-

None of the findings in a new working academic paper will likely surprise financial advisors. But they could provide some helpful data for conversations with investors.

February 4 -

With more than $12 trillion in assets, the company led by CEO Salim Ramji is pressing its advantages of scale in a rapidly consolidating, commodified industry.

February 2 -

The accounts give wealthy investors more opportunities to place alternative vehicles in a tax-advantaged retirement nest egg. But mistakes can be costly.

January 28 -

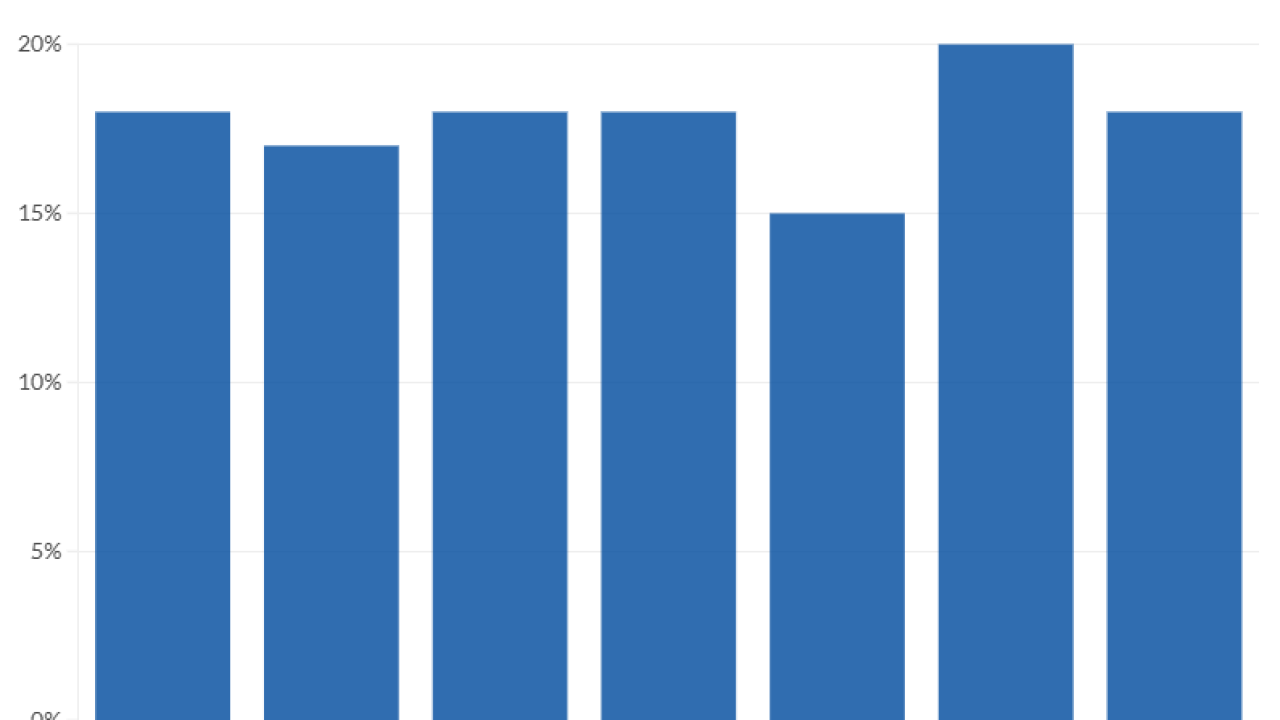

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

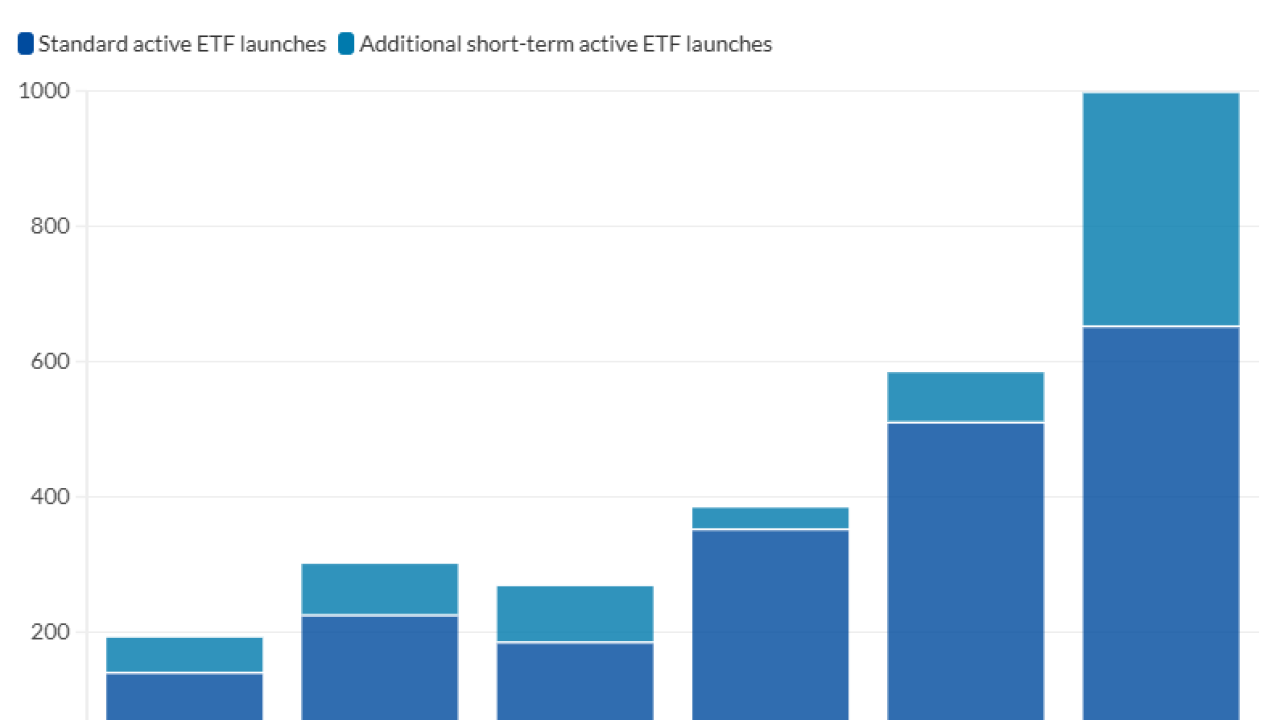

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Once rare, the same kind of permissive terms that are widespread on leveraged loans are becoming increasingly common in the $1.7 trillion private credit market.

January 15 -

Fixed-income represented a surprising bright spot in 2025, despite the warnings of "bond vigilantes" and inflation pressure. Here's the outlook for 2026.

December 30 -

An increasingly popular form of lending enables financial advisors and their clients to offset capital gains and find other tax savings.

December 15 -

A credit scare last month could have been a momentary blip, but financial advisors have always known there are a lot of risks in private investments.

November 5 -

Financial advisors know how to guide clients through volatility, but the math displaying the portfolio risks of AI may present an altogether different challenge.

October 29 -

