Fidelity revealed details of wide-ranging digital plans, from technology and platform upgrades to how the firm will provide advisors with a robo.

The moves are in part the culmination of the firm's digital strategy as well as its acquisition of financial planning software firm eMoney Advisor last year.

And it also comes as more firms are focusing on their digital presence. Earlier this month, Bank of America Merrill Lynch said it would launch a standalone robo advisor early next year. That follows similar announcements by other wealth management firms.

Fidelity says it's rolling out a number of changes intended to enable advisors to stay competitive in a fast changing digital landscape.

"What we're offering is much more than a robo," says Vinod Raman, vice president of digital advice solutions at Fidelity Investments.

THE HOLISTIC PICTURE

In one of the biggest changes, Fidelity's robo offering — called Fidelity Automated Managed Platform, or AMP — will start as a pilot program in the first quarter of 2017. Executives declined to say how many advisors would participate in the pilot, but added that it would include banks, RIAs and broker-dealers. The offering is expected to be more widely available in mid-2017.

The robo is intended to be as easy to use as possible for clients while also giving advisors a leg up in identify clients in need of more hands-on financial planning.

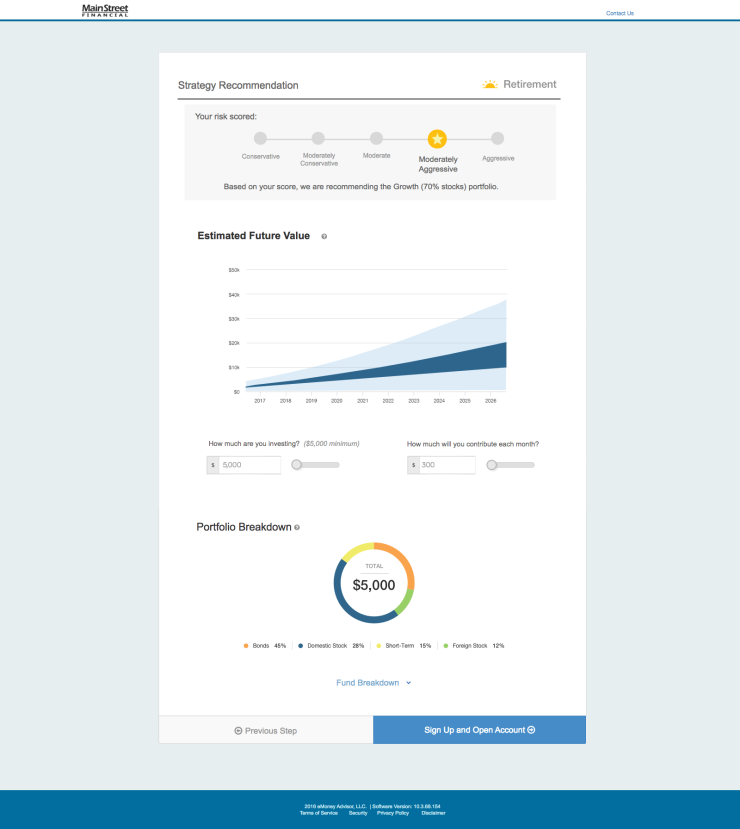

Fidelity's robo will use a streamlined and paperless account opening process, executives say, in order to allow clients to open an account in as few steps as possible. For example, a client interested in using the robo service for retirement would answer a handful of simple questions, such as their age, income and savings.

Clients using the service will be matched to one of 14 portfolios based on a risk assessment test, which RIAs and other firms can customize.

"The advisor can map their risk scoring framework to the models," says Gary Gallagher, senior vice president of investment products at Fidelity.

On the robo service's website, client can also list and link to other assets held away, such as checking accounts and life insurance policies, providing advisors with a more complete picture of the client's financial life.

If clients link their bank accounts and credit cards, then they can also see all their spending habits. "Advisors will know the holistic picture of their clients," Raman says.

PRICING

Advisors will also be able to identify clients that are using the robo service but who may benefit or need additional planning services. For example, advisors will be able to use eMoney's analytics tools to splice and dice their client base in any number of ways, including looking at digital only clients as well as traditional clients.

"The benefit here is that you can capture that next gen client who will one day become the next high-net-worth client," says Drew DiMarino, executive vice president of sales at eMoney Advisor.

The robo offering will come with the emX suite of products; the base price is about $1,500 to $1,800.

The firm will charge a to-be-determined fee to clients. "We're going to be very competitive with any other robo," Gallagher says.

However, RIAs and other firms offering client the robo can customize the fees charged. For example, some advisors may opt to offer additional services and charge extra 50 basis points.

PLATFORM UPGRADE

Fidelity's robo service will be fully integrated into an advisor's workstation, which the firm is upgrading.

Fidelity is combining two existing workstations, Streetscape and WealthCentral, into a common infrastructure. Starting in December, there will be a single web portal called Wealthscape.

-

A small group of existing customers will be the first to try out the mutual fund company's digital advice platform, Fidelity Go.

March 30 -

Custodian entering crowded field; minimum initial balance will be $5,000.

July 27 -

Fidelity has a new digital plan to work with advisors and is also developing a direct-to-consumer robo platform.

November 20 -

During the planning process for a digital platform strategy, Fidelity says its partners and brokers asked why it couldn't just go buy eMoney Advisor instead.

March 25

The firm is also plans to add new features to Wealthscape. For example, a new performance measurement tool — currently being tested by 15 piloting firms — will be made available next year.

Executives say these technology enhancements are increasingly in demand from advisors who feel pressured to up their offerings to clients. A survey of planners Fidelity conducted last year showed 43% of respondents expected that they would have to offer clients more services and resources in the future.