M&A

M&A

-

A new survey from DeVoe & Co. suggests a big shift in what RIA firms need today in order to attract potential acquirers. (Hint: It's no longer just superstar advisors.)

December 23 -

While the term "financial supermarket" may have gone out of fashion, firms still see opportunity to boost profits and keep clients loyal by blurring the lines between banking and wealth management.

December 22 -

Also, DayMark Wealth Partners sells a minority stake to Constellation Wealth Capital.

December 18 -

Founders Elissa Buie and Dave Yeske are leaving a legacy in the profession and at the firm under three successors taking over in 2026.

December 16 -

Also, Independent Financial Partners secures a $700M team from Commonwealth/LPL, and NewEdge Capital names a new CEO.

December 11 -

Consolidation has been ongoing for more than a decade in wealth management, but it accelerated to unprecedented levels this year.

December 10 -

Also, Cresset extends its reach in Texas, Janney recruits from Wells Fargo and Ameriprise, Merrill draws from Wells Fargo and Mercer acquires a $1B firm.

December 4 -

Preparation is everything: If clients are aware of the transition well in advance, experts say the risk is pretty low they'll leave the firm.

December 2 -

One of the most consequential M&A deals in years leads this roundup of the many ways big independent firms grew in 2025 and how they plan to continue growing in 2026.

November 28 -

Also, Raymond James lands a $420M father-son team from Edward Jones, Cetera recruits a $350M LPL duo, and Cambridge acquires a $1B AUM dual registrant.

November 26 -

Savant Wealth Management, Moneta Group Investment Advisors and EP Wealth Advisors lead a group of fee-only firms with headcounts well above their peers.

November 25 -

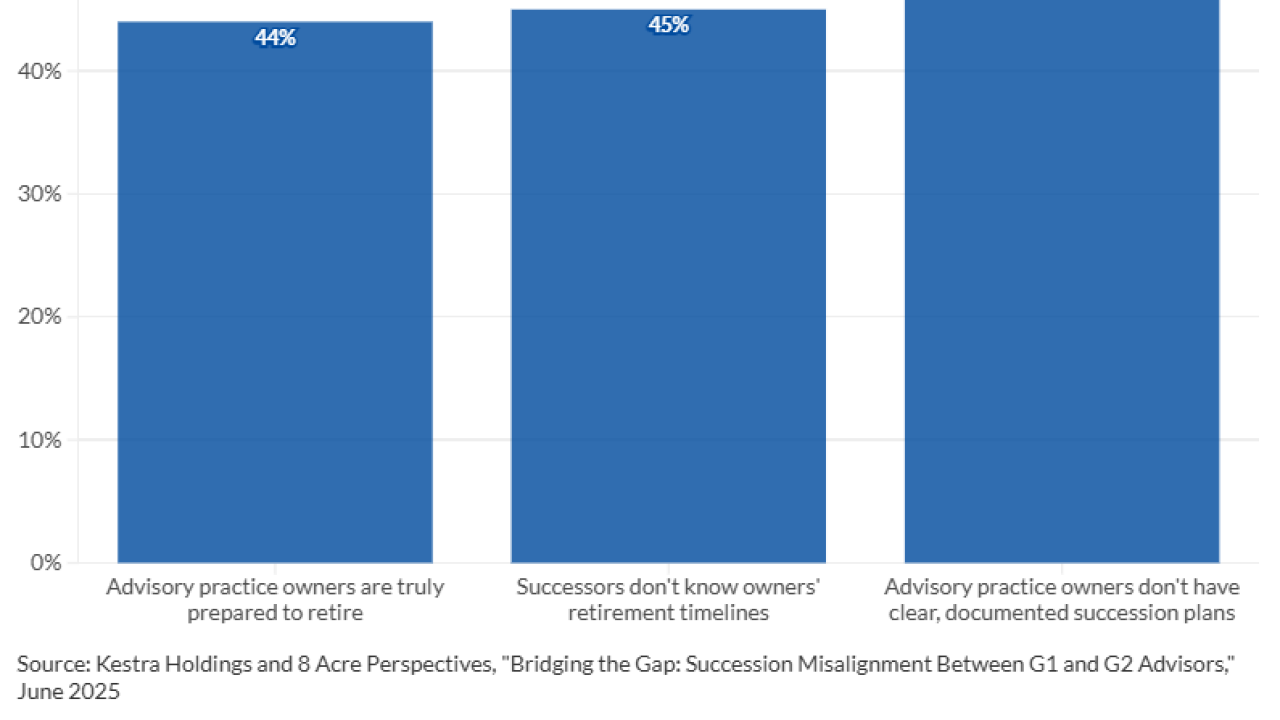

Experts say RIA owners often resist making themselves replaceable. But they'll have to choose between an internal or external deal someday.

November 24 -

Wells Fargo recruits a $543M JPMorgan team, Raymond James adds a $360M family practice and Beacon Pointe acquires a women-led RIA.

November 20 -

This year the top three firms in FP's exclusive study of RIAs that do not do any commission business manage nearly $120 billion combined.

November 19 -

At a time when private equity ownership is causing clashes between independent broker-dealers and some of their largest advisory teams, Private Advisor Group found another option.

November 19 -

The printable PDF includes rankings based on the firms' AUM as well as statistics on each firm's employees, client accounts and financial advisors.

November 18 -

RBC pulls $1.2B and $705M teams from rivals, Merrill gets a $420M duo, and several large M&A deals close.

November 13 -

Borrowers who receive discharges of their student debt under the Income-Driven Repayment program could be facing tax bills as high as $10,000 next year.

November 13 -

Minority transactions are increasingly appealing to sellers who are wary of giving up the full control of their firms. But experts say the deals do come with strings.

November 11 -

Also, an Ex-Truist/Balentine duo start an RIA, Raymond James grabs a team from Wells Fargo and Janney names a new head of advisor recruiting.

November 6