Two studies from Morningstar dive into the subtleties across the various categories of funds and the sources of the gap between actual and total investment returns.

September 18 -

The Trump megalaw's expansion of opportunity zone credits and other investment approaches comes with caveats based on timing and taxes.

July 14 -

Panelists at the Morningstar conference acknowledged the difficulties, even as they pointed out the ongoing opportunities from active management.

July 11 -

Politics are playing an outsize role in portfolio management. Here's how experts see the fixed-income sector changing under the pending One Big Beautiful Bill Act.

June 30 -

CEO Kunal Kapoor and other speakers explained how the shifting trends shaping the industry mean that advice is getting even more important.

June 26 -

The industry is awaiting SEC approval for dozens of applications, even as Vanguard's shareholder case highlights some of the tax complexity of the looming shift.

June 23 -

With the industry awaiting the regulator's looming actions, the index fund giant is seeking to apply its dual share class structure to actively managed strategies.

June 12 -

Areas around Jackson Hole, Aspen, Palm Beach, Miami, New York, Dallas and Austin are in the group. Other top performers may come as more of a surprise.

May 29 -

The increasingly popular Section 351 process offers many low-basis investment portfolios an exit ramp — without incurring any capital gains.

May 21 -

The dilemmas from data, client demand and recruiting could provide opportunities for upstarts. Here's how wealth and asset management firms are responding.

May 14