sees planning as an ongoing process.

August 18 -

Just about everyone in financial services wants to offer these retirement planning advice to wealthier boomers, but this firm rises to the top, says Tech Tools' columnist Joel Bruckenstein.

June 28 -

Does the newest iteration of a favorite advisor tool stand up to scrutiny? Our tech columnist takes it for a test drive.

April 18

When you add a new client, the default end date for the plan is age 90 for each spouse, but you can modify it. You can also add children, grandchildren and others to the household.

Next, you are prompted to enter salary for each spouse. By default, this is inflated 3% per year. Then, you choose one of three methods to estimate Social Security benefits for each spouse. Finally, you add employer retirement plan details, as well as any other tax-deferred or tax-free savings.

At this point, you will want to get clients to link all of their asset and liability accounts through Yodlee to create a net worth statement (or the information can be entered manually). You can also assign an asset class. You can designate which assets are managed by the adviser and whether the asset is to be included in the plan. You can manually enter insurance, real property and other accounts. You are then prompted to enter monthly living expenses and estimated taxes. Other expenses can be entered if necessary. A later prompt is to add goals. Some, like retirement, a separate retirement health, LTC and children’s education are created for you. Others can be added with a few clicks.

CRUNCHING THE NUMBERS

Once the data entry is completed, RightCapital crunches all the numbers and displays results. For example, the dashboard displays a total net worth graph. A liquidity graph displays target liquidity (the default is three months’ living expenses), current liquidity and surplus or deficit. If the client has aggregated accounts, you can view budget information. If you’ve entered debts, there is a screen to view and manage them. There is also a task page where the adviser can assign tasks to the clients and track completed tasks.

The investment screen displays current and target asset allocations. You can click to view the actions necessary to bring the portfolio back into balance. Other graphs include sector and style, whether the portfolio is concentrated or diversified, and diversification by tax bracket.

The retirement analysis shows probability of success, using a Monte Carlo analysis for the current versus the proposed plan that the software has generated. When you push the “action items” button, a screen appears that lets you alter goals, savings and asset allocation in the proposed plan to see the impact on it. There is also a confidence graph, which displays the simulation results in more detail.

You can also create scenarios, or use ones supplied with the application, to simulate various financial environments and their impact on the plan. For example, what would a depression do to the financial plan?

In addition, there is an income chart, still in beta, that shows expected sources of income during retirement. You have the option of running the same scenarios on income to illustrate the probable outcomes. All of these graphs allow you to alter the proposed scenario using such levers as retirement age and portfolio. An insurance tab shows the impact on the plan if each spouse would die next year under the current scenario and the recommended one. The adviser can propose adding coverage.

The disability tab shows income replacement coverage under current and proposed scenario. The education section shows coverage for education expenses under the current plan and allows the adviser to modify the plan using the action tab.

THE TAX TAB

The tax tab is a distinctive feature. A graph shows the estimated effective tax rates, broken down by type of tax, over time. If you click details, you can select a tax form and a year, and the application will generate a simulated set of data based on the inputs provided. The detailed tax projections cover Form 1040 and schedules A, B, D and AMT. There is a taxable Social Security worksheet as well. This section can be helpful in helping clients manage near-term tax liabilities.

You can also compare withdrawal strategies here. For example, you can choose sequential (withdraw from taxable accounts first) or pro rate withdrawal strategies. You can simulate filling up the lower tax brackets with Roth conversions to see the impact on the plan.

There is a lot to like about RightCapital.

There is a lot to like about RightCapital. Much of the initial plan creation and setup is done automatically, so learning the basics is relatively simple. That said, advisers should know all of the assumptions that power the model. This information is readily available, but I question whether novice users can understand the rationales for the assumptions and evaluate them.

Although there is a good amount of automation, there is plenty of opportunity for you to make the application your own. You can create your own model portfolios with their own scenarios, designating returns for equities, bonds and cash each year over a 30-year period. You can also enter your own capital market assumptions for each asset class.

One thing you cannot do right now is alter the glide path for those who choose that option. RightCapital says it may add that feature in a future release.

Blockbuster industry deals and unforeseen shifts in client attitudes are altering future forecasts for digital advice.

The ability to select a cash-flow-based plan or a goals-based plan is a plus, as is the ability to switch back and forth without losing data. The budgeting, cash flow and debt management modules all have great appeal when dealing with younger, less wealthy clients.

Integrated task management and task reminders are a plus. When an adviser assigns a task to a client, the client receives an email reminder shortly before the due date. When a client completes a task, the adviser receives a notification.

DRAWDOWN OPTIMIZATION

The tax efficient drawdown optimization is impressive. The fact that advisers can simply use dropdown boxes and slider bars to illustrate different withdrawal strategies as well as Roth conversion to fill up a tax bracket has great appeal. The optimization is integrated with Social Security, annuities and retirement income planning.

The application recently added capabilities to model fixed index annuities and variable annuities, including detailed features such as lifetime withdrawal benefit. Advisers can easily illustrate the impact of adding a new annuity to the portfolio.

Cybersecurity is on the minds of all advisers these days, so it is good to see that RightCapital has added factor authentication and encryption of data behind the firewall. It uses quantum randomness to seed encryption, a more secure practice than using pseudorandom number generators.

The product also offers a really good looking client portal that allows advisers to customize the end user experience add to the application’s appeal.

RightCapital currently integrates with TD Ameritrade, Schwab, Black Diamond, Riskalyze, Wealthbox and Blueleaf. It definitely needs to integrate with more mainstream CRM providers and more portfolio management applications.

The price is $74.95 per adviser per month without Yodlee integration or $99.95 per month with. I would recommend the latter. Volume and affiliate discounts are available, as is a free 14-day trial.

With this product, RightCapital is carving out a niche for itself. While it does not generate as much publicity as some competitors, perhaps it should.