-

As ETFs take a larger bite of the market, VanEck discusses how sustainable investing will contribute to the muni space.

-

The aim is to generate social benefits and investment returns

April 7 -

Wall Street is trying to bottle ESG, but ESG has other ideas.

December 7 -

With no standard definition of what constitutes a socially responsible investment, the SEC is looking to police funds and protect investors.

November 11 -

To succeed as an investment professional, you must take a holistic view of your investment strategy.

July 19 Inspiring Capital

Inspiring Capital -

The strategy, which puts social good ahead of returns, can strengthen bonds with philanthropically minded clients.

July 15 The Bridgespan Group

The Bridgespan Group -

A research and methodology company with a star-studded board launched the product with an eye toward advisors, retail clients and institutional investors.

June 1 -

Financial advisors, asset managers and researchers are racing to fill in the information gaps Americans reported in a new J.D. Power survey.

May 21 -

Not only are the portfolios similar, but performance is nearly identical, writes Bloomberg’s Aaron Brown.

May 7 -

The principal for operations and strategy of an independent research firm explains the range of available products and ESG data.

April 7 -

Impact investment manager Rachel Robasciotti and other advocates say the private proceedings are harmful to victims and helpful to firms protecting serial harassers.

March 29 -

The RIA acquired the innovative practice while bulking up its social justice investing efforts and its wealth redistribution planning services.

March 4 -

Financial firms globally have raised about $25.5 billion of sustainable-linked debt this year, according to data compiled by Bloomberg.

February 16 -

Sustainable funds in the U.S. attracted $51.2 billion in 2020, more than double the previous calendar-year record.

February 10 -

Complicating socially conscious investing is the fact the SEC doesn’t regulate how the category’s labeling is applied.

October 26 -

The pandemic has underscored the need for more socially and environmentally responsible financing.

September 10 -

Funds that buy debt backing sustainability matters grew 12% from the end of 2019 globally, reaching a record $209.5 billion of assets, data show.

September 4 -

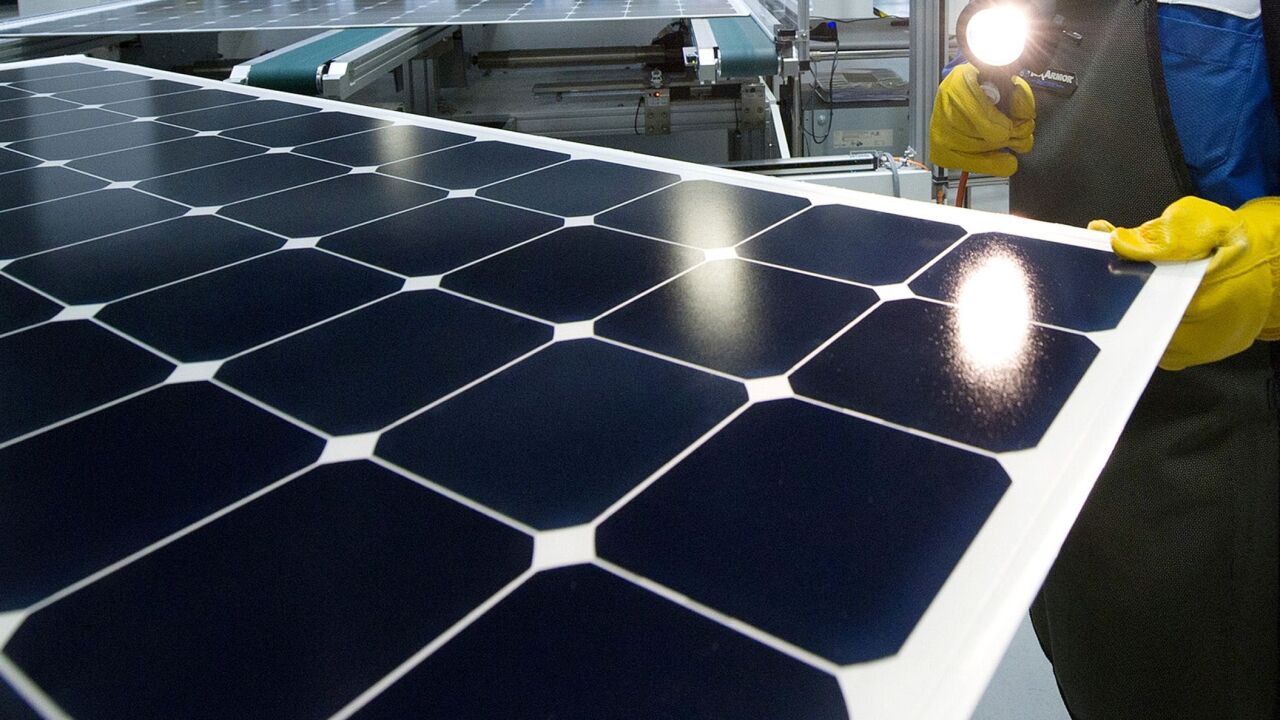

A range of factors have been cited for the clean-tech rally, including maturing wind and solar industries after a collapse in oil prices earlier this year.

August 26 -

“How many minority-owned ETFs do you know?” an advisor asks.

August 17 -

The framework provides asset managers with a set of recommended actions, metrics and methodologies to help them meet the “net-zero emissions” goal by 2050.

August 5